The CRMA sets ambitious targets for the EU to achieve by 2030. These include meeting at least 10% of the EU’s annual consumption of strategic raw materials through European mining and at least 40% through processed minerals demand. Furthermore, the EU aims to source at least 15% of mineral consumption from European recycling, while ensuring that no single non-EU country supplies more than 65% of Europe’s demand.

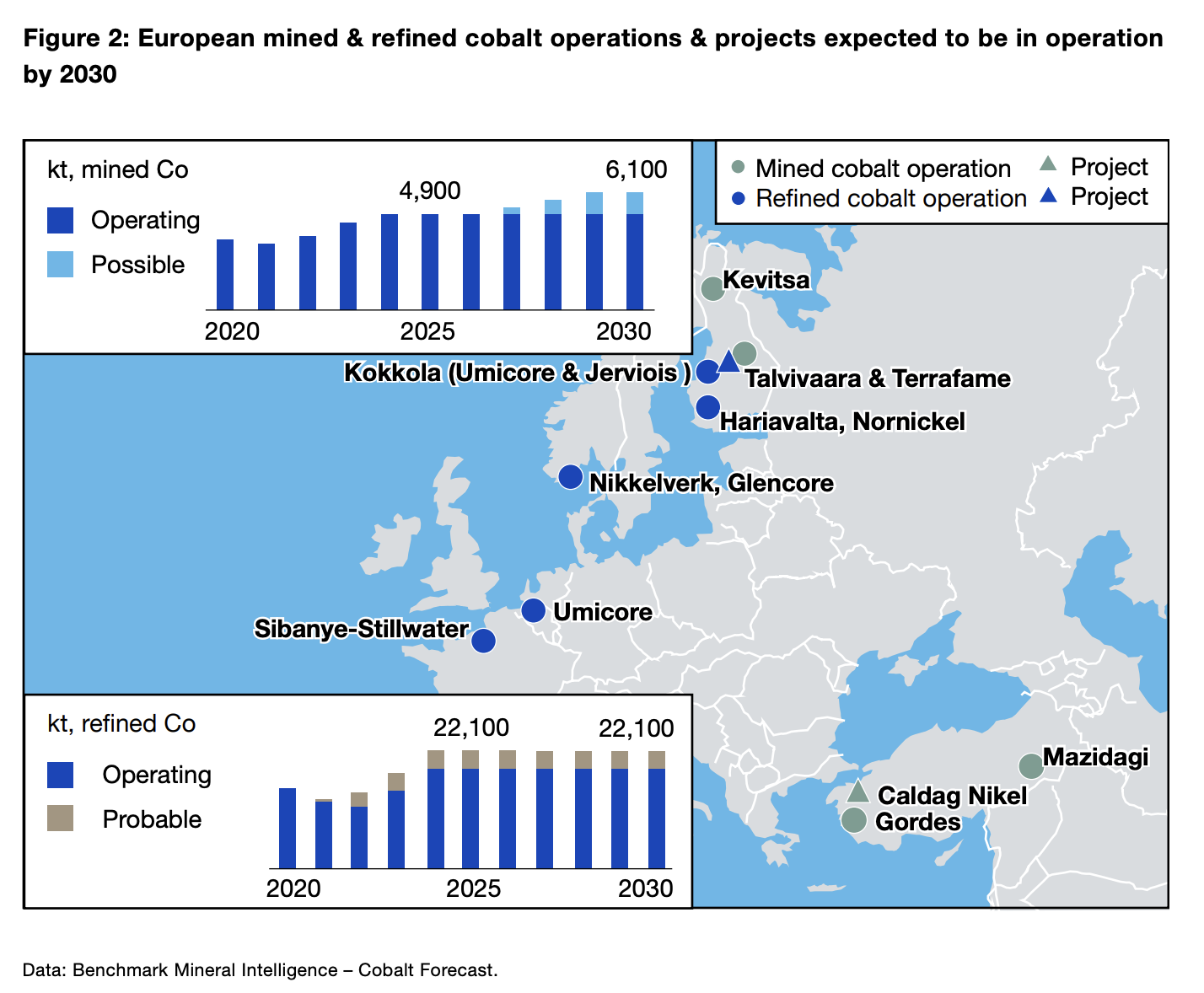

Among the critical raw materials highlighted by the CRMA is cobalt, an essential component in battery production. Currently, Europe only accounts for 2% of mined cobalt and 12% of global refined cobalt. Given the size of known reserves and current development plans, it is unlikely that Europe’s share in cobalt production will see significant changes in the foreseeable future.

To achieve the CRMA’s objectives, the EU acknowledges the need for increased investment and accelerated permitting processes. It is expected that the focus of investment will primarily be on the refined stage of the cobalt supply chain, bringing production of cobalt sulphate closer to the growing end-use markets. With a relatively straightforward logistics route, new European refining capacity is likely to rely on feedstock from the Democratic Republic of Congo (DRC), which is currently one of the major suppliers of cobalt.

However, the EU’s ability to meet its targets will also depend on the regulatory environment it establishes. One key consideration is the proposal for an Occupational Exposure Limit for cobalt, which could have a significant economic impact on cobalt refining and recycling facilities within the EU. A stringent exposure limit could potentially undermine the benefits of the CRMA and redirect funding to countries with less strict regulations or compel refining activities to remain within China.

As the EU strives to build a European clean energy economy and reduce its reliance on China, the successful implementation of the CRMA will play a crucial role. Balancing the need for domestic supply chains with the challenges of limited supply growth potential and regulatory considerations will be vital for the EU to ensure a sustainable and secure supply of critical raw materials in the future.

Source: Cobalt Market Report 2022 | Cobalt Institute