Selected reports

- Electric vehicles will soon lead global auto markets, but too slow to hit climate goals without new policies | Energy innovation

- The Internal Combustion Engine Bubble | Greenpeace

- Assessment of light-duty electric vehicle costs and consumer benefits in the united states in the 2022–2035 time frame | The ICCT

60% of new passenger vehicles EV by 2030 and 100% by 2035

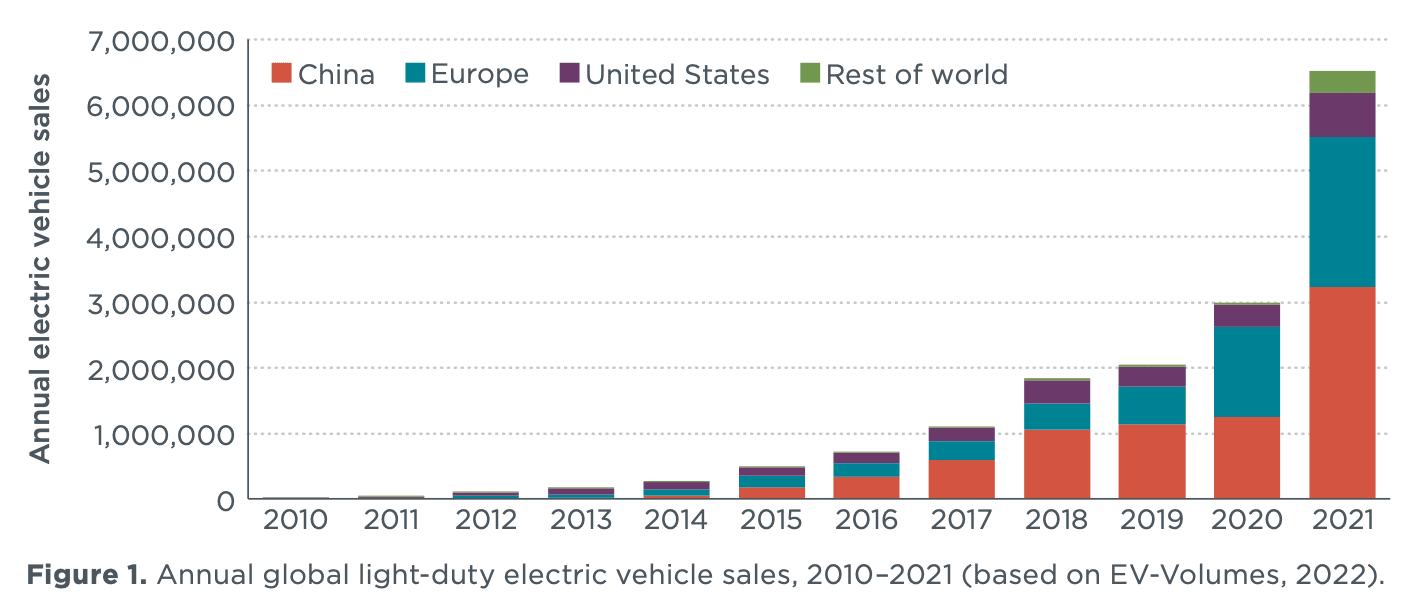

ZEVs are poised to dominate the world’s vehicle markets, but without extra legislative assistance, success at a rate consistent with climate goals is not a given. Case studies of solar and wind technology demonstrate the danger of insufficient governmental assistance, particularly for technologies that have significant societal advantages but are undervalued by markets, increasing the risk of delayed innovation and adoption. Case studies using solar and wind technologies also give hope that, despite the impacts of the learning curve, innovation and cost reductions will persist with increased EV use.

This report offers a policy roadmap for capturing the benefits of ZEVs for the environment, economy, and public health. Its top recommendation is that ZEV sales standards be well-designed and reach 60 percent of new passenger vehicles by 2030 and 100 percent by 2035, along with stricter tailpipe emissions regulations, fair consumer incentives, and supply-chain development.

Electric vehicles will soon lead global auto markets, but too slow to hit climate goals without new policies | Energy innovation

Over US$2 trillion is at risk in market capitalization and debt across the world’s 12 largest car manufacturers alone

As climate change intensifies, governments aggressively enforce sales bans on diesel and gasoline vehicles everywhere from New York to Singapore to the UK. According to recent data, conventional automakers are still lagging behind in the transition to electric vehicles, and their sales targets do not correspond to the Paris Climate Agreement’s 1.5°C goal.

This report assesses the disparity between conventional manufacturers’ sales goals and the actual sales of diesel and gasoline vehicles within the Paris Agreement’s 1.5°C limit. Researchers have shown that in order to avoid increasing financial losses and a catastrophic global warming, automakers must hasten the switch to zero-emission automobiles.

The Internal Combustion Engine Bubble | Greenpeace

Predicting average electric and conventional vehicle pricing in the USA

The likelihood of a switch to electric cars grows as the number of electric vehicle manufacturing volumes increases globally. Governments from all around the world are attempting to hasten the switch to zero-emission transportation in order to satisfy goals for energy security, air quality, climate change, and industrial growth. The United States is trying to catch up to other countries by supporting electric vehicles through supply-chain initiatives, automotive rules, customer incentives, and assistance for the installation of charging infrastructure.

In order to predict average battery electric vehicle (BEV), plug-in hybrid vehicle (PHEV), and conventional vehicle pricing across various light-duty vehicle classes in the United States through 2035, this paper looks at vehicle component-level costs. These cost projections are used to evaluate the potential benefits to consumers as well as the impact on US car emission requirements.

Assessment of light-duty electric vehicle costs and consumer benefits in the united states in the 2022–2035 time frame | The ICCT