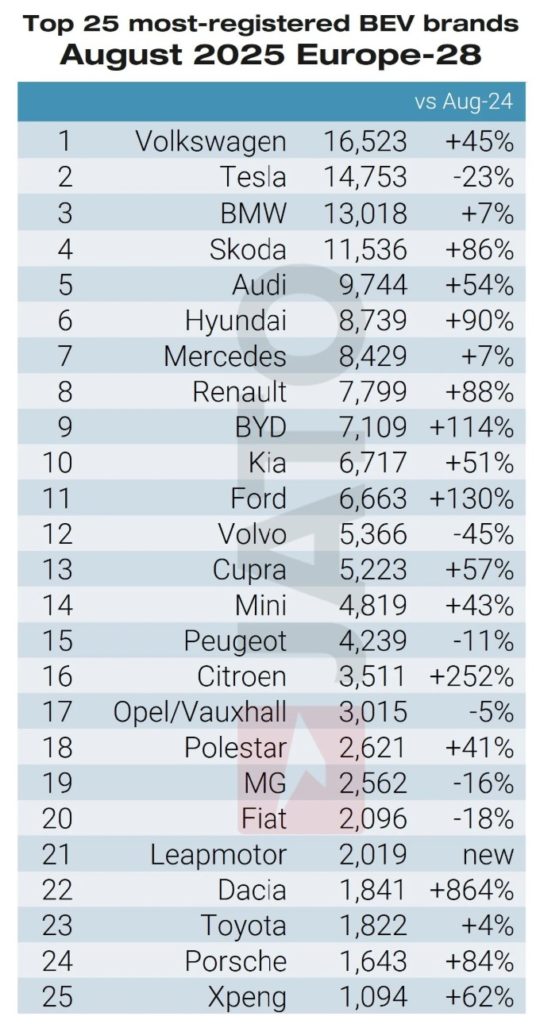

European BEV sales leaders: VW, Tesla, BMW, Mercedes and Hyundai-Kia

On the brand level, Volkswagen continues to lead in Europe, both in total registrations and in the EV segment. The group sold more than 217,000 vehicles in August 2025, maintaining its top spot. Its BEV volumes also grew in line with the overall EV market, confirming VW’s role as the backbone of European electrification.

Tesla held second place in BEV sales, led by the Model Y, although the brand’s growth was weaker than the overall BEV market, meaning its relative market share declined compared with last year.

BMW and Mercedes-Benz remained strong contenders, both growing their BEV deliveries above the market average. BMW in particular benefited from demand for its i4 and iX models, while Mercedes-Benz gained traction with the EQE and EQA.

Hyundai-Kia also recorded double-digit BEV growth, powered by the Hyundai Ioniq 5/6 and the Kia EV6, consolidating its reputation as a competitive non-European challenger.

Compared to last year, Volkswagen maintained stable market leadership, Tesla slipped slightly in share despite still commanding volumes, while BMW, Mercedes, and Hyundai-Kia all expanded their footprint.

