Expanding the network: Charge points to meet growing demand

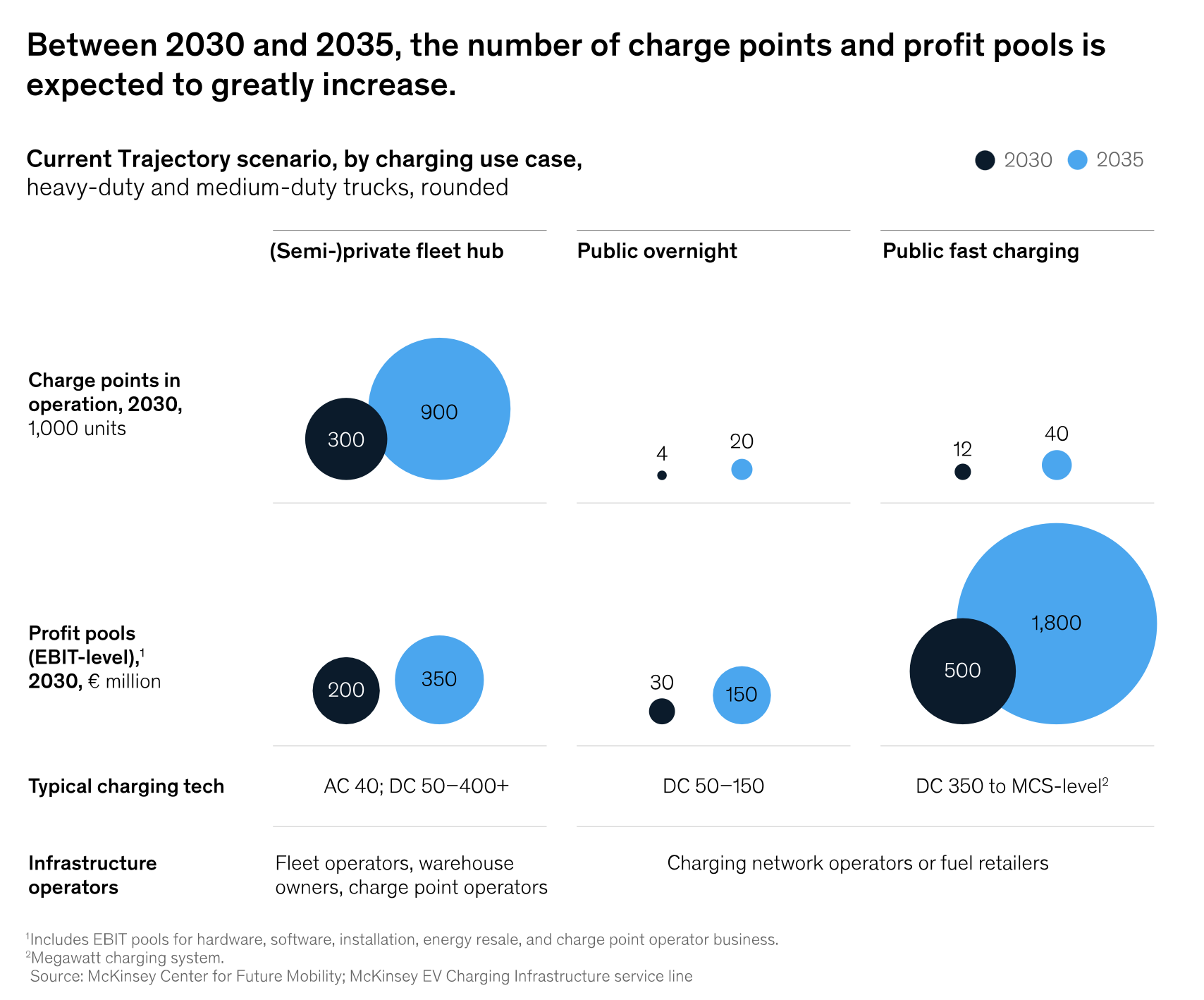

By 2030, Europe will need over 300.000 charging points for medium- and heavy-duty trucks, up from just about 10.000 today. This rapid increase will be essential to support the rise of electric trucks, which are a key part of meeting the EU’s emissions targets. The rollout will happen in two main stages. First, most of the new infrastructure will be installed at private fleet depots or semi-public hubs. These will primarily serve trucks with predictable, shorter routes—those that can be easily charged overnight or between trips.

