Northern Europe still leads the race

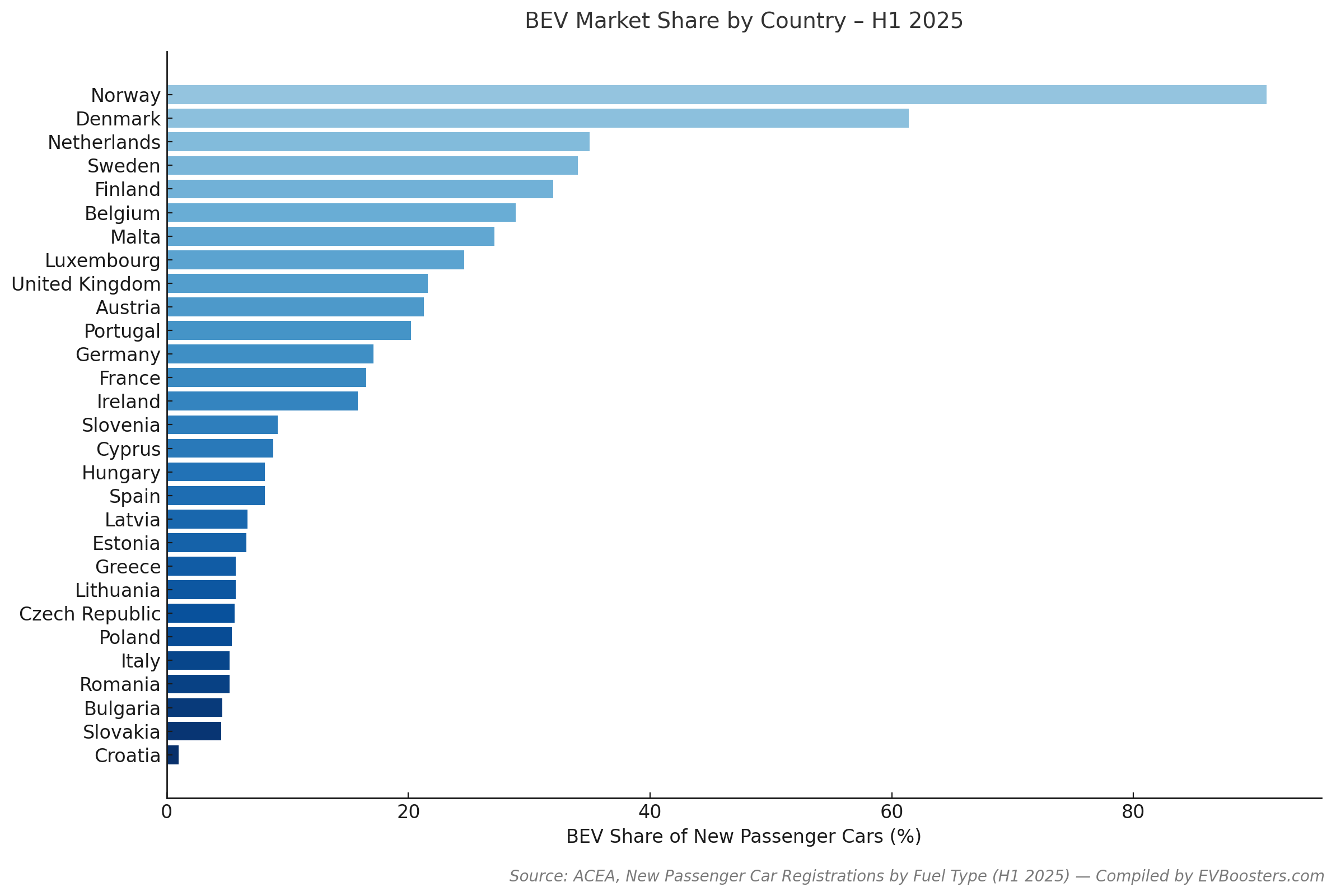

No region embodies electrification more completely than the Nordics. In the first half of 2025, Norway maintained its global leadership with an extraordinary 91 % BEV market share and roughly 56 300 new electric cars sold. It also operates one of the world’s most mature charging networks, now exceeding 34 000 public points, including 10 400 DC fast chargers.

