China is the industry leader in terms of EV sales and the growth of its charging infrastructure. Three years earlier than the intended deadline of 2025, China’s EV adoption reached 25% of all vehicle sales in 2022. Furthermore, By 2025, it plans to construct enough charging stations to accommodate more than 20 million vehicles. However, the country is aware of the unequal growth of its infrastructure, since almost 70% of its locations are now found in densely populated regions. The National Development and Reform Commission of China published recommendations in January 2022 for extending the charging network to towns and villages as part of its rural regeneration program.

Government officials need to be ready for a number of significant obstacles before they can develop the EV infrastructure:

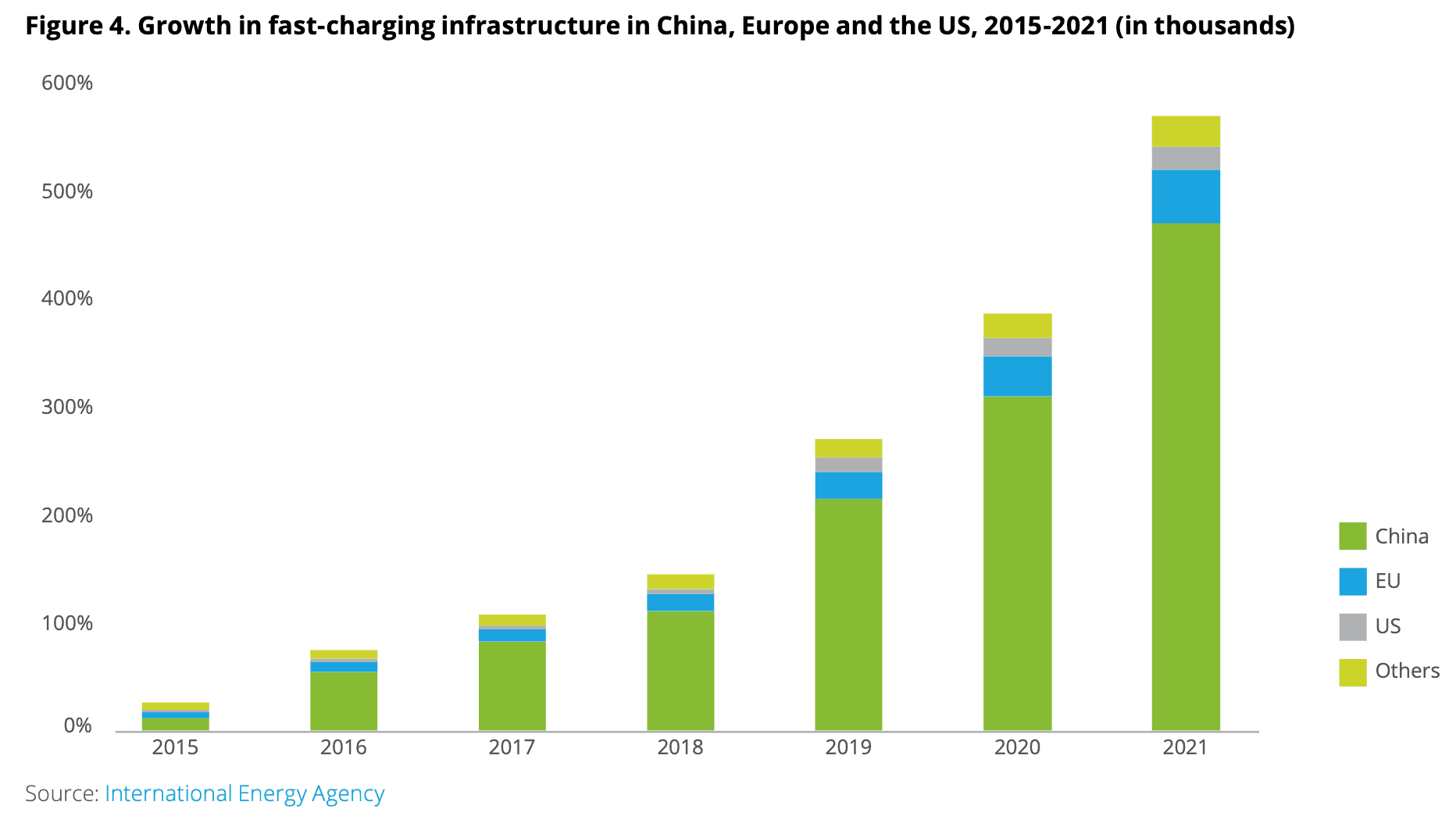

- Charging technology: Three distinct forms of technology that offer varying charging speeds can be used to charge modern electric vehicles (EVs). Level 1 chargers work with 120-volt outlets, which are the standard home current in the United States. A completely electric car may be charged in 40 to 50 hours on a level 1 charger, whereas a hybrid can be charged in 5 to 6 hours. An all-electric car can be fully charged in four to ten hours using a level 2 charger that runs at 208 or 240 volts, whereas a hybrid car can be fully charged in one to two hours. EVs may be fully charged in an hour using Direct Current Rapid Chargers (DCFCs), but only China has considerably expanded its infrastructure for fast charging. Rapidly increasing the number of DCFCs is necessary to prevent traffic jams and aggravation at charging stations, especially in the commercial vehicle segments

- Federal fleets: Given the size of the federal fleets, energising them can be a challenging undertaking. The UK government has set a target of converting all 40,000 of its central government vehicles, or cars and vans, to zero emissions by 2027. The US federal government had 1,100 charge stations in March 2022, according to the Government Accountability Office (GAO), and would require 100,000 to reach its fleet electrification targets.

- Smart Charging: The question of when automobiles should be charged is made more pressing by the cost of electricity. The time of car charging might have a big impact on how much it costs to operate a fleet. In a manner similar to the route optimization planning already carried out for delivery trucks, agencies and people paying such rates may need to adopt protocols in order to limit expenses. On June 30, 2022, the UK’s Electric Vehicles (Smart Charge Points) Regulation went into effect. According to this law, charge stations must be pre-configured with a charging schedule that corresponds to off-peak demand and smart capability that enables them to connect with the grid to dynamically adjust pricing to correspond to peak demand.

Source: Deloitte

Get ‘FREE OF CHARGE’ access to 450+ other valuable EV Market Reports in our database. Enjoy reading!