The second phase, kicking in after 2030, will focus on expanding public charging infrastructure. By 2040, Europe is expected to have about 100.000 public charging points in operation, particularly along highways to support long-haul electric trucks. This expansion will make electric trucking more practical for operators that rely on public access, and it will be a major factor in encouraging the adoption of electric vehicles for long-distance freight.

Profit pools: Opportunities for growth

The financial potential of Europe’s electric truck charging network is significant. From now until 2030, profit pools related to charging are expected to grow steadily, starting with an estimated €200 million. The biggest profits will come from fast-charging points, which are anticipated to reach around €500 million by the end of the decade. Fleet operators, eager to minimise downtime, are willing to pay a premium for fast charging, especially during required driver breaks.

On the other hand, overnight public charging is expected to generate a smaller profit pool of about €30 million. This lower figure reflects the limited scenarios where such charging would be necessary, as many trucks with shorter routes can rely on private depots or semi-public hubs.

Key challenges and strategic steps for growth

Expanding Europe’s electric truck charging infrastructure will be a complex endeavor, requiring careful navigation of several challenges. One major hurdle is ensuring sufficient access to energy, which may involve upgrading grid capacity—a costly and time-consuming process. This makes early planning crucial to secure the necessary infrastructure before demand fully takes off.

Furthermore, there are significant investment risks involved, particularly in building public fast-charging stations. Adoption of long-haul electric trucks may be slower initially, potentially leading to underutilisation of these public chargers. To mitigate such risks, Charge Point Operators (CPOs) will need to form strategic partnerships with key fleet operators, ensuring consistent use and thus reducing the risk of investing in idle infrastructure.

Another important strategy involves creating shared charging parks near major logistics hubs. This would help spread out the costs, making the transition to electric more accessible for individual players. Meanwhile, investing in microgrids and advanced energy management systems will be key to improving efficiency and reducing reliance on the main grid, especially in areas where power supply might be limited.

Outlook for the future: Integrated solutions and early advantages

The success of Europe’s electric truck charging infrastructure will depend on the ability of companies to deliver integrated solutions. This means going beyond simply installing charging points—it involves offering everything from financing and electricity access to installation and long-term operational management. Companies like truck manufacturers, utility firms, and specialised service providers are all well-placed to make a significant impact in this market.

The potential rewards are substantial, especially for those willing to move early. With over €700 million in profit pools expected by 2030, early players could carve out a solid market position and gain first-mover advantages. No single company currently dominates this space, making it a highly attractive opportunity for those prepared to navigate the initial complexities and invest in comprehensive solutions.

Conclusion: Turning challenges into opportunities

Europe’s push for zero-emission heavy transport is paving the way for an enormous growth opportunity in electric truck charging infrastructure. The period from 2030 to 2035 will be critical. The number of charging points will need to grow dramatically, and so will the profit opportunities for those who can build and operate the necessary infrastructure. It’s not just about putting chargers in place—it’s about understanding the needs of the logistics sector, forming smart partnerships, and deploying cutting-edge energy solutions.

The road to fully electrifying Europe’s trucking industry is full of challenges, but it is also rich with opportunity. Companies that can navigate the complexities—securing energy access, managing risk, and forming strategic alliances—will be well-positioned to lead this market and capture the potential profits. The time to act is now, and the companies that are ready to adapt and innovate will find themselves at the forefront of an emerging, highly profitable industry.

Source: McKinsey & Company