US Initiatives and Investments

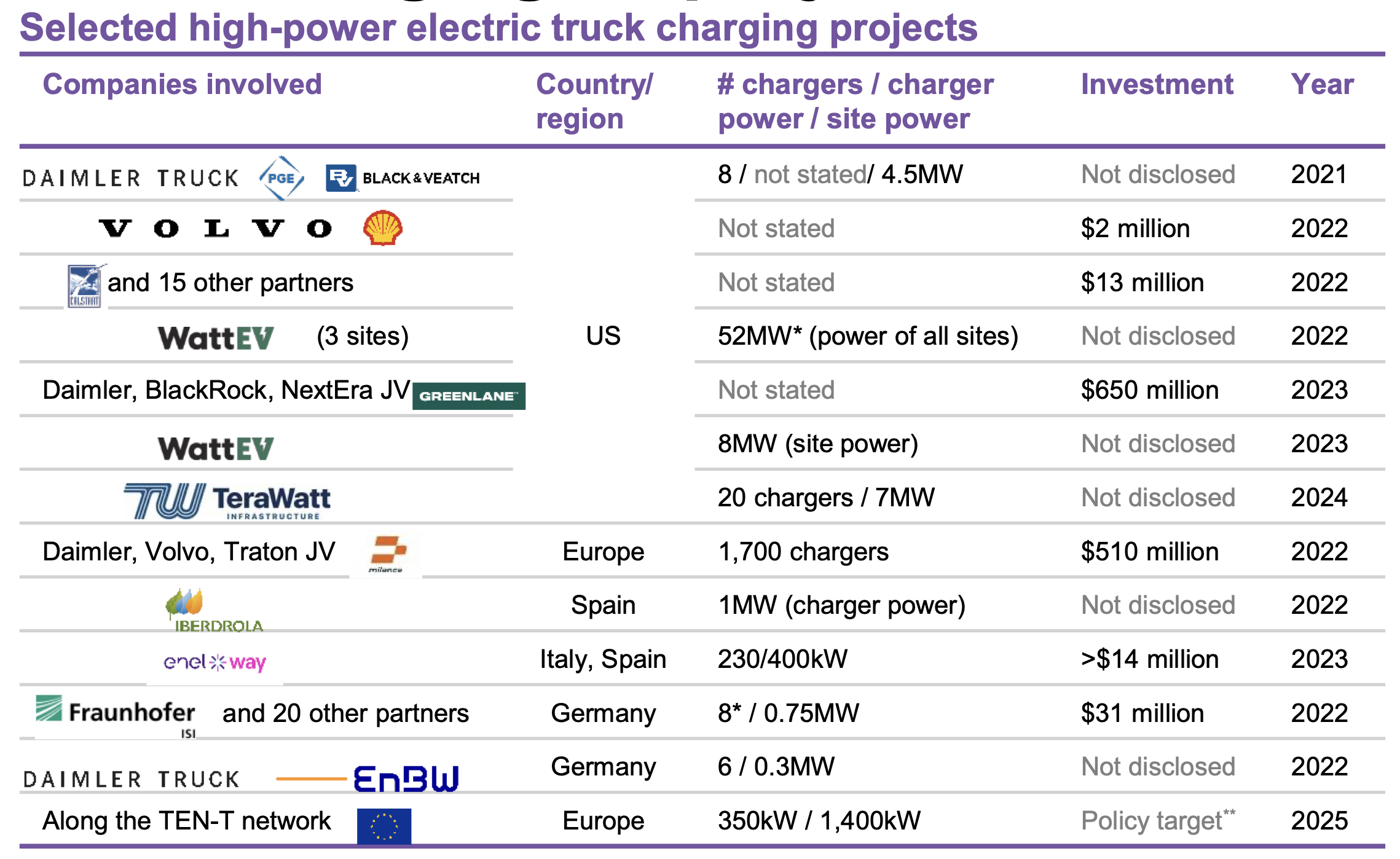

The United States has seen a flurry of activity, with key industry players like Daimler Truck, Volvo, and several utility companies, investing heavily into the development of high-power charging stations. Notable mentions include a joint venture between Daimler, Blackrock, and Nextera, earmarking $650 million for charging infrastructure in 2023, and Calstart’s collaboration with 15 partners pooling $13 million in 2022.

European Efforts and Policies

The momentum is equally robust in Europe, where a joint venture involving Daimler, Volvo, and Traton plans to roll out 1700 chargers, backed by a hefty investment of $510 million in 2022. The policy impetus comes from the Alternative Fuel Infrastructure Regulations (AFIR) and the Connected Europe Facility (CEF), providing a supportive backdrop for infrastructure development.

The projects are ambitious, with the total site power for many exceeding several megawatts. For instance, the US-based WattEV is developing sites with a combined power of 52MW. However, despite the potential for profitability, stakeholders are facing challenges such as high building costs, expensive equipment, and complex grid connections.

While the initial focus has been predominantly in the US, there is a growing shift towards European markets. Spain’s Iberdrola and Italy’s Enelxway are making their mark with significant investments, indicating a diversification in the geographical spread of these projects.

Conclusion

As these developments unfold, the industry is witnessing a collaborative effort among standalone operators, utilities, vehicle manufacturers, and financial investors in the US, while in Europe, the policy drive is setting the stage for a more sustainable commercial transport network. With a policy target set for the TEN-T network in Europe for 2025, the future of commercial EV charging looks promising, marking a critical step in the drive towards a greener transportation sector.

Source: Zero Emission Vehicle Factbook 2023 | BloombergNEF