More than 450 commercially available ZEV-models had been manufactured in 2021, five times more than in 2015. Boosted by more than half a trillion dollars in planned EV supply-chain investments, many new models are on the way.

Policy support keeps growing

Parallel with consumer interest and automaker commitments, policy support is also growing. More and more major markets are covered by 100 percent ZEV sales targets, such as the pledges by the European Union and California to complete the transition no later than by 2035.

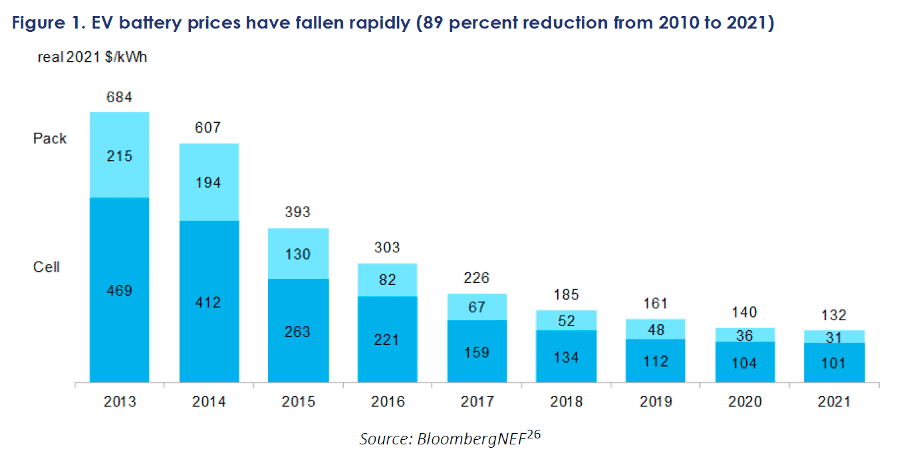

Due to rapid battery innovation, the last decade has seen a revolution in EV economics, causing the price of EV batteries to plunge by 8%. This has resulted in total lifetime costs for EVs being less than for a comparable ICE vehicle, due to EV savings on fuel and maintenance. Even though EVs are still slightly more expensive, the up-front cost difference is shrinking. In a couple years, most EVs are expected to cost less than comparable ICE cars.

Meeting climate goals

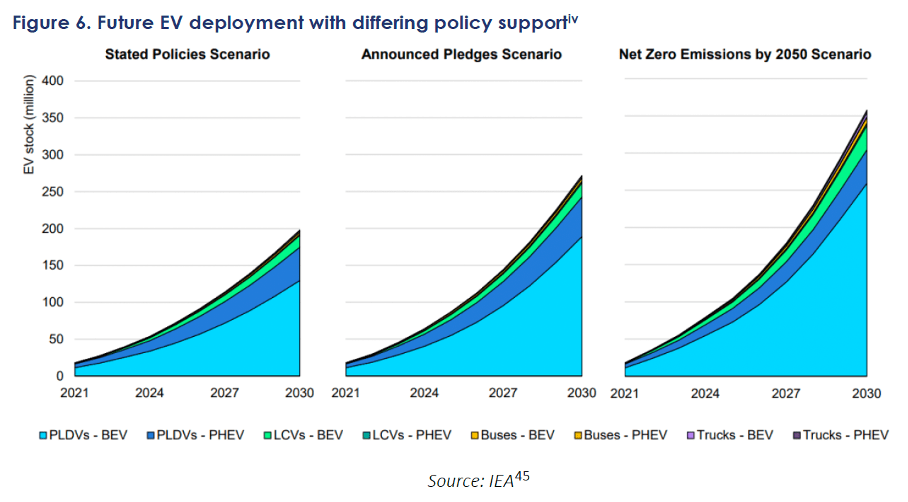

These trends have put transportation electrification in the fast lane. The question remains, however, if the ZEV transition is going fast enough to meet climate goals. To help answer that question, this report focuses on passenger vehicles and draws mainly on the International Energy Agency’s (IEA) Net Zero by 2050 study. This study charts a path to energy carbon neutrality by mid-century, based on a 2035 timetable for completing the transition to zero-emission passenger vehicles.

Even though ZEVs are on pole to take over global auto markets, more policy support is needed to meet climate goals. Case studies on solar and wind technology illustrate the peril of insufficient policy support, leading to the risk of deferred deployment and innovation.