Denmark follows with a 61.4 % BEV share and 52 900 sales, while Sweden and Finland reached 34 % and 32 % respectively. Fiscal incentives, strong consumer trust, and nationwide charging coverage underpin this leadership. These nations have effectively normalised the electric car: BEVs are no longer a niche choice but the default option.

Western Europe: scale and diversity

Western Europe delivers the continent’s largest sales volumes but also the greatest disparities.

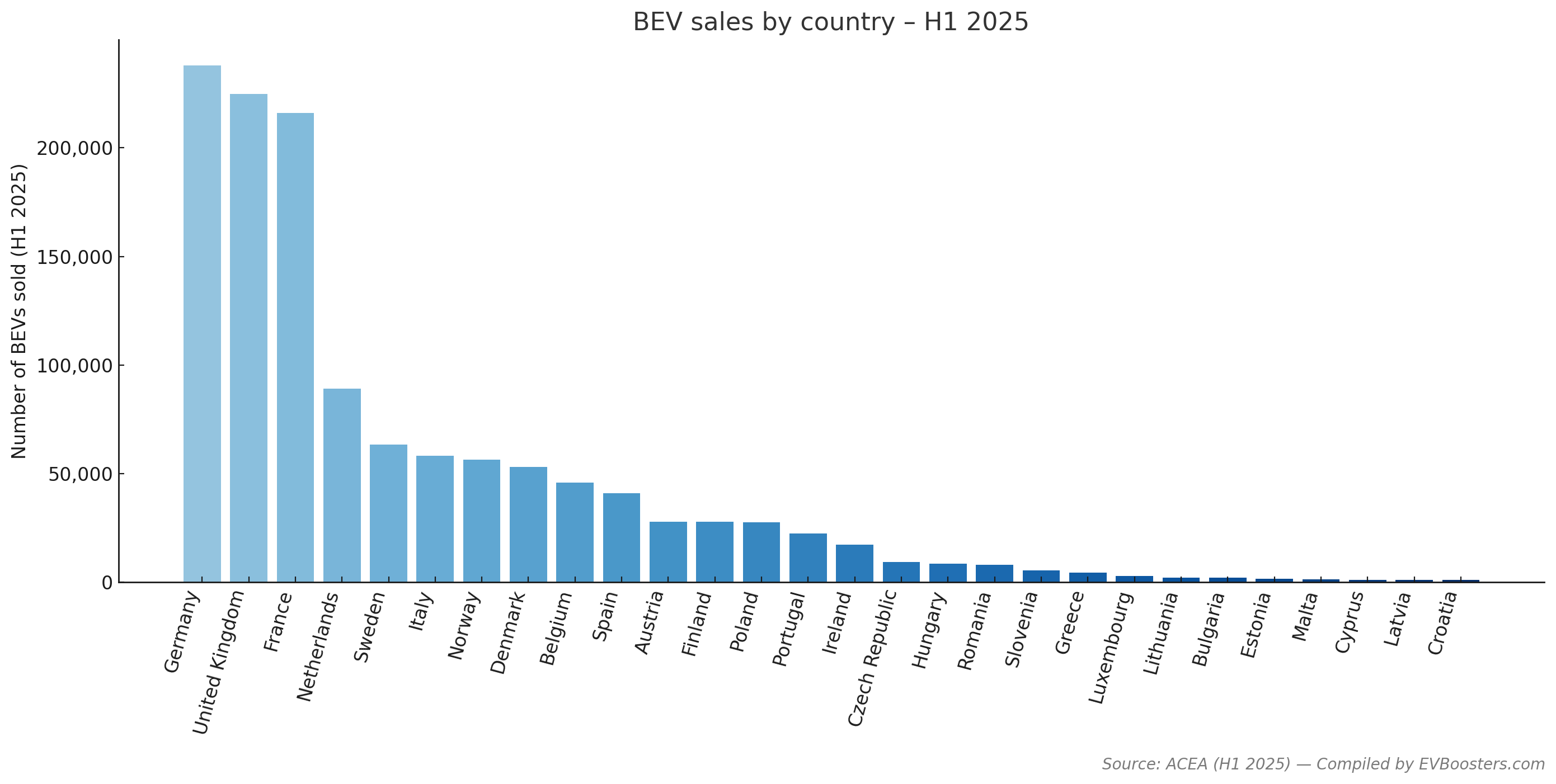

According to ACEA, Germany remains Europe’s biggest BEV market with 238 000 units sold in H1 2025, accounting for 17.1 % of new registrations. France follows closely with 216 000 sales (16.5 %), driven by national purchase bonuses and fleet electrification.

