Launch and Allocation of FAME II

Launched in April 2019, FAME II initially allocated ₹10,000 crore, which was later increased to ₹11,500 crore. The scheme aimed to foster a robust EV ecosystem by providing fiscal incentives across various segments, including two-wheelers, three-wheelers, passenger cars, and buses. By March 2024, the scheme had utilised 69% of its funds, reflecting both achievements and ongoing challenges.

Success in the Two-Wheeler Segment

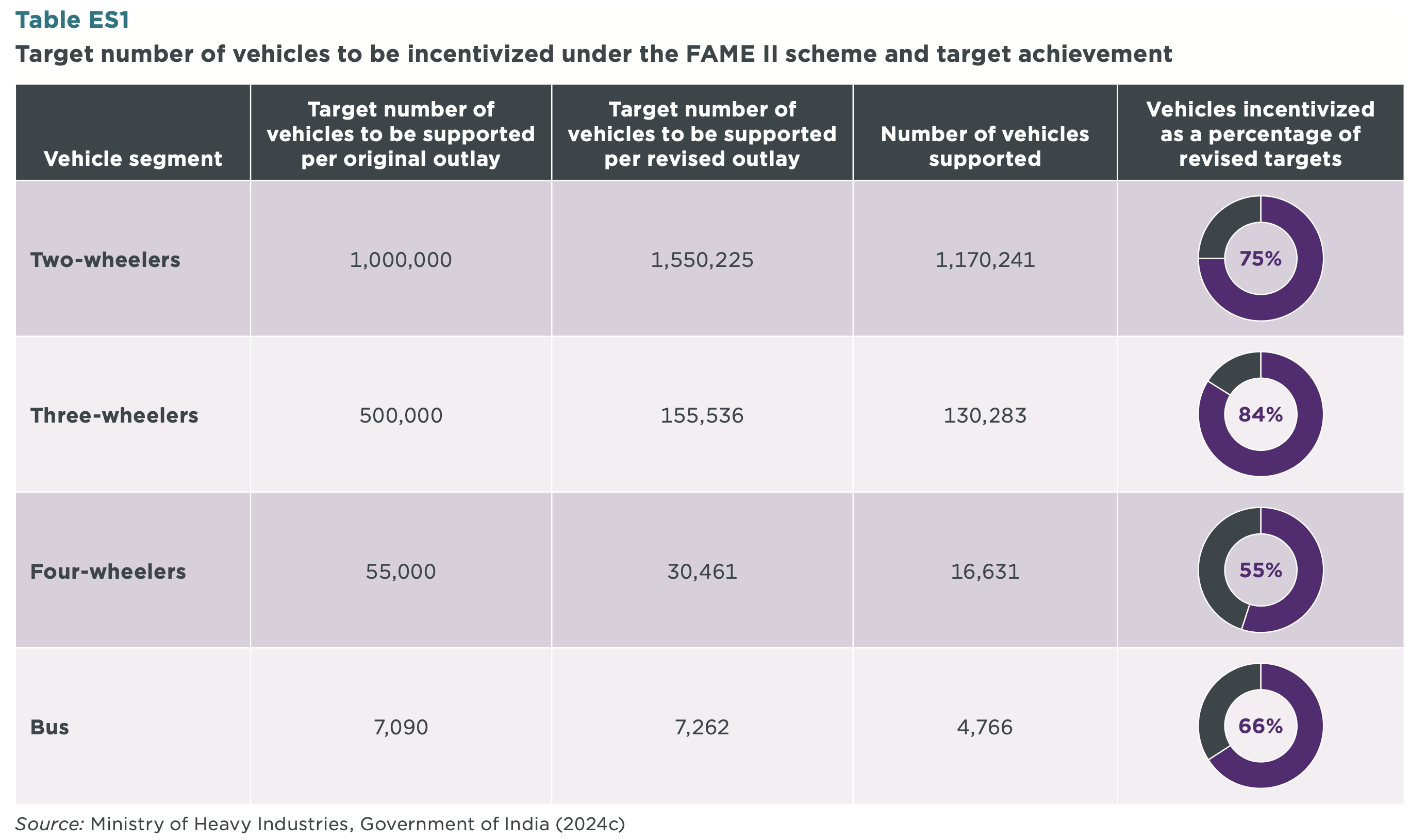

Electric two-wheelers (E2Ws) saw a marked increase in uptake, achieving 75% of the revised target. The subsidies under FAME II played a significant role in bridging the cost gap between electric and conventional gasoline models. However, the fluctuating levels of subsidies during the scheme’s tenure created instability in the market. Experts suggest maintaining higher subsidy levels until 2027 to ensure cost parity and sustained growth in this segment.

Achievements and Challenges in Three-Wheelers

Electric three-wheelers (E3Ws), especially passenger variants, also benefitted considerably, reaching 84% of their target. These vehicles became competitive with their traditional counterparts, thanks to the subsidies. Nonetheless, financing challenges persist, indicating a need for more supportive policies such as lower interest rates and longer payback periods to facilitate broader adoption.

Passenger Car Segment: Falling Short of Expectations

The passenger car segment, however, fell short of expectations, achieving only 55% of its target. Currently, subsidies do not extend to private electric cars. Analysts propose that introducing a subsidy of ₹10,000/kWh could significantly lower the upfront cost, enhancing market penetration. Additionally, incentives under the Vehicle Scrappage Policy could further reduce costs, making electric cars a more attractive option for consumers.

Public Transport Buses: A Primary Beneficiary

Public transport buses have been one of the primary beneficiaries of FAME II, with 66% target achievement. The successful deployment under the Gross Cost Contract (GCC) model highlights the potential of electric buses in urban transportation. To accelerate private sector adoption, especially for inter-city routes, financing mechanisms like interest subvention and credit guarantees are recommended.

Barriers to Widespread EV Adoption

Despite these strides, EVs accounted for just 7% of total vehicle sales in India in the fiscal year 2023-24. High upfront costs and limited access to financing remain significant barriers to widespread EV adoption. The transition to electric trucks (BETs) is also crucial for meeting India’s climate goals. Proposals for a subsidy of ₹20,000/kWh could make BETs competitive with diesel trucks, especially if initially targeted at government-operated vehicles.

The Road Ahead: FAME III and Future Prospects

Looking forward, the anticipated FAME III scheme aims to build on the successes and learnings of FAME II. Stakeholders emphasise the need for long-term, stable policies that offer consistent incentives and a clear roadmap. Such measures are essential to foster investor confidence and drive innovation in the EV sector.

Conclusion

The FAME II scheme has laid a strong foundation for India’s electric vehicle transition. By addressing the current challenges and implementing strategic policy measures, India can accelerate its journey towards a sustainable, low-carbon transport future. The upcoming FAME III scheme holds the promise of reinforcing this trajectory, driving India closer to its climate goals and fostering a greener economy.

As the nation gears up for the next phase of its EV promotion policy, the lessons from FAME II will be invaluable in shaping a more sustainable and inclusive future for India’s transportation sector.