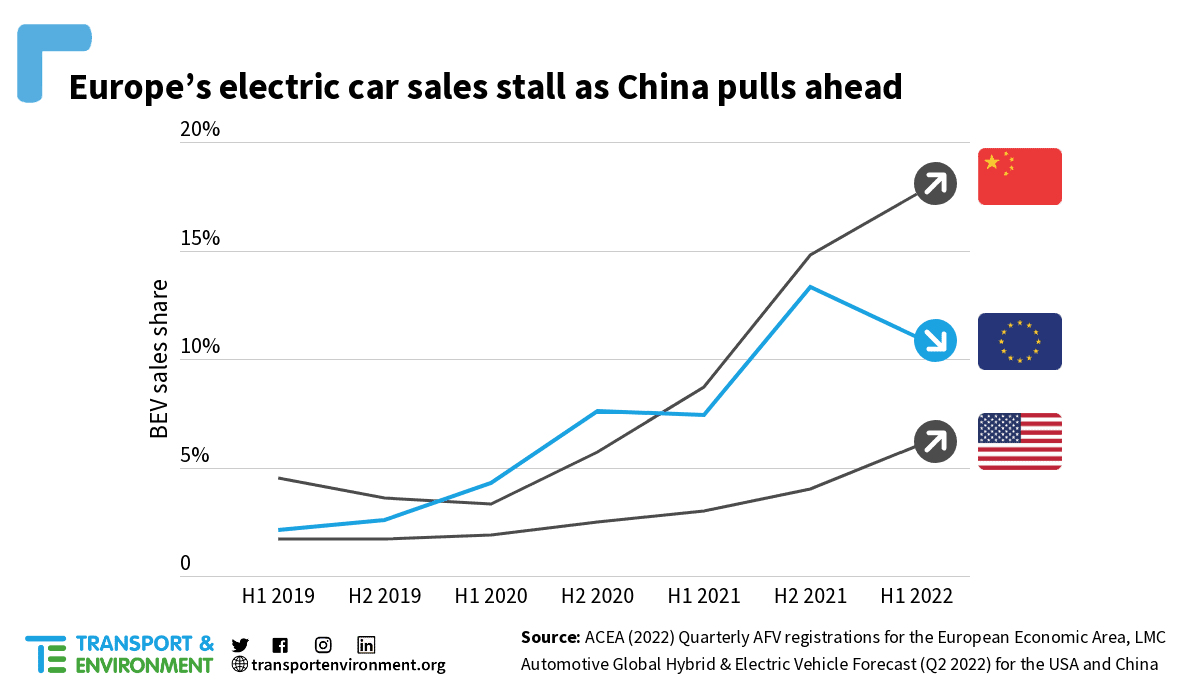

Electric Vehicle sales in Europe fell to 11% in the first half of 2022, from 13% in the second half of previous year. According to T&E, growing electric car sales in the United States and China indicate that a lack of legal incentives, rather than a supply chain crisis, is the root reason of Europe’s lethargic electrification efforts.

In the first half of 2022, BEV sales in China increased to over 18% of the new car market, while EV sales in the US increased by 50%. During the same time span, Europe’s proportion of BEVs declined by two percentage points, with Europeans experiencing extremely lengthy wait periods for electric cars.

Following the implementation of ambitious 2020/21 CO2 regulations in Europe, which resulted in an exceptional decline in average CO2 emissions from new automobiles (12% in both 2020 and 2021), EU car CO2 emissions dropped by just 2% in the first half of this year. According to T&E, this is due to the targets being too weak. Despite stagnant BEV sales, all except VW are on course to fulfil their CO2 targets for 2022.

According to carmakers’ voluntary promises, BEVs will account for more than three-quarters of the automobile market by 2030. However, if automakers merely perform the bare minimum to satisfy the EU’s standards – as they have done thus far – BEV sales will be only 55%. This would cost Europe 135 MtCO2 in emissions reductions over the next decade.

However, declining supply and extended wait periods are not the only issues confronting Europe’s car sector. European automakers are increasingly focused on luxury models, putting the mass market and, by extension, mass employment at risk of being controlled by foreign firms. T&E supports inexpensive electric car support in the form of low-cost leasing for electric vehicles, as proposed in France.

Source: Transport & Environment

Get ‘FREE OF CHARGE’ access to this and 400+ other valuable EV Market Reports in our database. Enjoy reading!