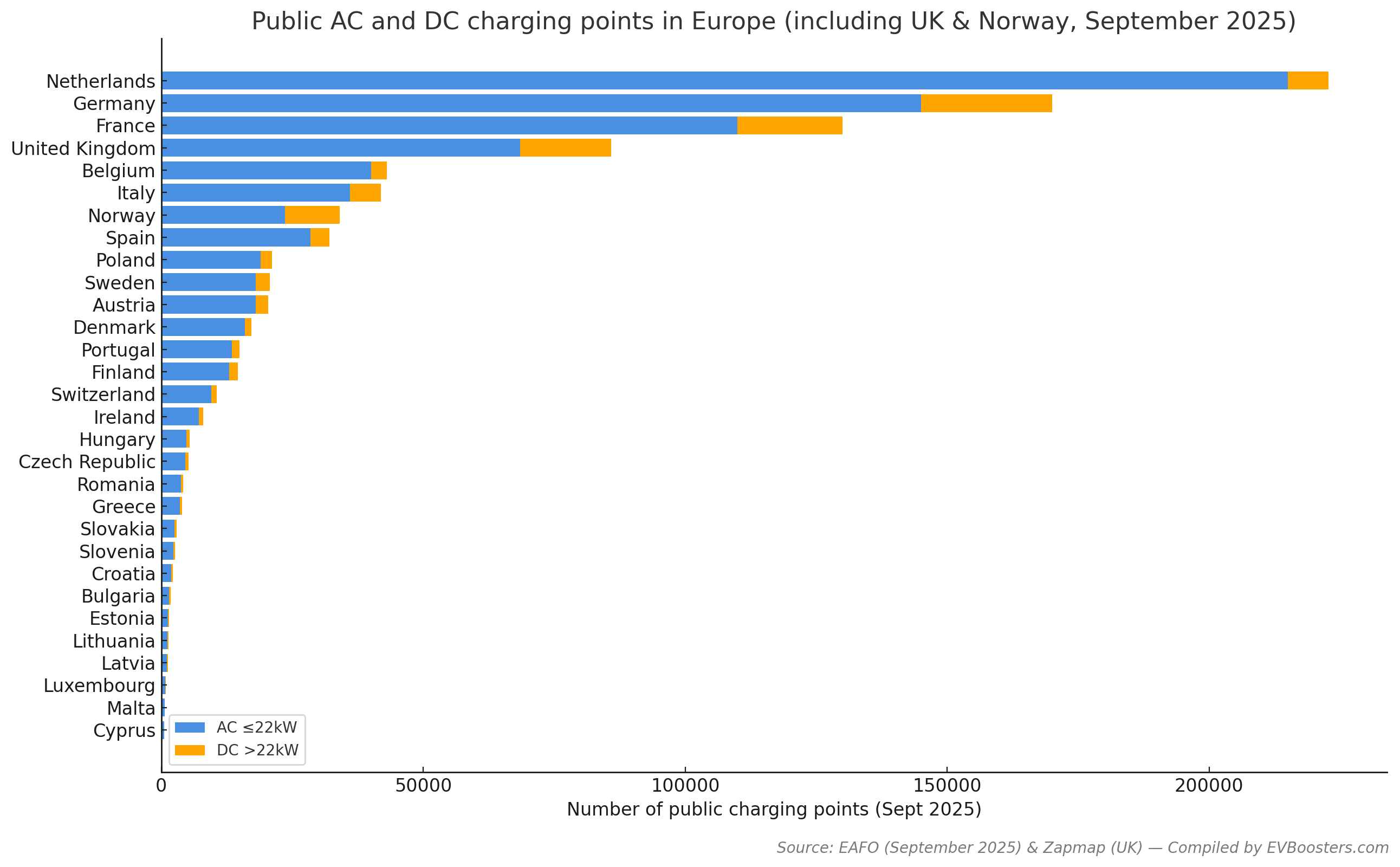

The Netherlands keeps its high-adoption trajectory, hitting a 35 % BEV share and 89 100 sales, supported by one of the world’s densest charging networks—over 215 000 AC and 7 800 DC points as of September 2025 (EAFO).

The United Kingdom, no longer an EU member but still a key European market, reported 224 841 BEV registrations in the first half of 2025—up 34.6 % year-on-year and representing 21.6 % market share (SMMT). Zapmap counts 86 021 public charging devices, of which 17 356 are rapid or ultra-rapid DC, underscoring Britain’s focus on motorway charging rather than dense urban AC networks.

Together, Germany, France, the UK and the Netherlands account for more than 60 % of all BEV sales and nearly the same share of Europe’s public charging infrastructure.

Southern and Eastern Europe: closing the distance

Further south, the electrification journey remains slow but steady. Italy recorded 58 300 BEV registrations (5.2 %), Spain 41 000 (8.1 %), and Portugal 22 500 (20.2 %).

In Eastern Europe, Poland 27 600 (5.4 %), Czechia 9 200 (5.6 %), Hungary 8 500 (8.1 %), and Slovakia 3 500 (4.5 %) illustrate modest but positive momentum.

Charging infrastructure remains the limiting factor. EAFO’s September 2025 dataset shows that all southern and eastern EU members combined host less than 10 % of the continent’s public chargers, most of them slow AC points. In several countries, the ratio exceeds 25 vehicles per charger, compared with fewer than 10 in the Netherlands.

Europe’s charging landscape: the numbers behind the map

Across the EU + UK + Norway, the total number of public charging points surpassed 1.05 million by September 2025.

AC (≤ 22 kW): ≈ 840 000

DC (> 22 kW): ≈ 210 000

(EAFO 2025)

The fastest growth is seen in DC infrastructure, up 41 % year-on-year. Germany and France together operate around 300 000 public chargers, while the Netherlands continues to host roughly one-fifth of the EU’s total network. The UK, although smaller in count, leads in power output, with one in four chargers now capable of fast charging.

Norway, outside the EU, remains impressive: with more than 10,400 DC fast chargers for just 5.5 million inhabitants, it has by far the highest DC per-capita density in Europe.

