Europe, being the second-largest electric car market after China, is witnessing its major carmakers struggling to keep up with the demand for crucial battery minerals such as cobalt, lithium, and nickel. The report’s findings indicate that less than a fifth of the estimated demand for these minerals has been met based on publicly disclosed contracts. This contrasts sharply with the more robust strategies of global counterparts like Tesla and BYD.

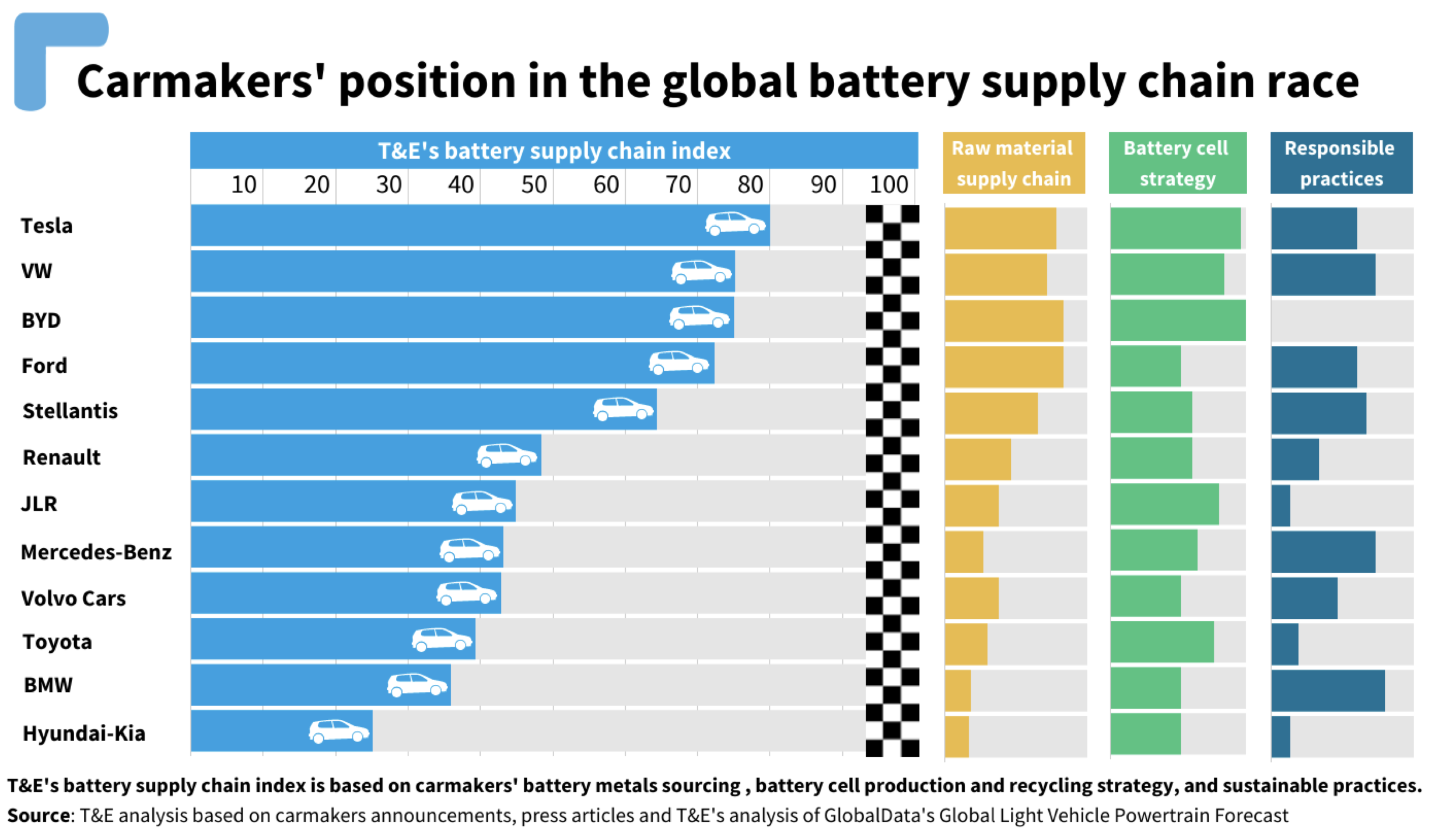

In a detailed ranking of preparedness for the 2030 electrification targets, Tesla emerges as the front runner, with Volkswagen leading among traditional European carmakers. Other brands such as Ford and Stellantis show relative preparedness, but the majority, including Renault, Mercedes-Benz, Volvo, and BMW, lag behind, scoring less than 50 out of 100 points.

The report underscores the high concentration of critical mineral supply in Asia, highlighting the risk it poses to European carmakers’ resilience and Europe’s strategic autonomy. To mitigate this risk, T&E recommends that European OEMs actively support the development of local supply chains. This support is not only crucial for their own resilience and supply security but also aligns with Europe’s strategic autonomy goals.

Sustainability in sourcing practices is another critical focus of the report. German carmakers, namely BMW, Mercedes-Benz, and Volkswagen, are lauded for their efforts in adopting responsible supply chain practices. This aspect is increasingly vital for long-term resilience and consumer acceptance in the EV market.

Despite progress in securing battery cell supply, T&E points out a “great raw materials disconnect” in the midstream and upstream segments of the supply chain. The report reveals that only a fraction of the lithium, nickel, and cobalt demand is secured by European carmakers by 2030. It emphasises the need for more proactive strategies in securing these materials, including direct procurement from miners and recyclers, resource efficiency, and innovation in battery chemistries.

The report concludes with a stark warning and a call to action for European carmakers. They are urged to accelerate their transition to EVs, support the creation of a robust European EV ecosystem, and secure the necessary raw materials sustainably. Failure to do so could result in a loss of market share to well-established Chinese and American EV makers and a potential decline in global market standing.

T&E’s analysis provides key recommendations for policymakers and industry stakeholders. These include locking in the 2035 combustion engine phase-out for supply chain investment certainty, encouraging faster scale-up of battery and EV manufacturing in Europe, and implementing product sustainability rules to foster sustainable battery cell manufacturing.

As the EV market continues to evolve rapidly, this report serves as a critical call to action for European carmakers to redefine their strategies and secure their position in the global EV landscape.

Source: Pedal to the metal | Transport & Environment