Uneven progress across Europe

The Blueprint 2030 analysis reveals sharp disparities between EU member states. In 2025, zero-emission truck market shares ranged from below 1% in lagging countries to nearly 9% in frontrunners such as Switzerland, the Netherlands, Sweden, and Germany. Where governments have introduced strong incentives and charging support, markets are growing. Elsewhere, regulatory gaps and insufficient infrastructure are stalling momentum.

This patchwork threatens to split Europe into a two-speed transition—creating uncertainty for investors, slowing corridor deployment, and undermining competitiveness. A coordinated EU and national approach is therefore essential.

European Truckmakers fall behind China

The global competition is already well underway. In 2024, over 90,000 electric heavy-duty vehicles (e-HDVs) were sold worldwide, with China securing a 22% market share by 2025. By contrast, Europe’s 10,000 electric truck sales represent a fraction of global progress. The risk is clear: without urgent action, Europe could fall behind both environmentally and industrially.

In China, the share of electric trucks has surged from just 4% two years ago to around 24% in 2025, with battery leader CATL forecasting that half of all new trucks sold in China will be electric by 2028. In comparison, Europe’s progress is far slower.

The gap is not simply technological — it is systemic. Truck manufacturers, logistics operators and energy providers across Europe all cite the same obstacles: insufficient investment in charging infrastructure, sluggish grid connection procedures, and inconsistent national incentives. Despite new EU rules on CO₂ reduction and the forthcoming ban on almost all new diesel trucks by 2040, the current infrastructure rollout is lagging far behind market needs.

Electric trucks are central to Europe’s decarbonisation strategy. They reduce fossil fuel dependency and can anchor industrial growth across the energy and logistics sectors. Yet for most fleet operators, the transition only becomes viable when total ownership costs reach parity with diesel. While this is already the case in China, European fleets are not expected to achieve parity until 2030, according to the International Energy Agency.

The four pillars of Europe’s electric truck transition

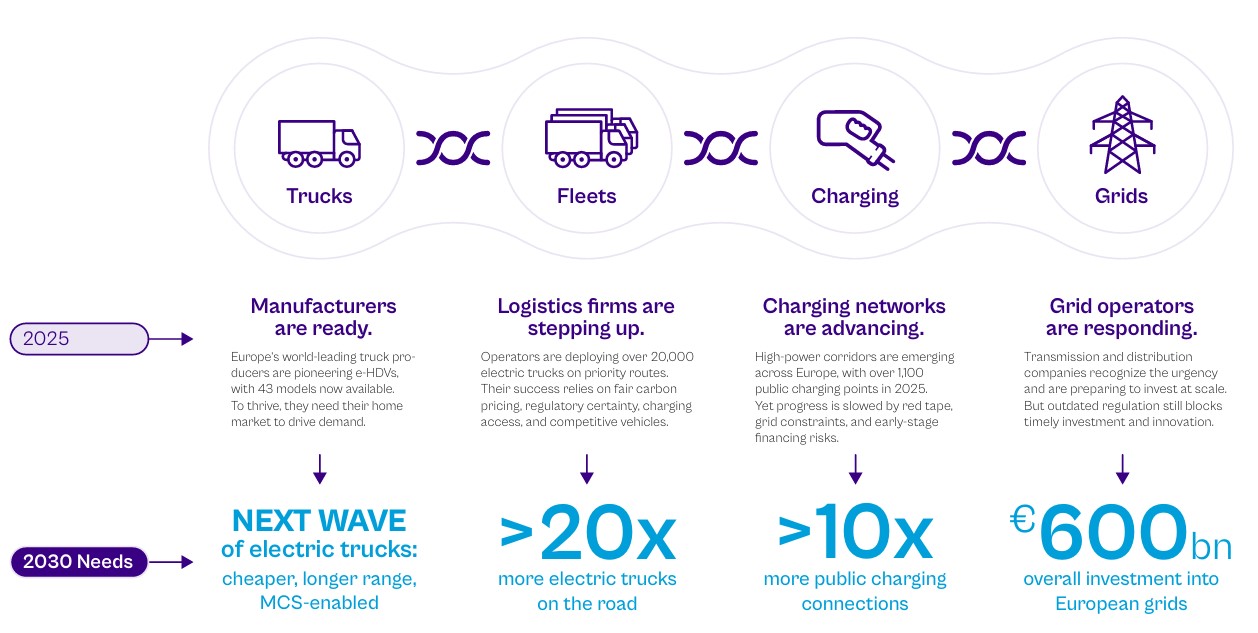

Blueprint 2030 identifies four pillars that must work together to lift electric truck sales from 3.6% to 38% by 2030.

1. Put competitive electric trucks at the forefront

Europe’s CO₂ standards set the direction, but barriers such as payload penalties and battery supply dependencies persist. The EU must update weight and dimension rules, secure raw material access, and expand domestic battery production to strengthen competitiveness.

2. Achieve comparable total cost of ownership

Electric trucks are cheaper to operate but costlier to buy. E-Mobility Europe calls for the full implementation of ETS2 carbon pricing, the end of fossil fuel tax exemptions, and consistent toll discounts for zero-emission trucks across all EU member states.

3. Actively drive zero-emission fleet demand

Fleet operators need predictable business cases to invest. New EU rules should incentivise corporate fleet decarbonisation, expand public procurement under the Clean Vehicles Directive, and modernise intermodal transport incentives to reward actual CO₂ reduction.

4. Step up Europe’s charging backbone

Europe currently counts around 1,100 public truck charging points, far below what’s needed. The Blueprint urges the EU to derisk early investments through targeted finance tools, accelerate permitting via the Grid Action Plan, and deploy Megawatt Charging Systems to support long-haul electrification.

An industrial and climate imperative

The electrification of freight is both a climate and an industrial imperative. If Europe fails to act, it risks losing its position in one of the world’s most strategic industrial transitions. Chinese manufacturers are already scaling faster and reducing costs more aggressively, while European firms are constrained by fragmented regulation and slower permitting.

However, the Blueprint shows that Europe’s industrial base — world-class truckmakers, logistics operators, and energy firms — has everything needed to succeed. What’s required now is speed, scale, and synchronization.

“Every part of the industry is investing heavily,” said Chris Heron, Secretary General of E-Mobility Europe. “What’s missing is policy alignment.”

The next 5 years will define Europe’s industrial and environmental leadership

Blueprint 2030 calls on the European Commission and national governments to take coordinated action:

- Deliver on CO2 standards by removing regulatory barriers and putting all enabling conditions in place.

- Incentivise clean fleet uptake with clear demand signals that guide corporate buyers and public procurement.

- Rebalance operating costs so zero-emission trucks become the competitive choice.

- Build the backbone with a modern grid and charging network, making Europe competitive globally.

The next five years will define Europe’s industrial and environmental leadership. With the launch of Blueprint 2030 on 1 October, E-Mobility Europe has given policymakers and industry a clear roadmap — one that could make Europe the global benchmark for clean freight by 2030.

Source: e-Mobility Europe

Download report Blueprint 2030 here