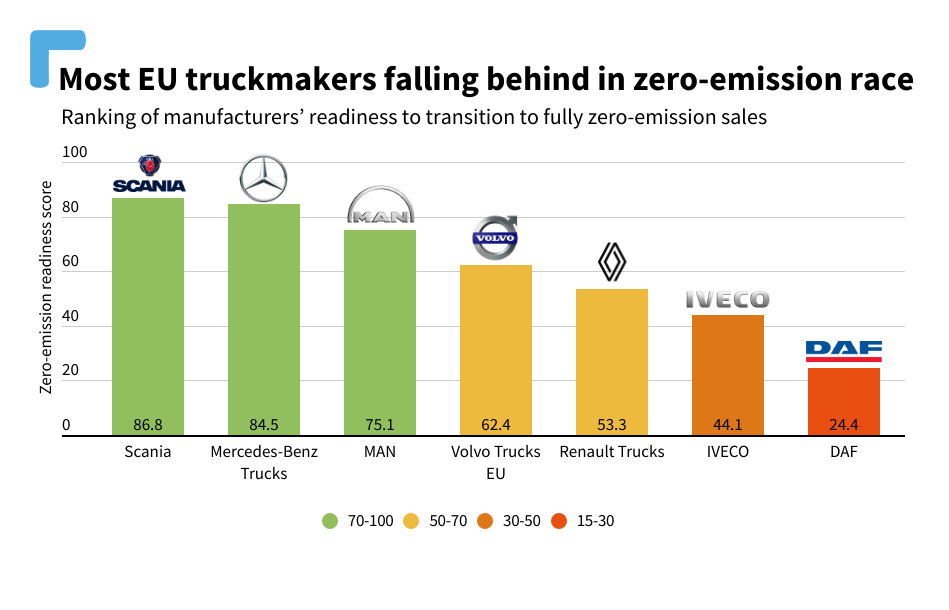

Scania, Mercedes-Benz Trucks, and MAN have emerged as the frontrunners among European truckmakers due to their ambitious announcements and strategies. All three companies have set a target of achieving 100% new zero-emission truck (ZET) sales by 2040 or even earlier. Volvo Trucks, currently leading the European market in battery-electric truck sales, has the most ambitious target for 2030 with a goal of reaching a 70% ZET sales share. However, Volvo Trucks has not committed solely to truly zero-emission technologies in the long run. On the other hand, Renault Trucks and IVECO Group are lagging behind in the transition. DAF, unfortunately, has received a weak score in the report for lacking a public ZET target for 2030 and performing poorly in the battery value chain.

One crucial aspect highlighted in the report is the need for stronger action to secure battery supply. Only Tesla, BYD, and TRATON’s Scania and MAN have managed to secure long-term supplies of battery raw materials, primarily due to their involvement in the car market segment. Other truck manufacturers, who have fewer connections with carmakers, are now faced with the challenge of building their own battery value chains through in-sourcing or partnerships. Without comprehensive battery ecosystems, European truckmakers risk losing their leadership positions in the years to come. The report emphasizes the importance of ambitious HDV (Heavy-Duty Vehicle) CO2 standards to encourage investment in the battery industry within Europe.

While Chinese manufacturers currently dominate the battery market, the report suggests that they are unlikely to face difficulties in sourcing batteries. In contrast, the report predicts that the IRA (Infrastructure and Jobs in America) will enhance investments in battery manufacturing in the US. Interestingly, approximately two-thirds of planned battery capacity in Europe could be at risk if robust industrial regulations are not established.

Source: Ready or Not | Transport & Environment