Europe adds around 190,000 chargers in 2025

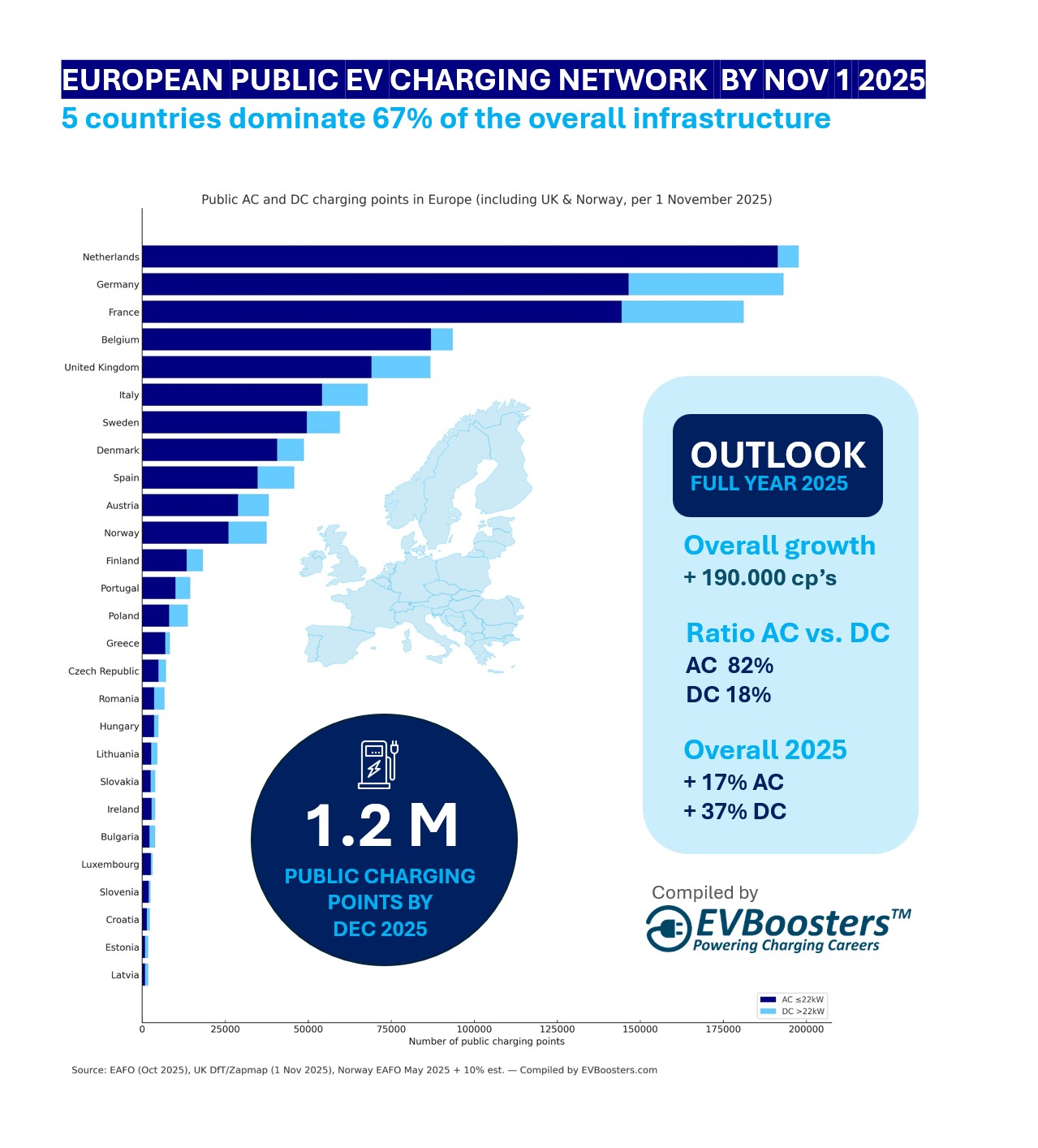

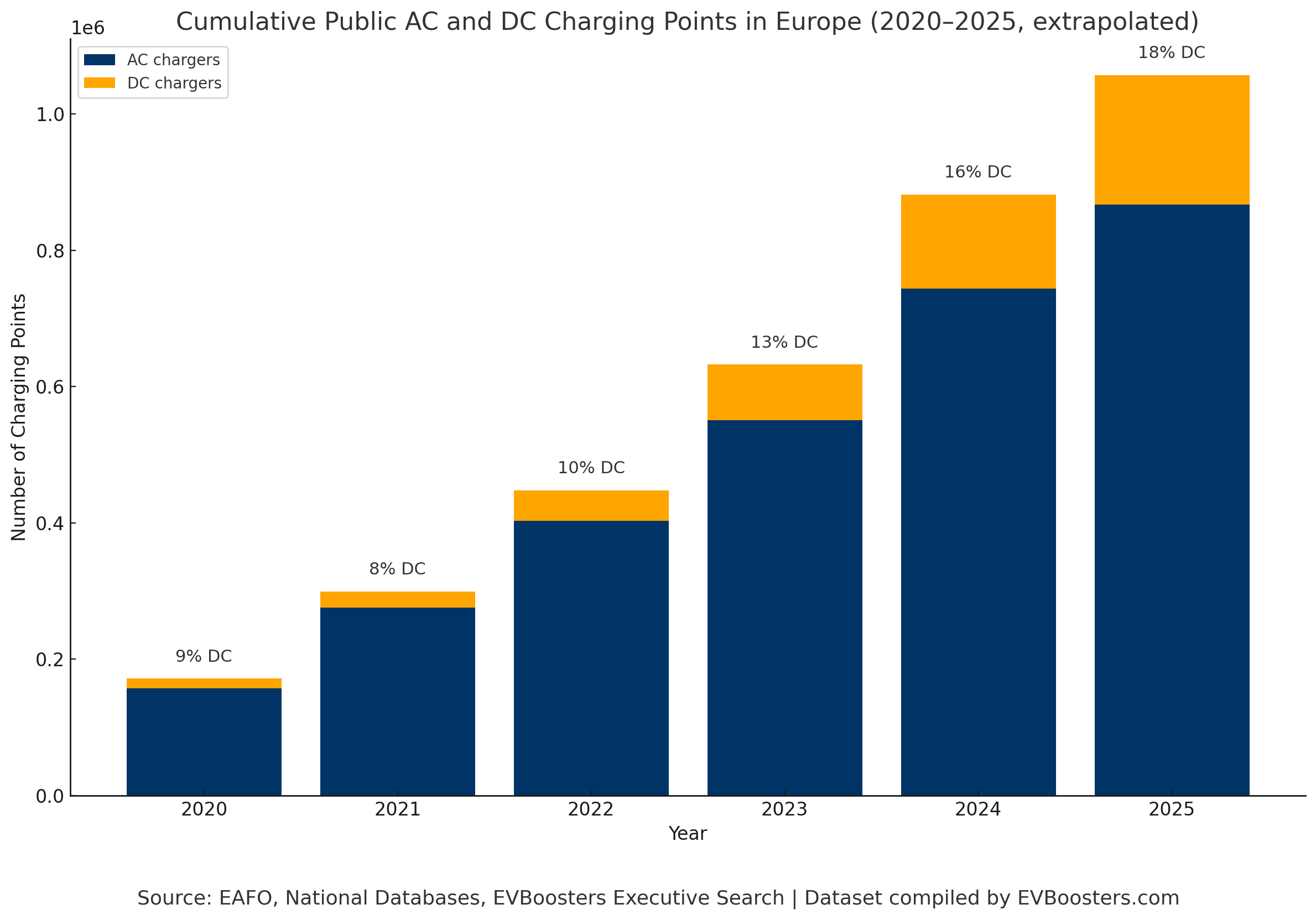

Combined EAFO and national datasets show that Europe reaches just over 1.11 million public chargers by October 2025. With typical monthly growth patterns and final national updates added, the continent is projected to end the year at approximately 1.23 million public charge points.

