Europe-wide context: EU + EFTA + UK

While the European Union alone recorded a 15.6 per cent BEV market share in the first seven months of 2025, the figure is even higher when looking at the wider region. Across Europe as a whole (EU + EFTA + UK), new BEV registrations accounted for 17.2 per cent of all new passenger car sales. This highlights how markets such as Norway, Switzerland and the UK are pushing the overall European average upwards.

A milestone for Europe’s electric mobility

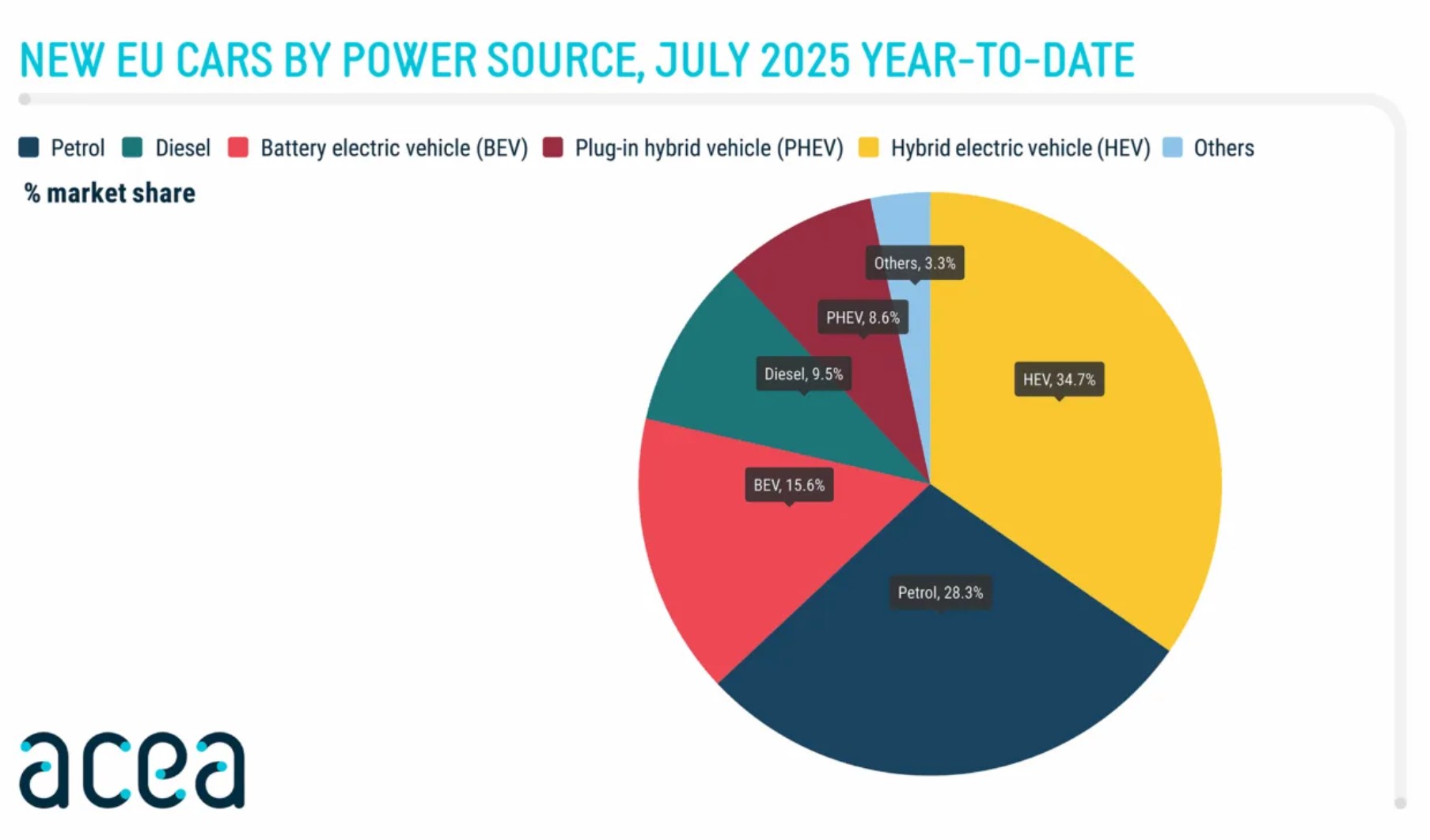

Crossing the one-million threshold in little over half a year underlines how quickly the market is evolving. Electric cars are no longer confined to early adopters but are steadily entering the mainstream. Importantly, BEVs matched their 15.6 per cent share in July alone, compared with just 12.1 per cent in July 2024. At that time, diesel cars still held a stronger position at 12.8 per cent. In 2025, however, diesel slipped to just 9.5 per cent, illustrating the rapid erosion of its market role.

Hybrids hold the lead, combustion loses ground

Despite the surge in pure-electric cars, hybrid vehicles remain the top choice for EU consumers. With a 34.7 per cent market share, hybrids have overtaken petrol as the dominant option. Many manufacturers now only release new model series with some form of hybridisation, a trend that is expected to strengthen in the near future.

By contrast, conventional combustion models continue to lose ground. Combined petrol and diesel market share fell from 47.9 per cent in 2024 to just 37.7 per cent this year. Petrol registrations alone dropped by more than 20 per cent, with France, Germany, Italy and Spain all reporting double-digit declines.

Country performance: Germany leads, France falters

The European market is far from uniform. National performances differ, with some countries surging ahead and others lagging.

Germany recorded a remarkable 38.4 per cent increase in BEV registrations, consolidating its position as the largest and most dynamic market in Europe.

Belgium posted a strong growth of 17.6 per cent, confirming that smaller markets are also playing a crucial role in the transition.

The Netherlands saw a more moderate rise of 6.5 per cent, reflecting steady progress rather than rapid acceleration.

France showed a contrasting picture: while July 2025 produced a 14.8 per cent gain, year-to-date registrations were down by 4.3 per cent compared to 2024.

