Volkswagen reaps the rewards of a diversified EV portfolio

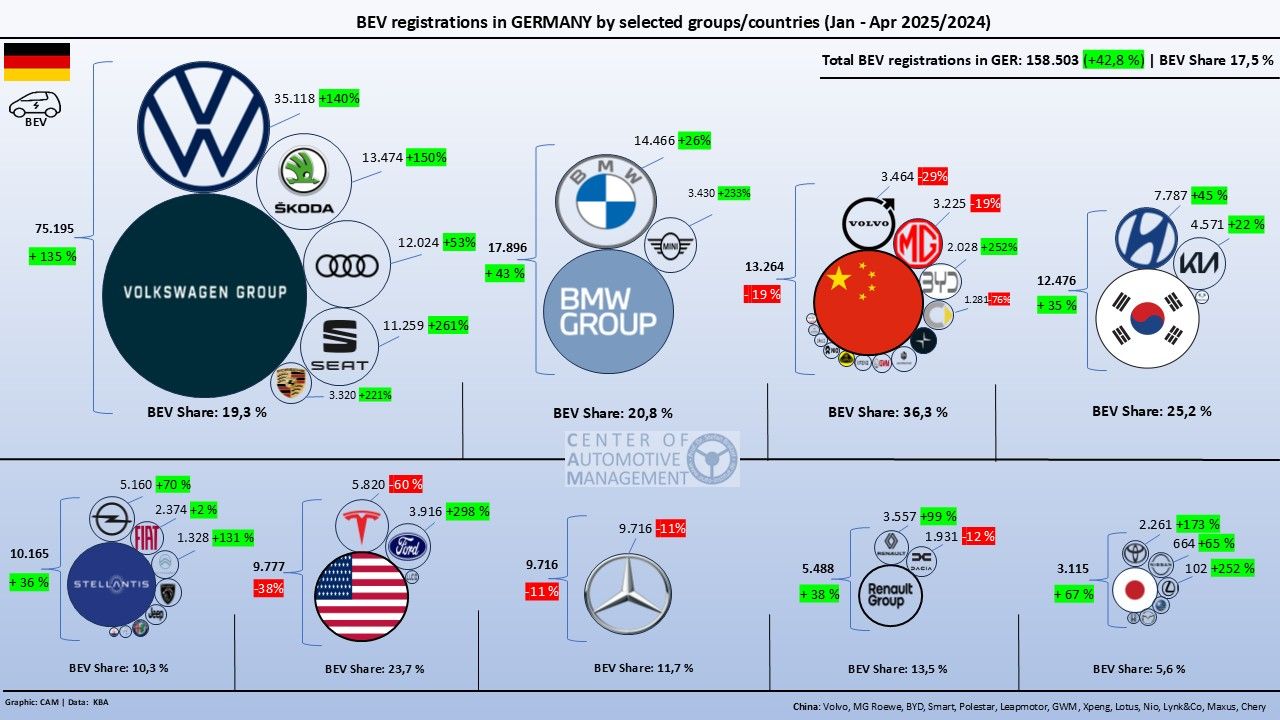

No group is better positioned to benefit from the EV surge than Volkswagen Group, which registered 75,195 BEVs during the period — nearly half of Germany’s entire electric market. The group’s core brand, Volkswagen, accounted for 35,118 units, while its sub-brands showed remarkable growth: SEAT/Cupra (+261%) sold 6,505 units, Škoda (+150%) added 10,258 units, and Porsche grew 221% to 5,978 cars. Volkswagen Group’s BEV share of total sales now stands at 19.3%.

BMW and Mini see strong electric car growth

BMW Group performed solidly with 17,896 BEV sales, representing 20.8% of its total volume. BMW delivered 13,884 electric cars (+26%), and Mini added 4,012 units, soaring by 233% year-on-year. The group’s dual-brand strategy is proving effective in both premium and urban segments.

Mercedes-Benz EV sales decline despite market growth

Mercedes-Benz remains under pressure. Despite registering 9,716 BEVs, its share of electric models fell to 11.7%. It is the only major German carmaker to report an overall decline in all-electric registrations — a sign that its electric portfolio is losing ground in an increasingly competitive landscape.

Stellantis and Renault post mixed but positive results

Stellantis registered 10,165 BEVs with mixed internal dynamics. Opel contributed 4,318 units (+70%) and Citroën grew to 2,754 (+131%), while Fiat stayed flat at 2,119. Other brands, including Jeep, DS, and Maserati, declined and failed to cross the 1,000-unit threshold combined. The group’s BEV share is now 10.3%.

Renault Group nearly doubled its BEV sales to 5,488 units (+99%). Renault brand models made up 4,762, while Dacia fell by 12% to 726 vehicles. With a BEV share of 13.5%, the group maintains a stable position in the mid-range market.

Chinese EV brands scale fast in Germany with new entrants gaining traction

China’s presence in Germany’s EV landscape is growing rapidly. A total of 13,264 BEVs were sold by Chinese manufacturers, reflecting a 36.3% electric share within their group. BYD posted 4,985 registrations (+252%), and MG followed closely with 6,479 units (+221%).

Some brands struggled: MG Roewe declined by 19% to 1,004 units, Smart dropped 76% to 447, and Volvo (owned by Geely) fell 29% to 349 units. But the arrival of Leapmotor, Xpeng, and Chery — together adding over 1,000 vehicles — offset the declines and confirmed China’s growing influence in Europe’s most important EV market.

Tesla loses ground with 60% as Ford (+298%) and Lucid gain attention

American manufacturers recorded 9,777 BEV sales, but the decline of Tesla was striking. Its German deliveries fell 60% to 6,865 units, reflecting increased competition and softening demand. Ford, in contrast, surged with 2,871 BEVs sold, a 298% increase. Lucid entered the market with a modest but symbolic 41 units.

South Korea keeps momentum, while Japan trails behind

South Korean manufacturers Hyundai, Kia and KGM maintained a solid position with 12,476 BEV sales and a 25.2% share within their group. Hyundai sold 6,974 vehicles (+45%), Kia 4,832 (+22%), and KGM added 670 units.

Japanese brands remain on the margins. They sold 3,115 BEVs, equal to 5.6% of their combined sales. Toyota led with 1,329 units (+173%), Lexus followed with 988 (+252%), and Nissan sold 798 (+65%). Mazda, Subaru and Honda each registered fewer than 100 electric vehicles.

Germany is setting the pace for EV sales in Europe

With over 158,000 BEVs sold in just four months, Germany is setting the pace for Europe. While Volkswagen and BMW continue to lead, the sharp drop in Tesla’s performance and the aggressive expansion of Chinese brands mark a turning point.

The fight for market leadership is now open. Pricing power, brand trust and adaptability to local demand will determine who dominates Germany’s increasingly competitive EV space — and by extension, the future of Europe’s auto industry.

Source: data and chart (May 2025 released) Center of Automotive Management (CAM), Germany.

Trusted growth partner for EV Charging Companies since 2018

Since 2018, EVBoosters has been the trusted executive search partner for powering EV Charging Networks in Europe —helping them scale by recruiting the leaders and experts who drive real growth. If you’re a CEO, founder, or investor looking to strengthen your leadership team or critical senior position (sales/operations/product), we’re here to help.

Schedule your introductory call HERE with our founder and managing partner Paul Jan Jacobs and let’s explore how we can support your growth journey too.