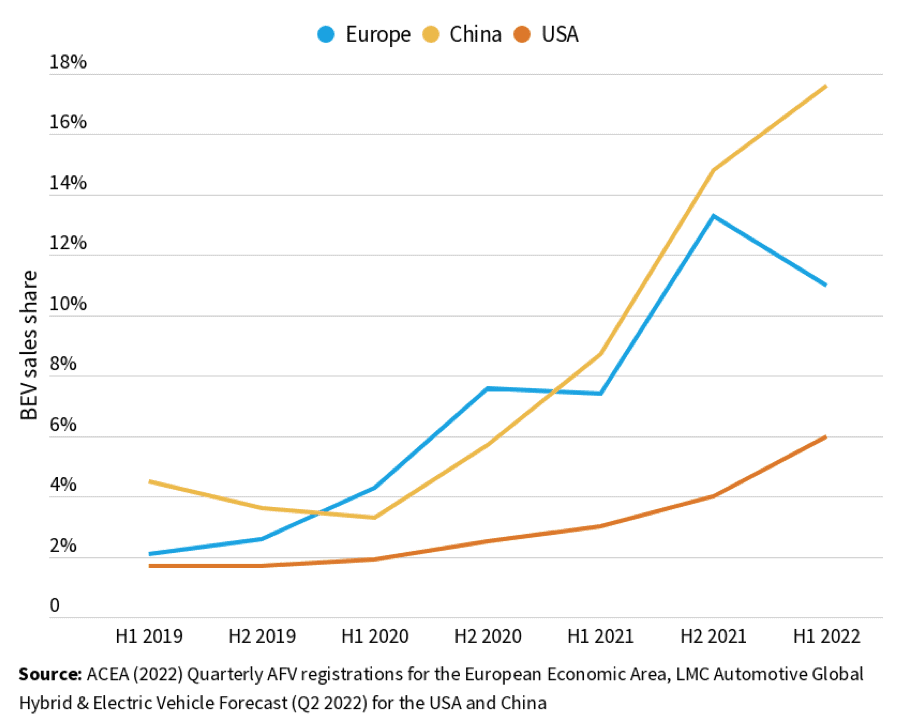

Despite an extraordinary decline in CO2 emissions from new automobiles operated in accordance with the 2020/21 CO2 requirements, CO2 emissions reduced by just 2% in H1 2022. The BEV market has also stagnated, accounting for 11% of the EU market. With EV sales increasing in both China and the United States, global supply chain issues cannot be blamed alone. Even with the customary dip in early-year sales, the BEV share should have been closer to 13%. Despite stagnant BEV sales, all except VW are on course to fulfil their 2022 CO2 target, highlighting the existing regulation’s shortcomings.

Electric car sales are at a crossroads, with industry trends predicated on automaker pledges vs. stagnation due to insufficient regulation until 2030. According to carmakers’ own sales commitments, BEVs will account for 78% of the automobile market by 2030. However, if automakers perform the bare minimum to satisfy required objectives and prioritise sales of combustion engine cars, sales will be 55%. In the event that EV sales stagnate, 20 million BEVs would not be sold in comparison to industry forecasts. This would result in an extra 135 MtCO2 during the decade, which is more than the Czech Republic’s annual GHG equivalent emissions.

The stagnation of European electric car sales contrasts with developments in China and the United States, where incentives are still fueling the EV growth. Carmakers in Europe are increasingly unable to satisfy rising customer demand, with longer wait periods than abroad and most car brands sold out. This standstill is accompanied by Chinese carmakers’ entry into the EU market – reaching 5% of the BEV market in H1 2022 – and an increasing percentage of electric cars manufactured in China (2 BEVs out of 10). If Chinese automakers maintain their present pace, their market penetration in Europe might range from 9 to 18% of the BEV market by 2025.

Failure by EU automakers to increase BEV supply might result in foreign manufacturers producing inexpensive versions and taking a big portion of the European mass market. If the EU is unable to control its own market effectively, it risks losing economic sovereignty in the car sector.