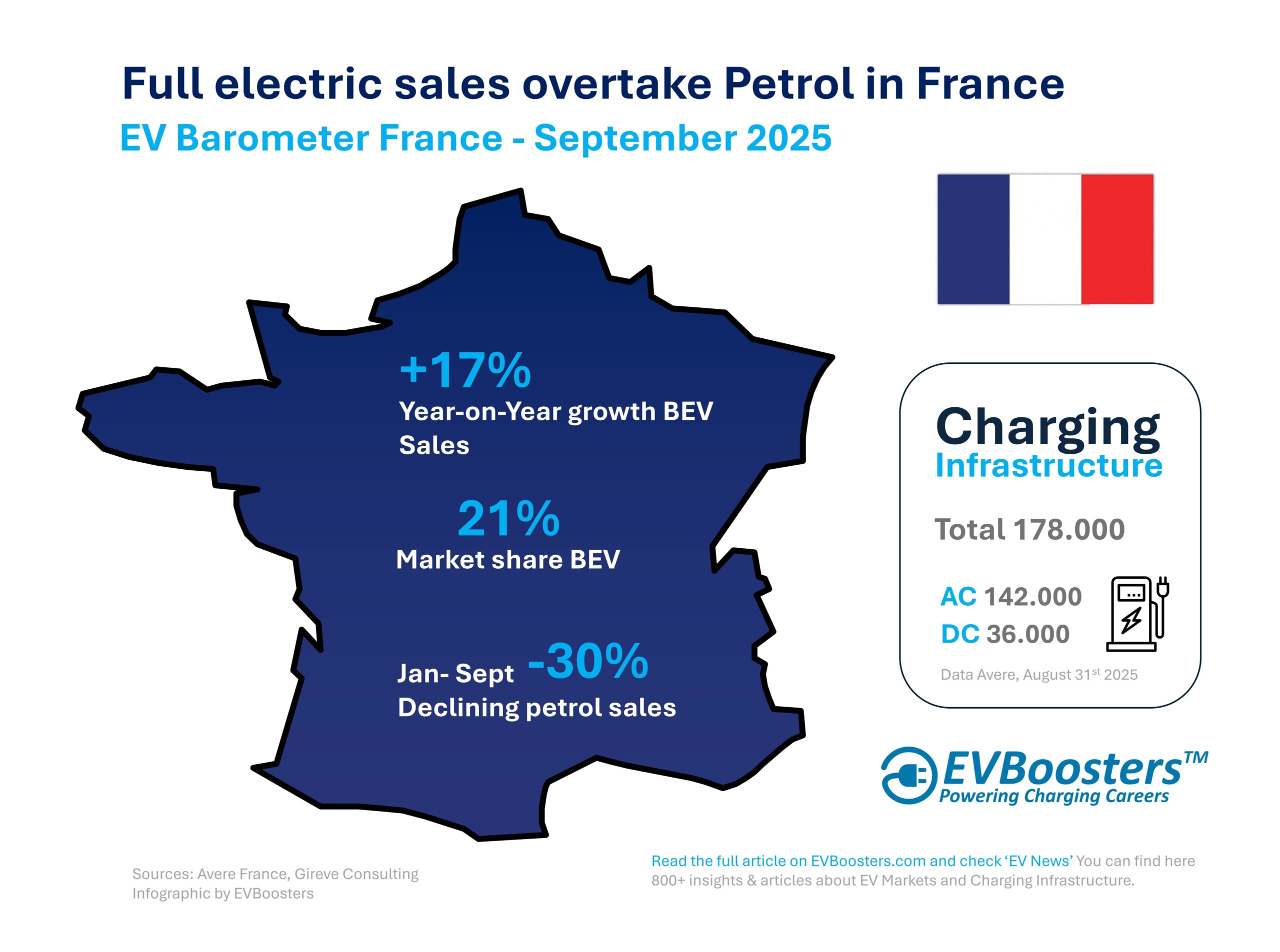

Strong growth in fully electric vehicles

Battery-electric vehicles continue to lead the transition, with 35,456 registrations, representing a 16.6% year-on-year increase, while plug-in hybrids declined slightly by 3.9%. BEVs now hold a market share of 20.8%, compared to 5.7% for PHEVs.

