Global growth patterns show BEVs strengthening while PHEVs fluctuate

Across the first 10 months of 2025, battery electric vehicles continued to lead the market transition. BEV sales grew approximately +24% YoY, supported by sustained consumer demand in China, strengthening sentiment in Europe and incentives in the United States. In October alone, global BEV registrations increased +19% YoY, reflecting renewed momentum after a softer first half of the year.

Plug in hybrids displayed a more uneven trend. While PHEVs remain relevant in Europe and certain Asian markets, global PHEV registrations in October declined −5% YoY, driven largely by weakening PHEV demand in China. This divergence confirms that PHEVs increasingly function as a transitional technology, while BEVs are consolidating their position as the long term powertrain solution.

Combined, BEVs and PHEVs represented roughly 25% of all new vehicles sold worldwide in the first 10 months of 2025.

BEVs represent 70% of all EVs sold, based on weighted continental averages

Over the January to October period, the global EV mix consisted of approximately 70% BEV and 30% PHEV. This ratio is derived from weighted averages based on continental market shares, reflecting the differing electrification speeds across major automotive regions.

-

China, representing more than 60% of global EV demand, maintains a heavily BEV driven ecosystem with ~80% BEV and ~20% PHEV.

-

Europe displays a more balanced adoption curve with approximately 60% BEV and 40% PHEV.

-

The United States remains BEV dominated with ~80% BEV and ~20% PHEV.

When weighed by each region’s contribution to global EV volume, the worldwide mix converges to ~70% BEV and ~30% PHEV. This structure highlights that BEV adoption is expanding consistently even in markets where PHEVs remain an interim solution.

