There was a 180 GWh global demand for batteries in 2018. To attain a production capacity of 2,600 GWh by 2030, it is predicted that demand will continue to increase by 25% each year. This is mostly because electric car sales are increasing; by 2030, it is predicted that they would use 2,300 GWh annually. The largest market, estimated to make up 40% of the worldwide market, will be China.

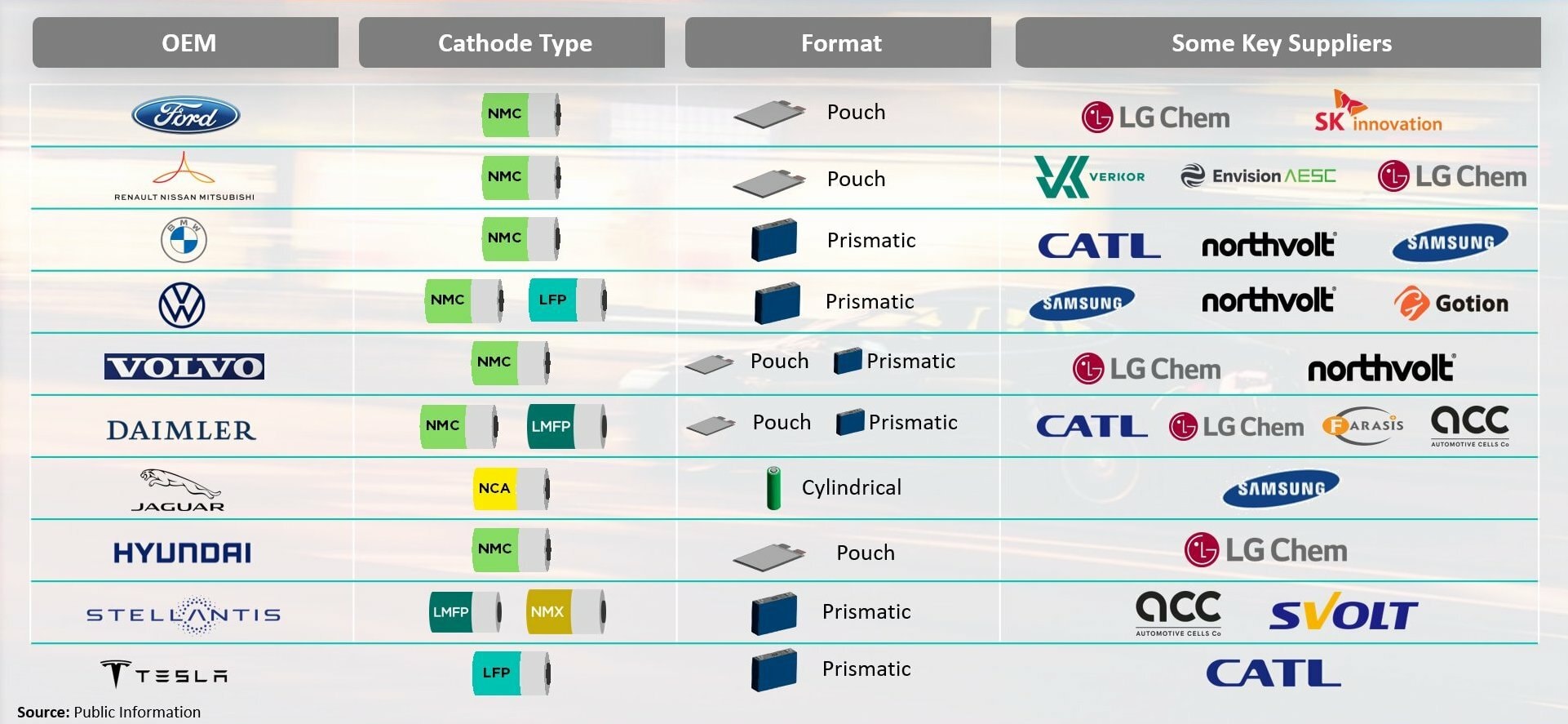

Electric car batteries are not uniform; instead, they come in a variety of cathode compositions and formats kinds. The primary OEMs choose the features and specifications that are most suited for their unique circumstances in conjunction with their primary battery suppliers. Battery manufacturers typically offer three different kinds of cell formats. Although they are heavier but simpler to make, there are smaller, mechanically robust cylindrical cells. Prismatic cells are produced by other battery manufacturers and have a larger capacity because of their shape and size. Pouch cells, on the other hand, lack a robust hard case but, because they are lighter in weight, have a great energy density.

The manufacturer’s decision is based on a number of inherent chemical and manufacturing factors. However, the final battery pack design for the automobile is influenced by the cell type chosen, including the thermal management system and the mechanical durability of the modules and the pack’s case. South Korea is home to 3 large battery manufacturing conglomerates: LG Chem, Samsung, and SK Innovation. While simultaneously expanding its choices, LG Chem manufactures cylindrical cells for Tesla while also making pouch cells for other OEMs. Samsung concentrates on producing prismatic batteries for Volkswagen. Ford, Mercedes-Benz, Volkswagen, Hyundai, and Kia are among the automakers that SK Innovation supplies with pouch cells.

With its headquarters in China, CATL is the world’s biggest manufacturer of lithium batteries. Prismagenic cells are produced by both Gotion and CATL. Panasonic, a Japanese manufacturer that ranks third in global battery production, provides Tesla with cylindrical cells. Nissan receives pouch cells from another Japanese business called Envision AESC.

Today’s market offers a variety of lithium battery chemistries that are frequently used by automakers. Currently, LFP, NMC, and NCA batteries are the three cathode compositions that are most often utilised.

Each chemical has unique benefits and drawbacks that make it appealing for particular vehicle uses. Although they are more costly, NCA batteries typically offer a greater energy density. LFP requires greater capacity inside the automobile since it has a lower energy density. However, compared to NMC and NCA, LFP chemistry offers superior safety. Compared to batteries that require pricey cobalt in the cathode, LFP batteries are more affordable. On the other hand, NCA batteries have the longest cycle lives.

The majority of contemporary electric vehicles on the market employ NMC and NCA batteries because of their reduced volume and greater driving range. However, in bigger vehicles, such as buses and trucks, where capacity is less of a restriction, the less expensive and safer LFP batteries are considered a suitable alternative. Battery producers are compelled by material scarcity and cost to research ways to reduce or even replace the active components in the cathode.

Source: FIA, CiCenergiGUNE

Get ‘FREE OF CHARGE’ access to 450+ other valuable EV Market Reports in our database. Enjoy reading!