The third quarter of 2025 closed 20% higher than the same period in 2024, reflecting sustained consumer confidence and a maturing market. This growth is driven not only by corporate fleets but also by private buyers, who accounted for 46% of all registrations. The government’s new social leasing scheme, designed to make EVs affordable for lower-income households, is expected to boost private demand even further in the coming months.

Declining petrol sales and a structural shift

While electric adoption accelerates, internal combustion vehicles are losing ground quickly. Over the first nine months of 2025, petrol car registrations dropped by 32.8%, totalling 265,023 units compared with the same period last year. September marked a historic low, with only 26,934 petrol vehicles registered, representing just 19.2% of the total market, the lowest share ever recorded in France.

Hybrids have now become the largest single powertrain category, with 62,000 units registered in September.

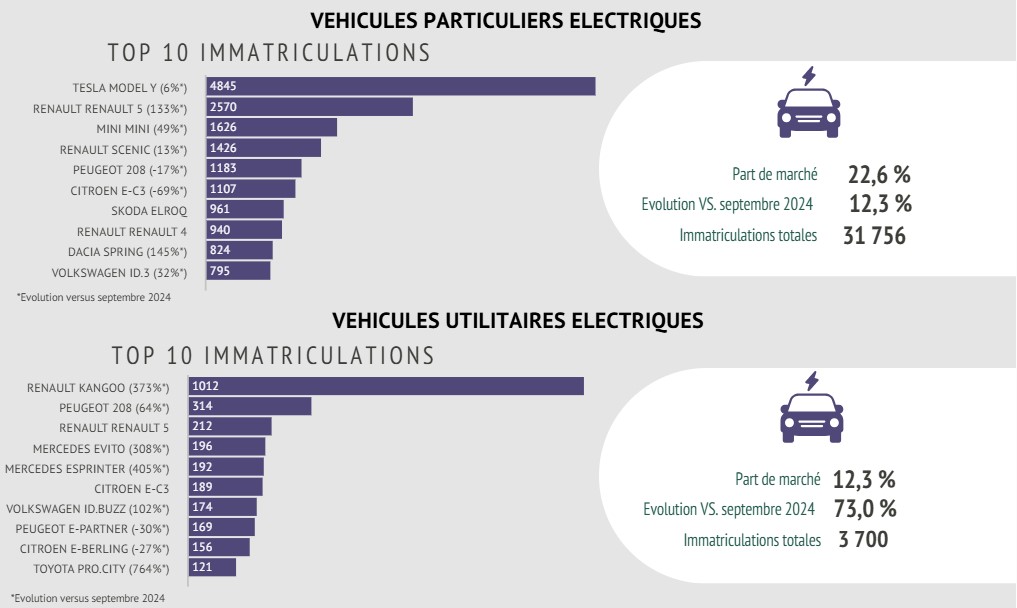

Tesla Model Y is the best-selling car

The Tesla Model Y remained the country’s best-selling electric vehicle in September, with 4,845 units, reaffirming its dominance in the crossover category through range, reliability, and the strength of its charging network. Renault achieved a remarkable comeback, placing three models in the national top ten, the Renault 5, Scenic, and Renault 4, each reflecting the brand’s commitment to local production and mass-market electrification.

The Renault 5 saw registrations surge by 133%, appealing to price-sensitive buyers with its nostalgic yet modern design. The Dacia Spring also gained momentum, growing by 145%, confirming its position as one of Europe’s most affordable EVs. Meanwhile, Volkswagen’s ID.3 and BMW’s Mini Electric posted steady gains, demonstrating that demand in France is spreading across both mainstream and premium segments.

Government incentives driving adoption

France’s policy framework continues to play a crucial role in this transformation. Since 1 October 2025, the government has introduced an additional €1,000 purchase bonus for EVs assembled within the European Union that use batteries manufactured in the European Economic Area. This measure complements existing energy-efficiency (CEE) subsidies and reinforces Europe’s domestic EV supply chain.

The government also launched its long-awaited social leasing plan on 30 September 2025. The programme allows low-income households to lease a fully electric car for up to €200 per month, with the option to return or buy the vehicle after three years. It targets households earning less than €16,300 per share, living more than 15 kilometres from their workplace, and driving at least 8,000 kilometres per year for commuting or business purposes.