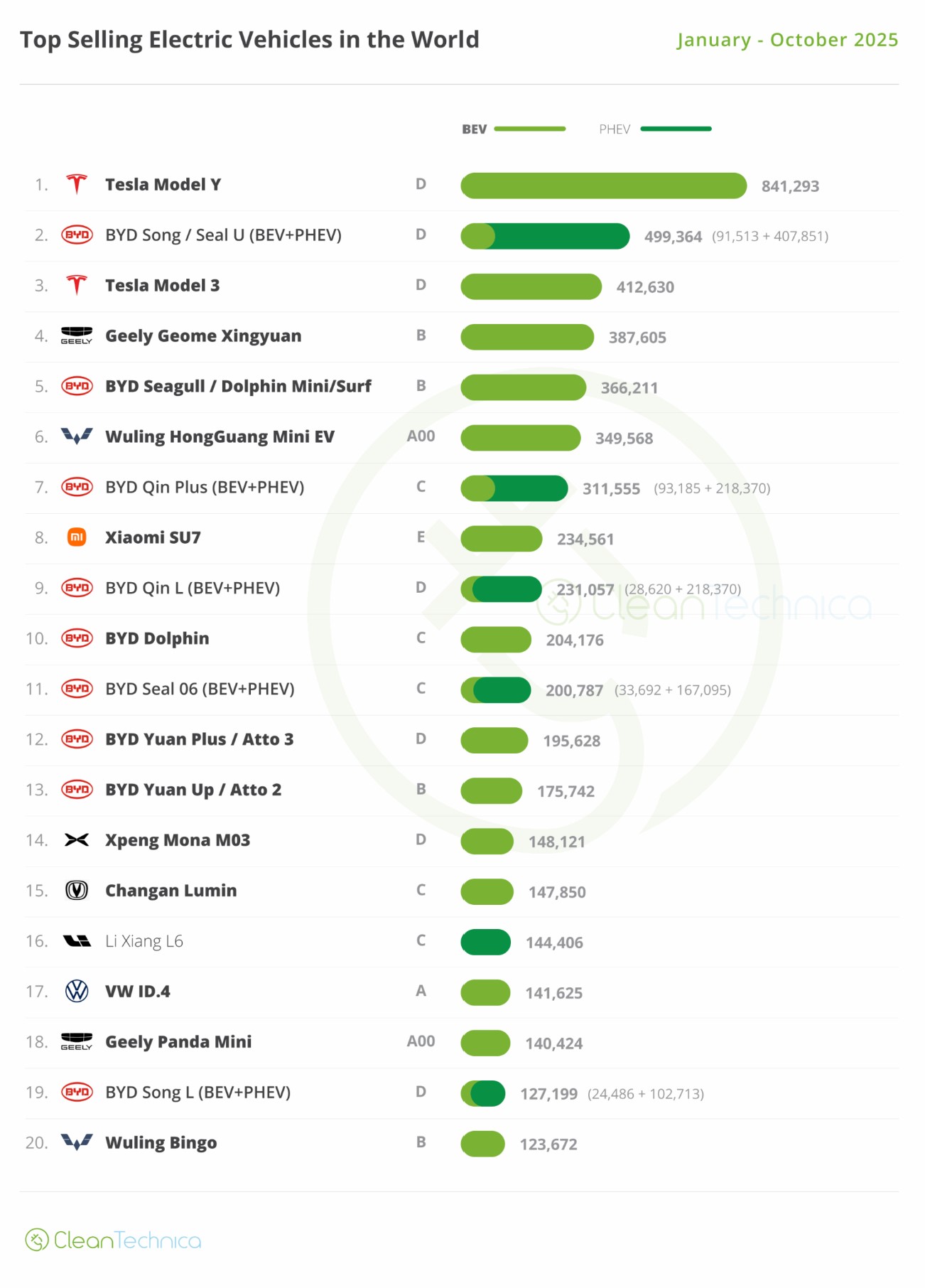

Chinese EV makers dominate 8 of the top 10 global best sellers

CleanTechnica’s model ranking makes the shift undeniable. Chinese brands occupy the majority of global top positions through the Wuling Mini EV, BYD Song, BYD Yuan, BYD Dolphin, BYD Seagull and rising entries from Geely and Changan.

October marked a symbolic turning point: the Wuling Mini EV temporarily surpassed the Tesla Model Y in monthly global volume. While the Model Y still leads for the full year, this milestone illustrates how powerful China’s compact and ultra affordable EV segment has become.

The Chinese advantage is driven by several structural factors:

-

Vertical integration that compresses costs, accelerates development and ensures battery supply.

-

Gigantic domestic scale, enabling real time learning and product iteration cycles unmatched by Western OEMs.

-

Rapid development cadence, with model refreshes every 12–18 months instead of the 5–7 year cycles common in Europe.

-

Competitive pricing, often 20–40% below Western equivalents without sacrificing quality.

Tesla remains the strongest Western competitor and continues to hold the YTD global number one position with the Model Y. However, the competitive environment has shifted from a Tesla vs legacy OEM dynamic to a Tesla vs China dynamic, especially in compact and mass market segments.

Xiaomi’s rise introduces a new type of competitor

A particularly disruptive force in 2025 is Xiaomi, whose SU7 exceeded 234,000 units sold in its first 10 months. This performance is unprecedented for a new automotive entrant.

Xiaomi reshapes competition in three ways:

-

Ecosystem integration: its vehicles connect seamlessly with Xiaomi’s cloud, devices and software services, creating a unified digital environment appealing to younger buyers.

-

Consumer electronics economics: rapid iteration, procurement efficiency and cost control from the smartphone industry transfer directly into automotive.

-

Brand loyalty: hundreds of millions of global Xiaomi users enter the EV market with pre-existing trust in the brand.

Xiaomi’s success signals that future mobility competition may increasingly come from technology companies, not only traditional automakers.

Europe faces increasing strategic pressure as electrification timelines slip

This global shift coincides with heightened uncertainty in Europe, where several automakers have announced delays in their electrification roadmaps. Ongoing negotiations within the European Union this week underscore growing concern about the scale and speed of China’s EV export surge.

However, the CleanTechnica data reveal a clear reality. The market is moving faster than European industrial policy. Chinese brands continue to gain share across multiple segments, while European OEMs face rising cost pressure, slower development cycles and mounting dependency on external battery supply.

Delaying electrification now risks widening Europe’s competitiveness gap rather than closing it. Without accelerated investment, cost restructuring and innovation, Europe risks losing relevance in the world’s fastest growing automotive sector.

Sources

EVBoosters Executive Search used the core data from CleanTechnica and EV-Volumes as the primary basis for this article. In addition, the following sources were consulted to ensure a complete and accurate picture of global EV market developments. European market insights were drawn from ACEA’s 2024–2025 EV registration statistics and EAFO’s reporting on BEV and PHEV penetration across EU member states. Chinese market dynamics were validated through monthly NEV data from CPCA and CAAM, while the US BEV–PHEV mix was supported by datasets from Cox Automotive and the US EPA. Together, these sources provide a comprehensive and up to date foundation for the analysis presented.