This implies a net addition of around 190,000 chargers over 2025, a strong continuation of Europe’s multi-year upward trend. Belgium continues to stand out as one of the continent’s fastest-growing markets, supported by policy direction, grid expansion and urban charging initiatives. Germany, France, the Netherlands and the United Kingdom collectively represent around 67% of Europe’s public charging capacity, shaping corridor density, roaming traffic and overall system utilisation.

A market shaped by both expansion and performance

Europe’s network growth is increasingly defined by utilisation and performance, not just installation volume. AC charging still accounts for around 82% of all public chargers, reflecting the network’s early stage of maturity and urban density. Meanwhile, DC charging continues to scale at more than double the rate of AC, driven by rising long-distance travel, growing taxi and delivery fleets and stronger economic returns on high-power sites.

AC infrastructure is entering a phase where uptime performance, hardware renewal and energy optimisation become core priorities, while DC networks capture most new strategic investment.

Uneven growth results in structural bottlenecks

While Europe’s overall infrastructure development remains strong, growth is unevenly distributed. Some countries operate dense, well-developed networks, while others remain in early stages of deployment. According to multiple European assessments, several member states will need to significantly increase their annual rollout pace to stay aligned with the European Commission’s 2030 targets.

Grid capacity remains one of the most significant constraints. Access to medium-voltage grid connections often determines whether high-power charging hubs can be deployed, and connection lead times vary widely across regions. Land availability presents an additional bottleneck, as sites combining grid readiness, traffic volume and sufficient space have become increasingly scarce.

Utilisation levels vary sharply across Europe. Smaller charging point operators in particular often face underutilisation, which limits reinvestment capacity and slows further expansion.

The next five years are decisive

Europe’s target of 3.5 million public charge points by 2030 is both ambitious and essential. To close the gap between the projected 1.23 million chargers in 2025 and the 2030 target, the continent must add more than 2.2 million chargers in the next five years.

This requires a dramatic acceleration in deployment speed, land acquisition, grid investment, and permitting efficiency across all member states. Industry analyses suggest that if EV adoption continues to rise rapidly, the actual infrastructure need could be significantly higher, with scenarios ranging from 5 million to 9 million chargers by 2030.

The period 2025–2030 will therefore determine whether Europe can build an EV charging ecosystem capable of supporting mass EV adoption, logistics electrification, and dependable corridor travel.

Decisive acceleration needed towards 2030

The scale of the 2030 ambition requires a clear acceleration. Europe must not only install more chargers but also improve utilisation, reliability and strategic site development.

This acceleration depends on two reinforcing dynamics. The first is a faster increase in EV adoption across Europe. Higher EV uptake strengthens utilisation, supports a healthier investment case and accelerates the demand for high quality charging infrastructure. The second is a further professionalisation of the charging sector. Operators are moving from a rollout driven approach to a balanced focus that combines growth with reliability, uptime and an excellent customer experience.

When these elements come together, public charging evolves from a capacity race into a high-performing service ecosystem. This is essential for ensuring that the transition from ICE to EV happens naturally and with confidence from the driver’s perspective. The CPO’s, investors and policy leaders who can combine scale with a consistently outstanding charging experience will define the next decade of Europe’s EV charging landscape.

Methodology and sources

This analysis uses EAFO public charging data (2020 – Oct 2025), UK data from Zapmap, Norway datasets and EVBoosters’ validated projections for 2025. Growth calculations incorporate insights from EAFO, ICCT, BloombergNEF, McKinsey, ACEA, EIT Urban Mobility and European Commission AFIR documentation.