Chinese brands slicing into the European market

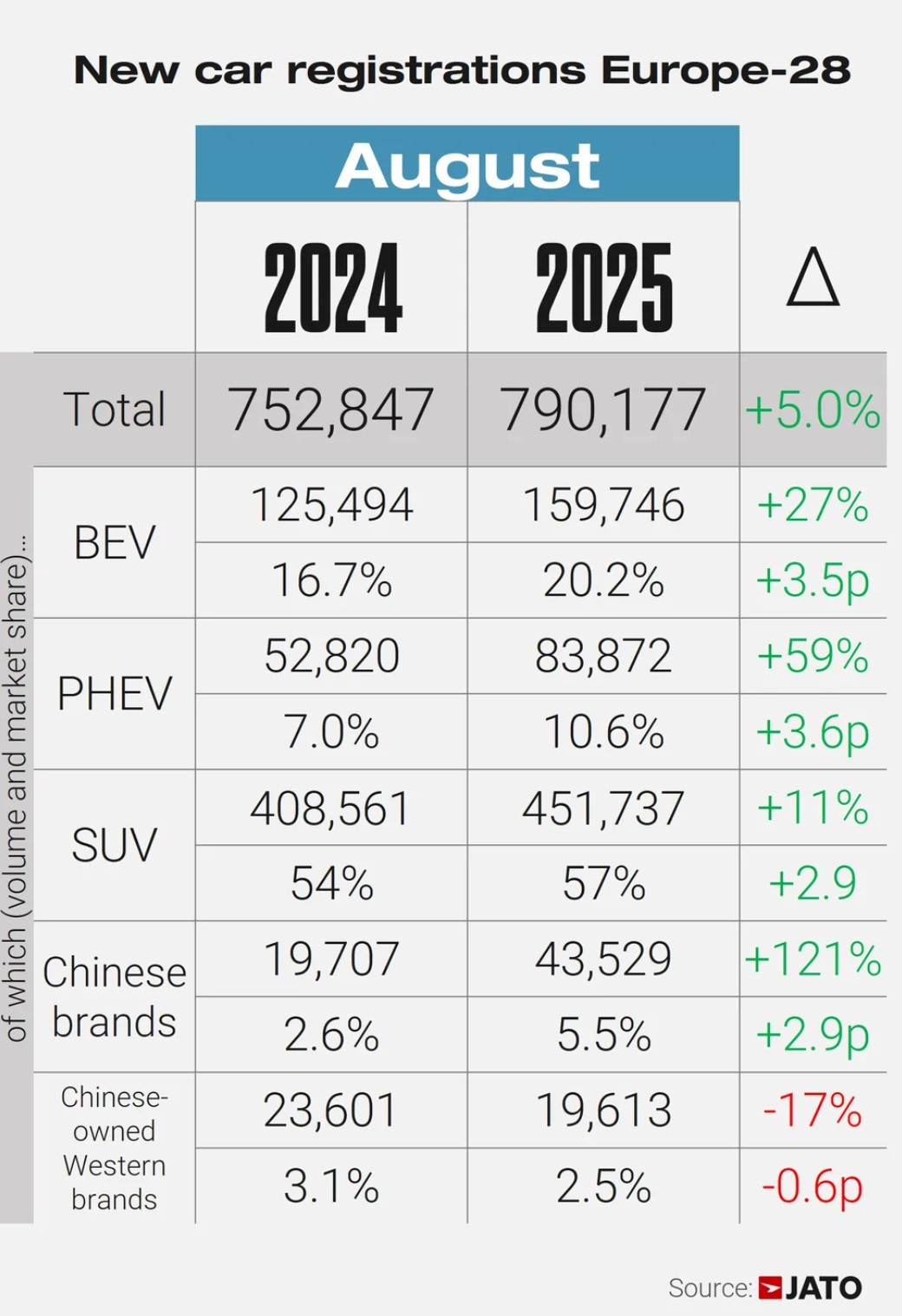

One of the most striking developments in August 2025 is the rapid rise of Chinese automobile brands in Europe. Chinese sales more than doubled year on year, with 121 % growth, pushing their combined registrations beyond 43,500 units in a single month. In fact, these volumes surpassed the individual monthly sales of some well-established European brands such as Audi and Renault.

While over 40 Chinese brands are active in Europe, the top five—MG, BYD, Jaecoo, Omoda, and Leapmotor—account for around 84 % of total Chinese brand sales.

MG registered more units than both Tesla and Fiat in August 2025.

BYD surpassed Suzuki and Jeep in volumes.

Jaecoo and Omoda outsold European names such as Alfa Romeo and Mitsubishi.

Chinese brands are not only competing in pure BEV space—they are also aggressively pushing in the PHEV sub-segment. In August 2024, Chinese PHEV registrations in Europe were negligible (around 779 units), but by August 2025 they had surged to 11,064 units. BYD alone ranked as the eighth best-selling PHEV brand in Europe. Top PHEV models from China (such as the BYD Seal U, Jaecoo J7, MG HS) featured in the European PHEV top-ten.

Several factors underpin the rise of Chinese brands in Europe:

Competitive pricing through scale in EV supply chains.

Value-for-money offerings with strong range, features, and warranties.

Rapid localization to meet European standards.

Aggressive diversification across both BEV and PHEV markets.

Still, Chinese brands face challenges: tariffs, brand perception, charging infrastructure, and aftersales service remain hurdles to long-term dominance.

Top-performing BEV models

The Tesla Model Y remained the best-selling BEV in Europe in August 2025. Despite its sales growth trailing the market average, the Model Y still dominated the rankings, underlining Tesla’s strong brand recognition and charging ecosystem.

The Tesla Model 3 also saw growth but underperformed the broader BEV market, signaling increasing competition in the midsize sedan category. Among European brands, the Volkswagen ID.4 and Skoda Enyaq performed strongly, both showing growth above the market average. The ID.4 climbed into the top three BEV rankings, reflecting Volkswagen Group’s ability to scale volumes. The BMW i4 and Mercedes-Benz EQE entered the top 10 with solid growth, demonstrating premium brands’ improving traction in the BEV segment.

Meanwhile, Chinese entrants are beginning to feature among the top-selling BEVs: MG placed models in the top 10, outperforming several established European competitors. This performance highlights the speed at which Chinese brands are moving from the fringes into mainstream visibility.

Compared to August 2024, Tesla’s flagship models grew more slowly, Volkswagen’s ID family accelerated, BMW and Mercedes significantly improved their positions, and MG became the first Chinese brand to consistently rank among Europe’s top-selling BEVs.

Chinese brands quietly reshape Europe’s top 25

As of August 2025, Europe is witnessing a genuine acceleration in BEV adoption. Volkswagen continues to dominate, Tesla maintains leadership through the Model Y, while BMW, Mercedes, and Hyundai-Kia are expanding strongly.

Chinese influence in Europe’s car market is no longer marginal. In August 2025, six brands in the European top 25 are in Chinese hands. These include outright Chinese players like BYD, MG, Leapmotor and Xpeng, as well as Volvo and Polestar, both of which are part of Geely.

In terms of volumes, BYD now ranks as the ninth best-selling brand overall, and MG has outperformed several long-established European competitors. Step by step, Chinese groups are claiming brand-level market share.

Yet the picture changes when we zoom in on the top 25 best-selling BEV models: not a single Chinese model has made the list so far. Tesla’s Model Y, Volkswagen’s ID.4 and Skoda’s Enyaq still dominate Europe’s EV streets, while Chinese cars remain absent from the most visible model rankings.

The big unknown is how quickly this will change. If current growth continues, by 2027.