Key Trends in EV Adoption

China’s Dominance

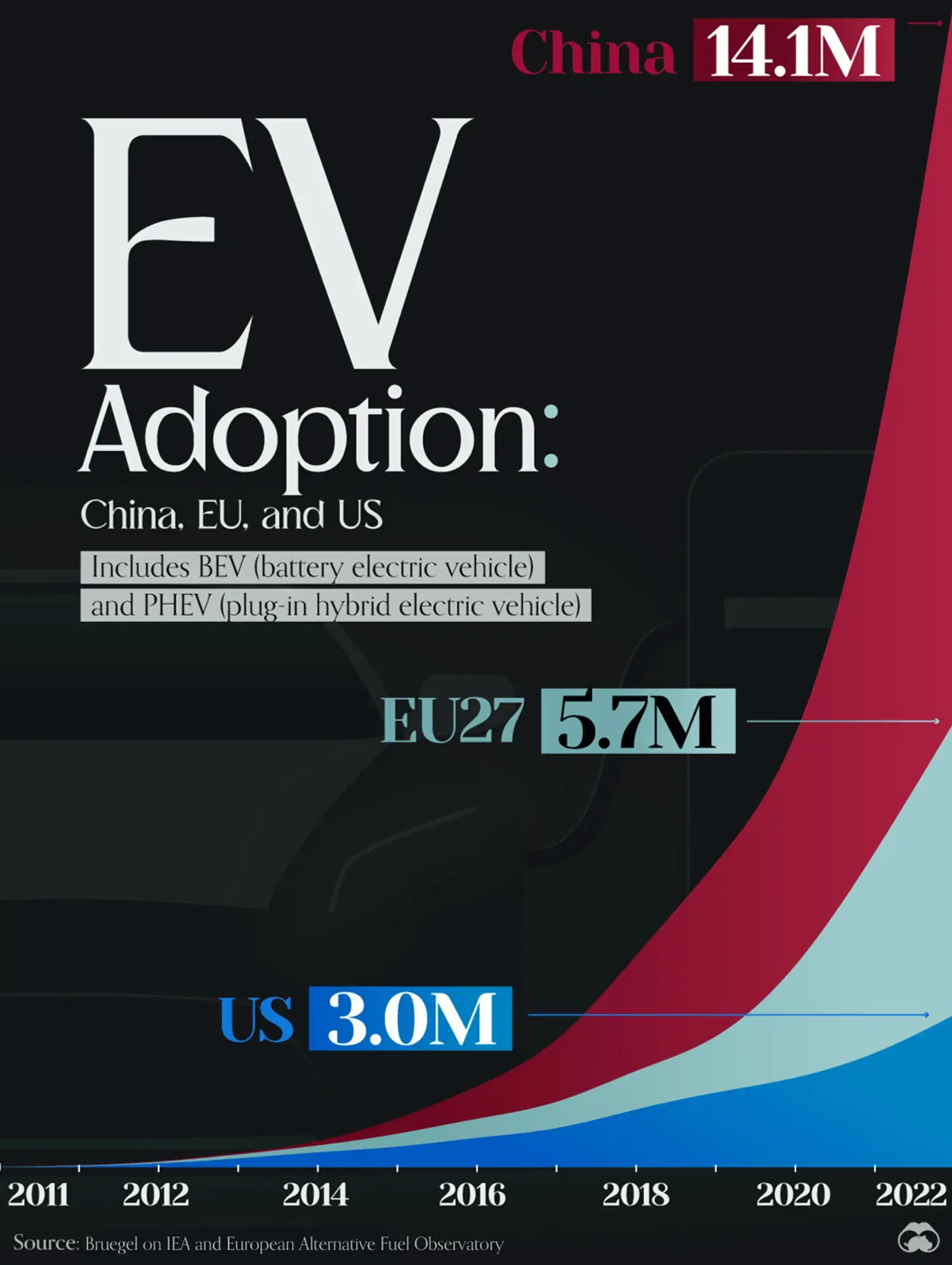

China’s EV market has expanded dramatically, driven by substantial government subsidies and incentives. From 2017 to 2022, the country saw a 63% increase in its EV stock, thanks to a robust policy framework aimed at boosting electric mobility. More than 200 billion yuan (approximately $28 billion) was spent on EV subsidies and tax breaks over the period from 2009 to 2022. This financial support covered public transportation, taxis, and consumer vehicles, making EVs more accessible to the general populace.

European Union’s Steady Growth

The EU27 has also made significant strides, achieving a compound annual growth rate (CAGR) of 62% in EV adoption. The European market’s growth has been fuelled by stringent emission regulations, generous incentives, and a strong push towards sustainable transport solutions.

United States’ Moderate Pace

In comparison, the U.S. EV market has grown at a more modest CAGR of 31%. While federal incentives and state-level programmes have supported this growth, the pace has been slower compared to China and the EU. The U.S. market is characterised by a combination of innovation from private enterprises and supportive, albeit less aggressive, government policies.

The Role of Subsidies and Policy Shifts

China’s early and aggressive investment in subsidies has been pivotal. For instance, purchase subsidies for EV consumers were phased out only at the end of 2022. The Chinese government’s strategic focus now includes incentivising EV production and usage through infrastructure support and tax exemptions.

In the EU, a blend of direct consumer incentives and robust regulatory frameworks has fostered growth. Policies are now evolving to further reduce carbon emissions, with continued support for EV infrastructure development.

The U.S. continues to support EV adoption through a mix of federal tax credits and state-specific incentives. However, the scale and impact of these measures are comparatively smaller than those in China and the EU.

Life After Subsidies

With the phase-out of purchase subsidies, the focus in China is shifting towards tightening regulations and enhancing market competitiveness. The introduction of the dual-credit scheme, which rewards manufacturers for producing cleaner vehicles, exemplifies this shift. The goal is to sustain momentum in EV adoption and ensure a smooth transition to an electrified transportation system.

Conclusion

China’s unprecedented growth in the EV sector showcases the impact of sustained governmental support. As subsidies phase out, the focus will shift towards market-driven growth, technological innovation, and stringent regulatory frameworks. The EU and the U.S., while trailing behind China, continue to make significant progress, driven by a mix of incentives and regulatory measures aimed at achieving long-term sustainability goals. The global race towards electrification is well underway, with each region adapting its strategies to meet unique challenges and opportunities.