Beyond its social objective, the scheme serves a strategic purpose by encouraging demand for vehicles and batteries produced in Europe, strengthening industrial sovereignty while expanding clean mobility.

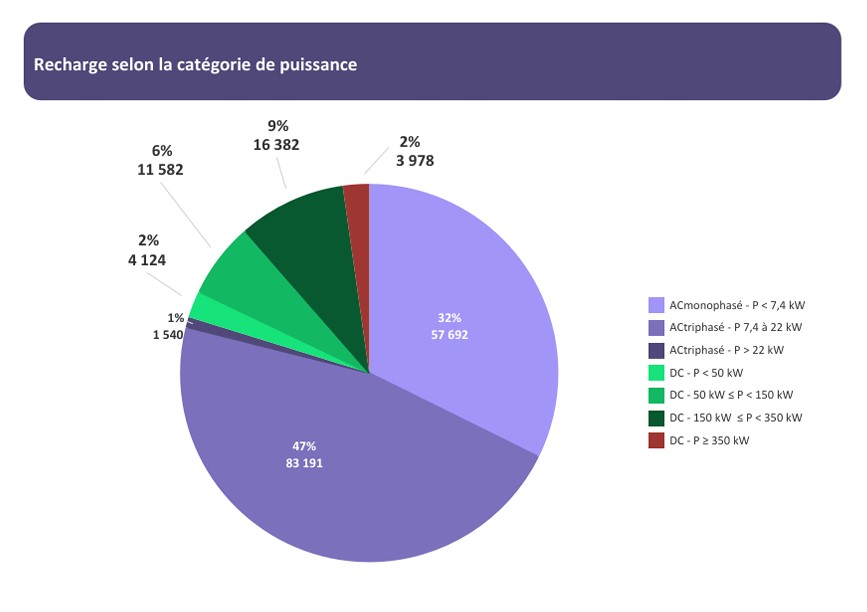

Number of DC Chargers France nearly doubled in 2 years’ time

France’s public charging network continues to grow rapidly. As of 31 August 2025, the country counted 177,180 public charging points, according to Avere-France and Gireve.

The data reveal a strong dominance of AC chargers, which make up around 80% of all installations, while DC fast and ultra-fast chargers represent about 20%.

Over the past 24 months, the number of DC chargers has nearly doubled, growing at an average rate of +40% per year, compared with +18% annual growth for AC chargers. In 2021, DC represented less than 10% of all public charge points, but by mid-2025 that share has risen to one in five. This marks a clear technological shift toward high-power infrastructure designed for intercity travel, logistics hubs, and fleet operations.

Meanwhile, AC infrastructure continues to expand steadily in line with residential and workplace demand. Most new installations fall in the 7.4 to 22 kW range, which remains the backbone of everyday charging for both private drivers and company fleets.

One public charger per 11 EVs,

In 2025 alone, France added more than 18,000 new AC chargers and 4,000 DC fast chargers, led by leading Charge Point Operators such as Electra, IONITY, Fastned, Powerdot, Driveco, Chargeguru, TotalEnergies and Engie Vianeo. The rapid rollout of high-power corridors now makes it possible to travel across the country without range anxiety, a key factor supporting BEV adoption among long-distance drivers.

Regional distribution remains uneven, with Île-de-France, Auvergne-Rhône-Alpes, and Provence-Alpes-Côte d’Azur together hosting almost 40% of all public chargers. Nevertheless, France’s overall density, roughly one public charger for every 11 electric vehicles , remains among the best in Europe. The national target of 200,000 public charge points by early 2026 now looks fully achievable, reflecting both public investment and private market momentum.

A new phase for France’s EV transition

France’s EV market has entered a new stage of growth where affordability, infrastructure, and industrial strategy come together. The success of mass-market models such as the Renault 5 and Dacia Spring shows how consumer trust grows when cost and convenience align.

Supported by strong incentives, a fast-expanding and balanced charging network, and a sharp decline in petrol sales, the country now stands as Europe’s most advanced and strategically aligned EV ecosystem, setting a benchmark for the continent’s clean transport transition.

Sources: Avere-France, Gireve, AAA Data, Colombus Consulting, Autovista24, and the Ministry of Energy Transition (France), September 2025.