Selected reports October 2022:

- From boom to brake: Is the e-mobility transition stalling? | Transport & Environment

- Affordable evs and mass adoption: the industry challenge | JATO

- Deploying charging infrastructure to support an accelerated transition to zero-emission vehicles | The Zero Emission Vehicles Transition Council

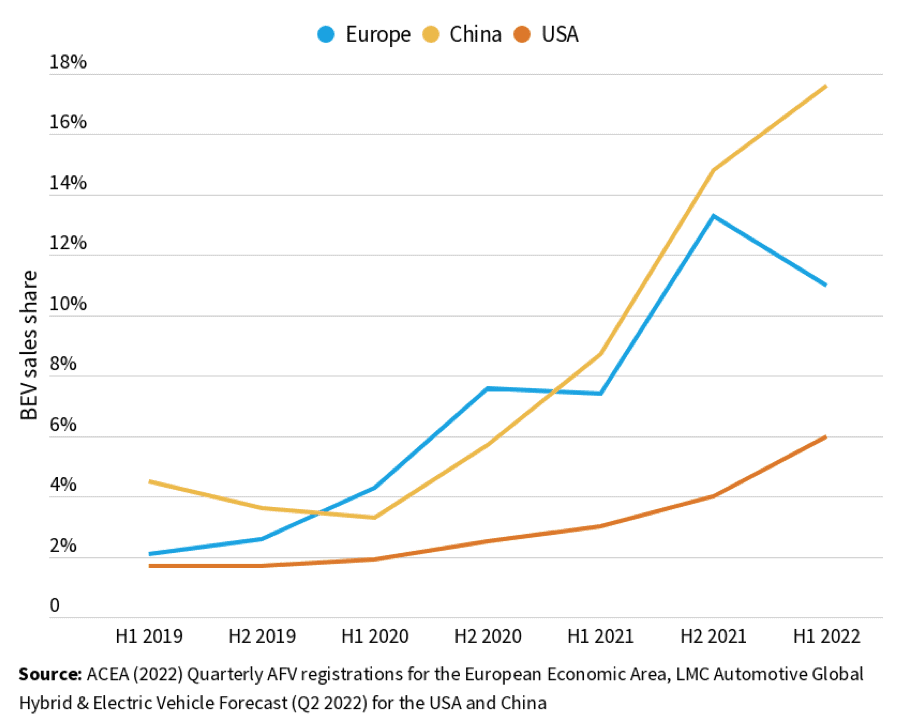

European sales of electric vehicles decreased to 11% in the first half of 2022.

Chinese manufacturers are gaining market share in Europe, selling 5% of all BEVs so far this year. By 2025, they may provide somewhere between 9% and 18% of the battery electric cars (BEV) in Europe, based on current trends.

The annual automobile CO2 research by Transport & Environment shows that European EV sales are stagnating as China and other competitors gain a footing in the market.

Access this report here

EV adoption is slowed down by the fact that EVs are still more expensive than ICE

OEMs all over the world have modified their business models to direct investment toward the creation and manufacturing of brand-new, improved EVs rather than conventional ICE cars.

However, EV adoption is being slowed down by the fact that EVs are frequently still more expensive than their ICE counterparts. this research evaluates government and industry activities with regards to current trends and market information.

Get the full summary of this report here

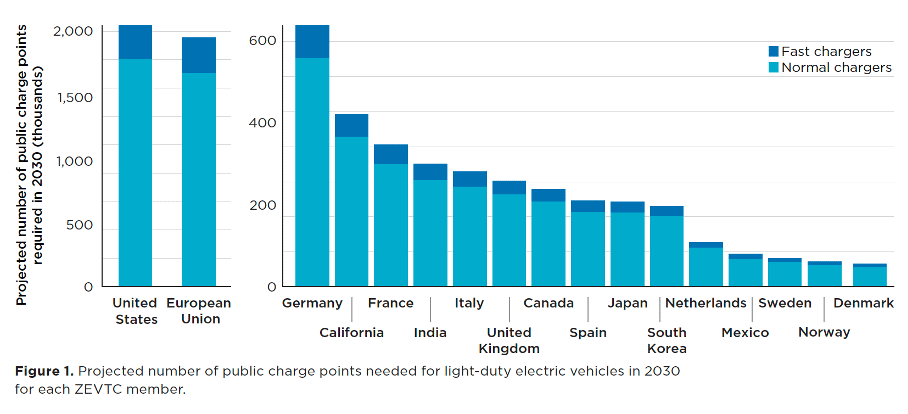

To ensure long-term infrastructure expansion for electric trucks, governments must take action right away.

The cost of hardware, installation, and planning for public and private charging infrastructure across all ZEVTC jurisdictions is expected to be over €336 billion by 2030, according to the ICCT’s most recent report. Both the public and commercial sectors will bear an equal share of these costs.

Emerging government initiatives show how stakeholder planning and collaboration that transcends silos spanning energy, transportation, and environmental agencies, as well as electrical providers, is essential for infrastructure development.

Get the full summary of this report here

If you have any suggestions feel free to provide feedback or upload your report.