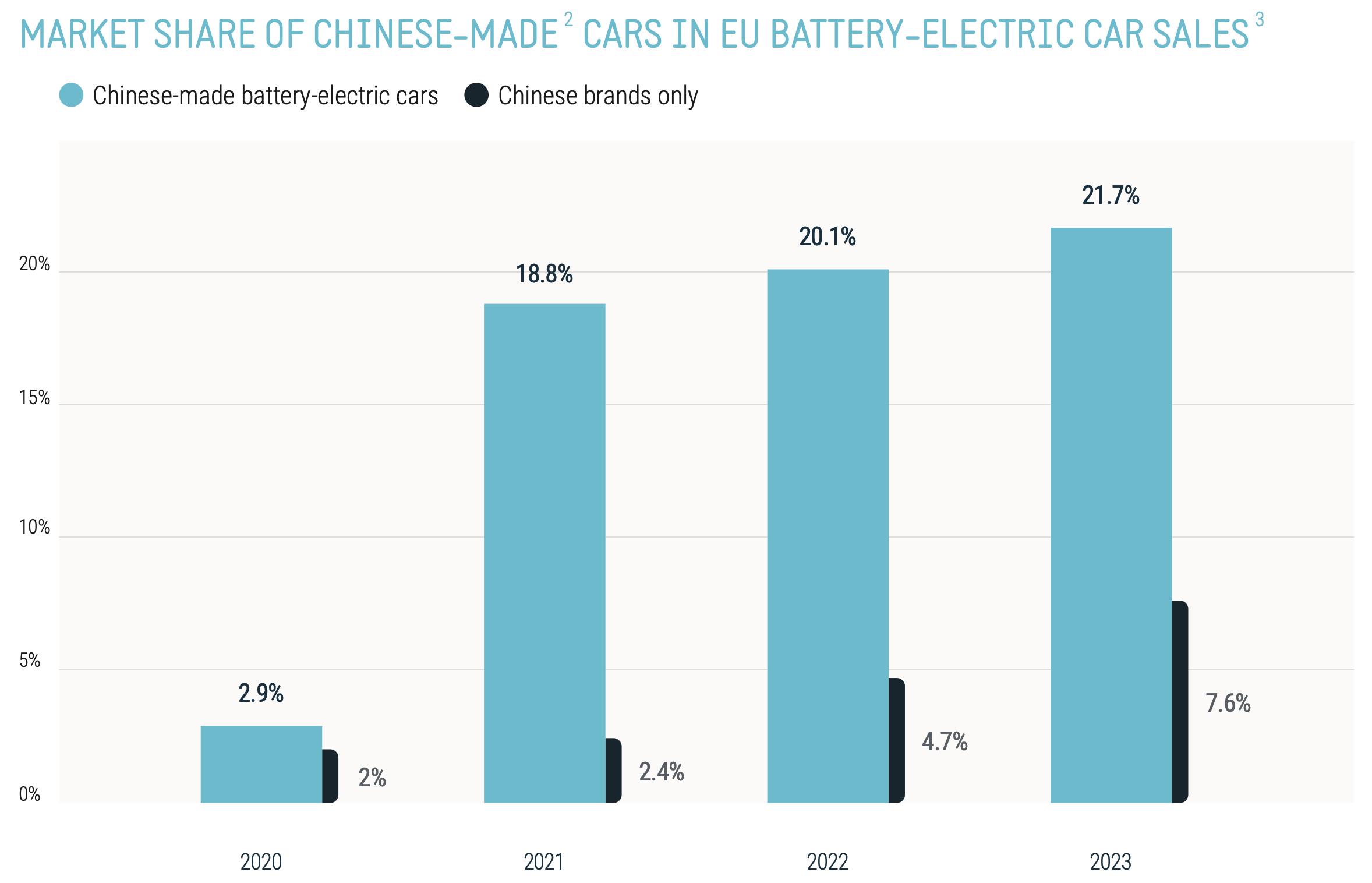

The investigation revealed that the value chain for BEVs in China is heavily subsidised, granting Chinese manufacturers an unfair competitive advantage in the European market. This has led to a substantial increase in the market share of Chinese-made BEVs in the EU, rising from approximately 3% to over 20% in just three years. Notably, Chinese brands alone account for about 8% of this market share.

Trade Flows and Market Dynamics

In 2023, the EU imported 438,034 battery-electric cars from China, valued at €9.7 billion. In stark contrast, the EU exported only 11,499 BEVs to China, worth €852.3 million. The disparity highlights the significant imbalance in the BEV trade between the two regions.

To address this, the European Commission has pre-disclosed the provisional duties that will be applied to three sampled Chinese producers:

- BYD: 17.4%

- Geely: 20%

- SAIC: 38.1%

Other cooperating Chinese BEV producers not included in the sample will face a weighted average duty of 21%, while non-cooperating producers will be subject to a residual duty of 38.1%.

Ensuring Fair Competition

The European Automobile Manufacturers’ Association (ACEA) welcomed the Commission’s decision, underscoring the need for a level playing field in international trade. ACEA Director General, Sigrid de Vries, stated, “Free and fair trade is essential for a globally competitive European automotive industry. Healthy competition drives innovation and choice for consumers.

However, what the European automotive sector needs above all else to be globally competitive is a robust industrial strategy for e-Mobility.”rnrnDe Vries emphasised the importance of access to critical materials, affordable energy, a coherent regulatory framework, and sufficient infrastructure for charging and hydrogen refilling. These elements, she argued, are crucial for the EU to maintain its competitive edge in the green transition.

Procedural Steps and Member State Involvement

The anti-subsidy investigation, formally initiated on 4 October 2023, is set to conclude within 13 months. Provisional countervailing duties may be published by 4 July 2024, with definitive measures to follow within four months. The Commission has informed all interested parties, including the Chinese government and companies, as well as EU Member States, of the intended measures.

Member States will play a critical role in the final decision. While they do not vote on the level of provisional duties, they will be briefed on the Commission’s findings and will vote on the imposition of definitive measures. This vote will require a qualified majority, ensuring a thorough review of the evidence and methodology used in the investigation.

Industry and Market Impact

The imposition of provisional duties aims to mitigate the economic injury caused by subsidised imports and to restore competitive balance. The duties will be added to the existing 10% import duty on BEVs. This measure is intended to prevent strategic dependencies on foreign partners and to ensure that the EU’s green transition is not compromised by unfair trade practices.

The Commission has also considered the potential impact of these duties on consumers and market operators. The transparent and procedural approach aims to give all parties sufficient time to adjust and prepare for the eventual tariffs.

Next Steps

Following the pre-disclosure, sampled companies have the opportunity to comment on the accuracy of their individual duty calculations. By 4 July 2024, the Commission will publish a regulation detailing the provisional findings, with duties entering into force the following day. Interested parties will then have 15 days to comment on the provisional findings, and a further seven days to comment on responses from other parties.

The investigation will continue, with the Commission expected to reach its final conclusions within four months of the provisional measures. Final duties, if imposed, will be in force for five years, ensuring long-term stability and protection for the EU BEV industry.

Conclusion

The European Commission’s decision to impose provisional countervailing duties on Chinese BEVs is a significant step towards ensuring fair competition and protecting the EU’s automotive industry. By addressing the issue of unfair subsidies, the Commission aims to create a level playing field, promoting innovation and sustaining the EU’s green transition. The coming months will be crucial as the investigation progresses and definitive measures are considered.

Source: European Commission, ACEA