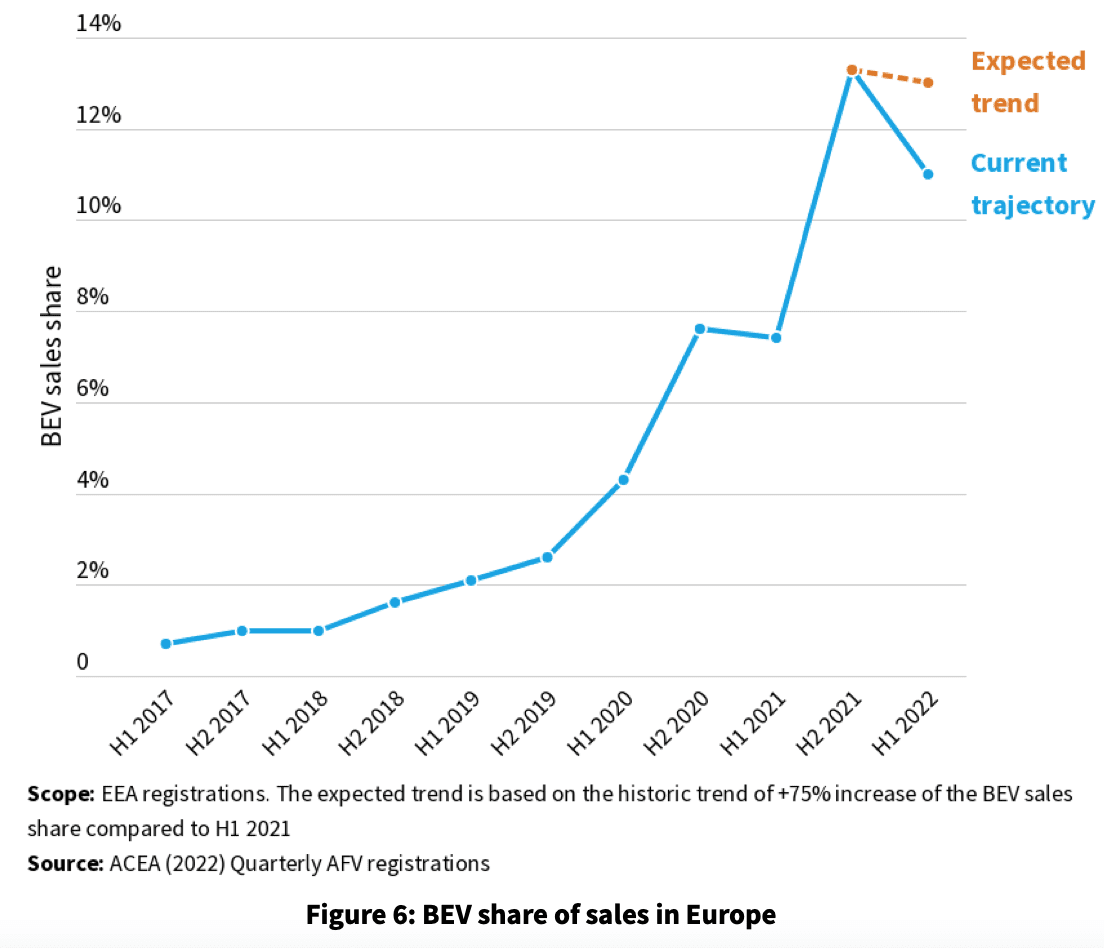

As shown in H1 2021, a lower sales share at the beginning of 2022 was anticipated, as carmakers prefer to raise their BEV sales towards the end of the year, resulting in low stocks at the start of the next year after the Christmas production break. However, the actual findings are well below the projected trend.

When compared to the previous year, BEV sales climbed by around 75% in both H1 2021 and H2 2021. Following this trajectory, a 13% BEV sales share in H1 2022 was predicted.

In the absence of stronger CO2 standards by 2021, the current trajectory might be an aberration in a long-term increasing trend, or the first sign of a troubling pattern of EV sales stagnation in Europe.

Although external issues influenced automotive supply chains (semiconductor and wire harness shortages, Chinese Covid shutdowns), Transport & Environment indicates that this decline is mostly a problem in Europe due to lax regulation.

Globally, the European BEV market decline in the absence of new CO2 goals stands in sharp contrast to growth in other key markets. BEV sales continue to rise in China (3% increase in BEV sales share in H1 2022 compared to the previous semester) and the United States (2% increase) as a result of more aggressive regulatory incentives.

This demonstrates that regulatory incentives and objectives are a crucial driver of supply and cannot be explained just by supply chain disturbances. Without more strict CO2 reduction objectives in the next years, Europe risks falling behind its industrial competitors and losing the lead in future-proof technologies to other parts of the world.

Source: TNO

Get ‘FREE OF CHARGE’ access to this and 400+ other valuable EV Market Reports in our database. Enjoy reading!