Early 2025 EV sales in France declined due to reduced subsidies and consumer uncertainty, with many buyers delaying purchases.

Nevertheless, with social leasing, revised ecological bonuses, and new models like the Renault 5 E-Tech, demand is set to accelerate year-end.

Together, these four countries account for over 60 per cent of all BEV registrations in the EU, highlighting their pivotal influence on Europe’s overall trajectory.

Plug-in hybrids: growth driven by southern Europe

Plug-in hybrid vehicles (PHEVs) also contributed to electrification momentum. Registrations rose to 561,190 units, equivalent to an 8.6 per cent market share, up from 6.9 per cent last year. Growth was particularly strong in Spain (+94.5 per cent), Italy (+60.3 per cent) and Germany (+59.2 per cent), underscoring how southern European markets are increasingly relevant in the EV mix.

Industry perspective: regulatory strain

Despite the progress, ACEA has stressed that a 15.6 per cent BEV share is “still far from where it needs to be at this point in the transition.” The association recently joined forces with CLEPA, the European suppliers’ group, in urging EU policymakers to reconsider the pace of emissions regulation.

In a letter to European Commission President Ursula von der Leyen, ACEA President Ola Källenius, who is also CEO of Mercedes-Benz, argued that the current 2035 target—allowing only zero-emission cars to be registered—may no longer be feasible. This plea highlights the growing tension between regulatory ambition and market realities.

Outlook: momentum with challenges

The European car market is at a turning point. BEVs are moving rapidly towards the mainstream, and crossing one million registrations in just seven months is a landmark achievement. Yet hybrids remain dominant, and combustion models, though shrinking, still account for over a third of sales.

The divergence between national markets—Germany’s surge versus France’s hesitation—also reveals that the transition is uneven. Combined with regulatory pressure and varying manufacturer performance, the road to a fully electric Europe remains complex.

What is clear, however, is that Europe’s automotive landscape is shifting at an unprecedented pace. Strategic policy, sustained consumer incentives and accelerated infrastructure investment will be critical in ensuring that today’s momentum translates into long-term transformation.

Sources

ACEA, new car registrations July 2025