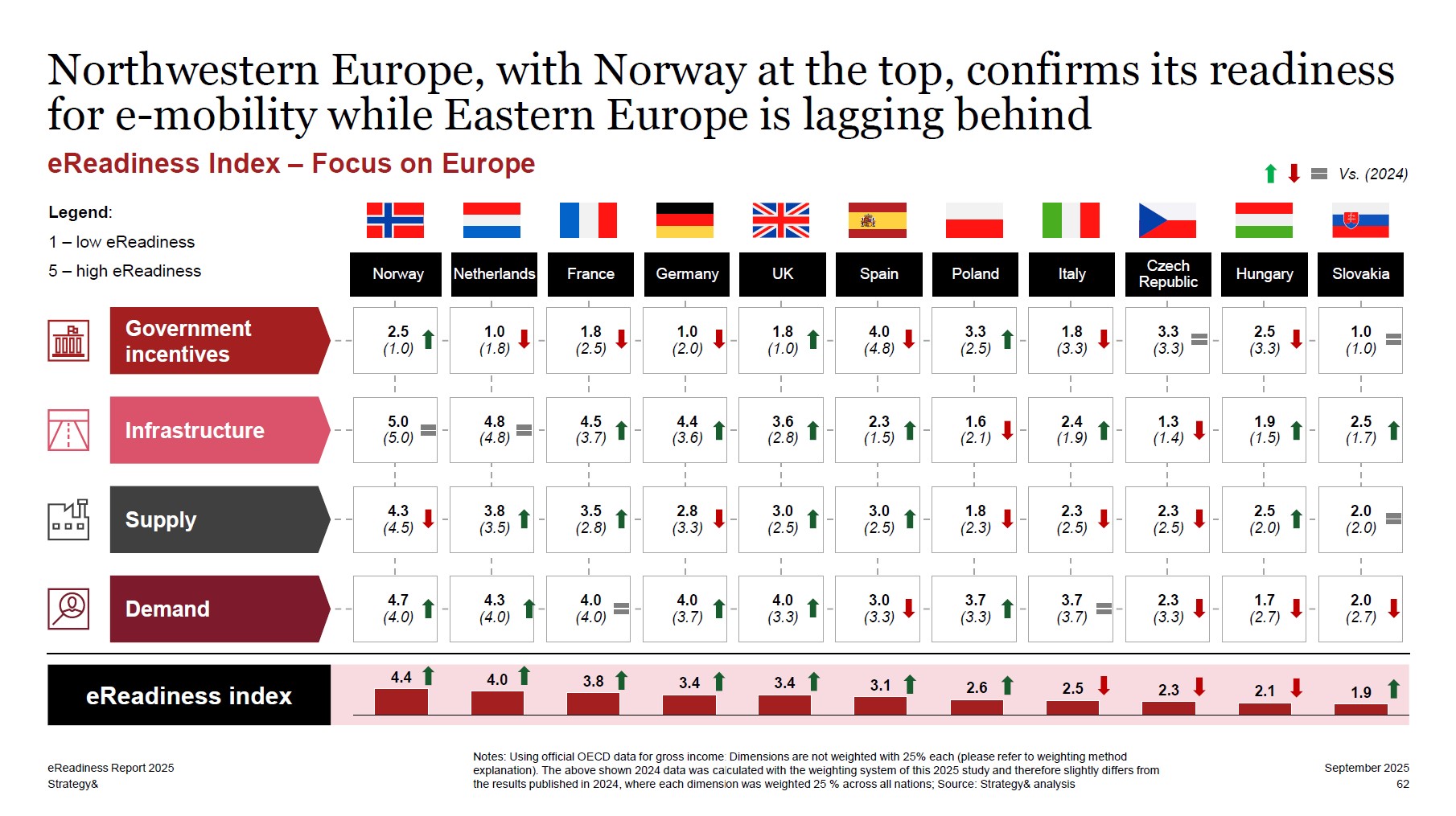

Two speeds, one destination

PwC Strategy&’s conclusion is unambiguous: Europe is advancing at two different speeds. Northern and Western markets are on track to make electric cars the majority of new sales by 2030, supported by strong policy frameworks and grid capacity. Southern and Eastern countries risk falling five to seven years behind without accelerated public- and private-sector investment.

The European EV transition has momentum, but readiness is more than sales—it is about infrastructure, accessibility, and consistency. Unless Europe narrows the charging gap, the continent’s BEV boom could outpace the very network meant to sustain it.

Sources

ACEA (July 2025) | EAFO (Sept 2025) | SMMT (UK) | OFV & NOBIL (Norway) | Zapmap (Oct 2025) | PwC Strategy& eReadiness 2025

This article has been written by EVBoosters Executive Search (since 2018), which finds and connects the leaders shaping Europe’s EV charging industry. From pioneering scale-ups to established CPOs, eMSPs, and technology platforms, we identify board, C-level, and senior executives who accelerate the shift to a fully electrified future. Contact Paul Jan Jacobs if you’d like to discuss your company’s growth challenges.