A look back: CHAdeMO’s early role

When CHAdeMO launched in 2010, it was revolutionary. It enabled EVs to charge up to 80% in about 30 minutes, providing a much-needed boost for long-distance travel. Its name, which loosely translates to “let’s have a cup of tea while charging,” reflected this quick-break approach.

CHAdeMO’s compatibility with early Japanese EVs like the Nissan Leaf and Mitsubishi Outlander PHEV helped it gain traction in Europe. At a time when the EV market was still finding its feet, it offered an accessible and reliable solution for drivers. By continually increasing its charging capacity—now up to 400 kW, with future versions aiming for 900 kW—it remained competitive for many years.

However, while CHAdeMO was instrumental in building Europe’s early EV charging networks, its dominance has steadily declined. The rise of CCS, which offers similar speeds and broader compatibility, is reshaping the market.

The shift to CCS

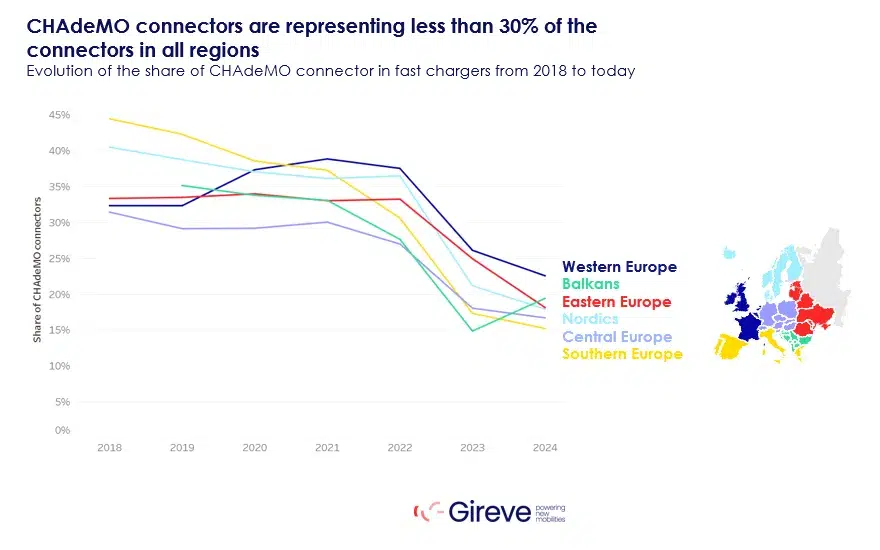

Today, CHAdeMO connectors represent less than 30% of all fast-charging points in Europe, and fewer than 15% of new installations include them. In countries like France and Germany, providers are focusing on CCS-only setups, reflecting the preferences of manufacturers and drivers.

The change isn’t just about consumer choice—it’s also about policy. In 2021, France updated its requirements for high-power charging stations, dropping the obligation to include CHAdeMO. Instead, stations must now offer CCS-compatible connectors, such as Type 2 and Combo2. This shift aligns with Europe’s broader effort to standardise charging infrastructure, making it simpler for EV owners and operators alike.

Slowing installation rates

Data from Gireve’s roaming platform shows a marked slowdown in the growth of CHAdeMO connectors. Between 2017 and 2023, CHAdeMO installations grew by just 35% annually, compared to an 80% growth rate for all connectors. By 2024, many charging network operators, including Allego, had stopped adding CHAdeMO to new stations.

This trend mirrors developments outside Europe. In the United States, for example, Electrify America has also ceased installing CHAdeMO connectors at new sites, citing limited use and the growing preference for CCS among drivers and automakers.

Despite these challenges, some providers continue to offer CHAdeMO as part of multi-connector setups, ensuring legacy EVs can still charge. GRIDSERVE, for instance, maintains CHAdeMO support alongside CCS at many of its locations. However, these configurations are becoming less common as CCS cements its position as the standard.

Usage and relevance today

The decline in CHAdeMO installations has been accompanied by a sharp drop in usage. According to Gireve, charging points with CHAdeMO connectors see up to 85% less activity compared to CCS-equipped points. In 2024, CHAdeMO accounted for just 4.4% of total charging sessions in Europe.

This low demand is largely due to the rise of new EV models, most of which are designed exclusively for CCS. Even Nissan, a longtime advocate of CHAdeMO, has adopted CCS for its newer vehicles like the Ariya to better meet European drivers’ needs.

That said, CHAdeMO hasn’t disappeared entirely. Its compatibility with vehicle-to-grid (V2G) technology remains a key strength, particularly for applications where cars can return energy to the grid. While this capability keeps CHAdeMO relevant in niche markets, CCS is also developing V2G features, further diminishing CHAdeMO’s appeal.

Looking ahead: The future of CHAdeMO

While CHAdeMO played a vital role in building Europe’s early charging infrastructure, its future in the region looks uncertain. Many operators and policymakers are prioritising CCS, which offers a more unified experience for users and supports Europe’s long-term sustainability goals.

CHAdeMO’s strength lies in its adaptability. Recent versions include compatibility with China’s GB/T standard, and adapters now allow CHAdeMO vehicles to use other fast-charging options. However, with most new stations focusing on CCS, CHAdeMO is expected to fade from Europe’s EV landscape in the coming years.

Conclusion

The story of CHAdeMO is one of innovation, adaptation, and eventual decline in Europe. It helped lay the foundation for today’s fast-charging networks, but the market has moved on. As CCS becomes the default choice for manufacturers and operators, Europe’s charging infrastructure is consolidating around a single standard.

Gireve’s analysis underscores the importance of adapting to these changes. By supporting both legacy systems and new technologies, the EV charging industry is creating a more accessible and efficient future. For CHAdeMO, its legacy will remain a testament to its pioneering role in electric mobility, even as the focus shifts to what comes next.

Source: Gireve