Policy Recommendations

The report hands out recommendations to policymakers for ZEV shares of new passenger vehicles to reach 60 percent by 2030 and 100 percent by 2035. Considering technological and market trends these goals should be achievable. This report highlights new vehicle sales performance standards as a basis to accelerate EV sales consistent with achieving climate goals.

There are two varieties when it comes to new vehicle sales performance standards for decarbonization: ZEV sales and tailpipe greenhouse gas (GHG) emissions. The report recommends using both tailpipe and ZEV standards where possible.

Consumer incentives

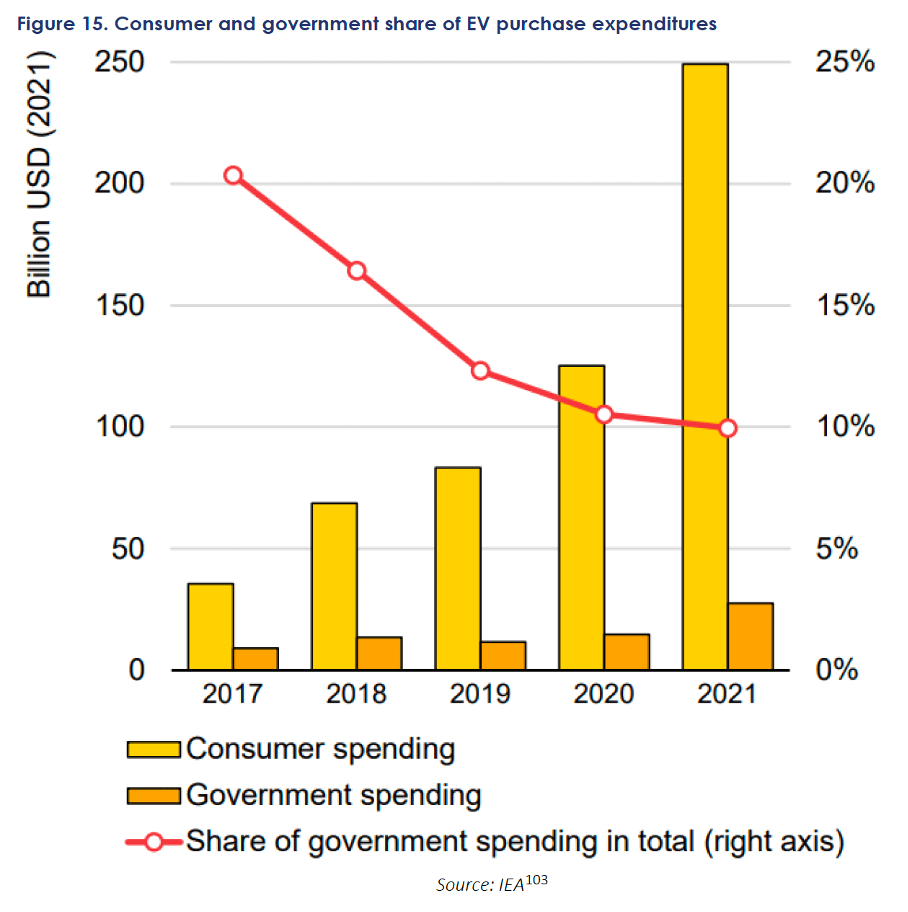

Consumer incentives for EV purchases will be critical in coming years. As projected, most EVs will cost less than comparable ICE vehicles by 2030.

It is also essential to execute policies that spur public charging infrastructure investment, whether through public funding or by inducing private investments. Even though much EV charging takes place at homes, there should be sufficient public charging points available for convenient, long-distance travel.

Another priority to support a rapid EV transition lies in policy supporting expanded supply-chain capacity in an environmentally responsible way, including increased critical mineral production. The global investment in new critical mineral supplies provides confidence about the potential for additional supply.

The extraordinary rise of EV sales could spur a surprisingly fast transition to EVs dominating the mainstream market. However, inadequate policy support could hinder the EV transition.

Therefore, policymakers should support rapid EV deployment with smart, agile policies like those outlined in this report.

Get ‘free of charge’ access to more than 400 valuable EV Market Insights via evmarketsreports.com, the world’s largest e-Mobility Reports and Outlooks database. Enjoy reading!