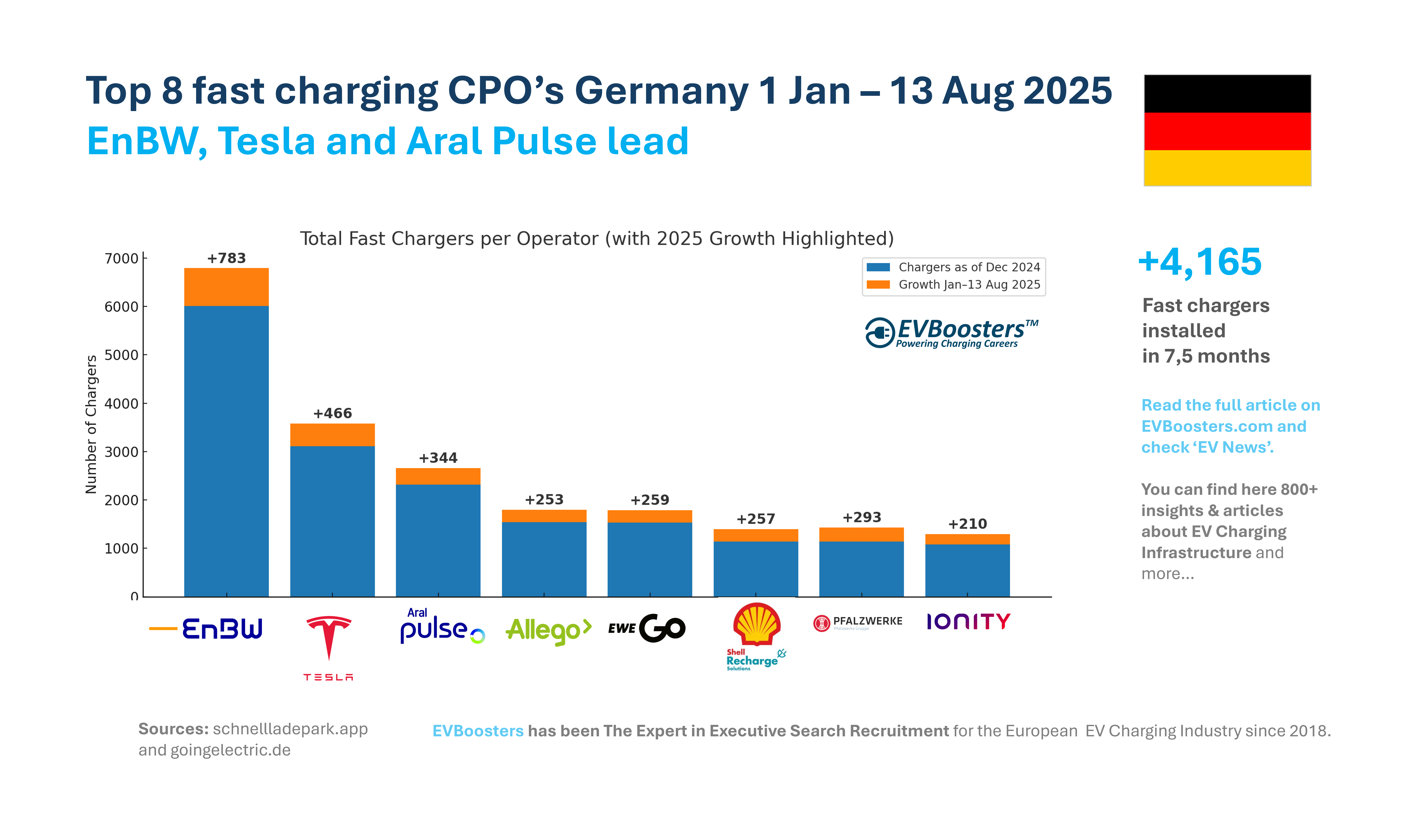

Key Takeaways per CPO – 1 Jan until 13 August 2025

EnBW: Still the clear market leader, now approaching 7,000 fast chargers. With an impressive absolute growth of +783 since January, EnBW continues to prioritise full national coverage and reliability. Its strategy focuses on high-density corridors and high-uptime infrastructure. In March 2025, EnBW announced it would scale back its long-term target from 30,000 to over 20,000 fast-charging points in Germany by 2030. The decision reflects a strategic shift towards more focused, economically sustainable growth, taking into account regulatory complexity, grid limitations, and market maturity.

Tesla: With +466 new chargers, Tesla maintains strong growth momentum while opening its Supercharger network to non-Tesla drivers. Its user-friendly experience and high-power hardware remain a benchmark for convenience and speed, particularly on long-distance routes.

Aral Pulse: Adding +344 chargers since January, Aral Pulse leverages its vast fuel station footprint to integrate EV charging across strategic travel hubs. Its consistency places it firmly in third place, with a balanced urban and intercity presence.

Allego: With +253 new chargers, Allego continues to focus on cities and commercial areas. The operator is becoming increasingly relevant for everyday drivers in metropolitan environments, where reliability and accessibility are key.

EWE Go: EWE Go adds +259 chargers and competes closely with Allego. Its strength lies in regional coverage across Northern Germany, supporting both commuters and regional fleets with consistent availability.

Shell Recharge: With a +22.5% growth rate and 50 new chargers in August alone, Shell Recharge is bouncing back strongly. Its hybrid model — combining retail with high-speed charging — gives it a competitive edge in transitional mobility spaces.

Pfalzwerke: This regional provider shows the fastest percentage growth of all (+25.7%), reflecting its aggressive and agile expansion strategy. Focused primarily in Southern Germany, Pfalzwerke is carving out a reliable regional network with growing national visibility.

IONITY: Although its absolute growth is lower (+210), IONITY continues to play a pivotal role in high-power highway charging. With a pan-European footprint, its focus is on long-distance travel, premium locations, and ultra-fast infrastructure.

Growth Overview: 1 January 2025 → 13 August 2025

| Operator | Dec 2024 | Aug 2025 | Absolute Growth | % Growth |

|---|---|---|---|---|

| EnBW | 6005 | 6788 | +783 | +13.0% |

| Tesla | 3110 | 3576 | +466 | +15.0% |

| Aral Pulse | 2317 | 2661 | +344 | +14.8% |

| Allego | 1541 | 1794 | +253 | +16.4% |

| EWE Go | 1531 | 1790 | +259 | +16.9% |

| Shell Recharge | 1143 | 1400 | +257 | +22.5% |

| Pfalzwerke | 1141 | 1434 | +293 | +25.7% |

| IONITY | 1084 | 1294 | +210 | +19.4% |

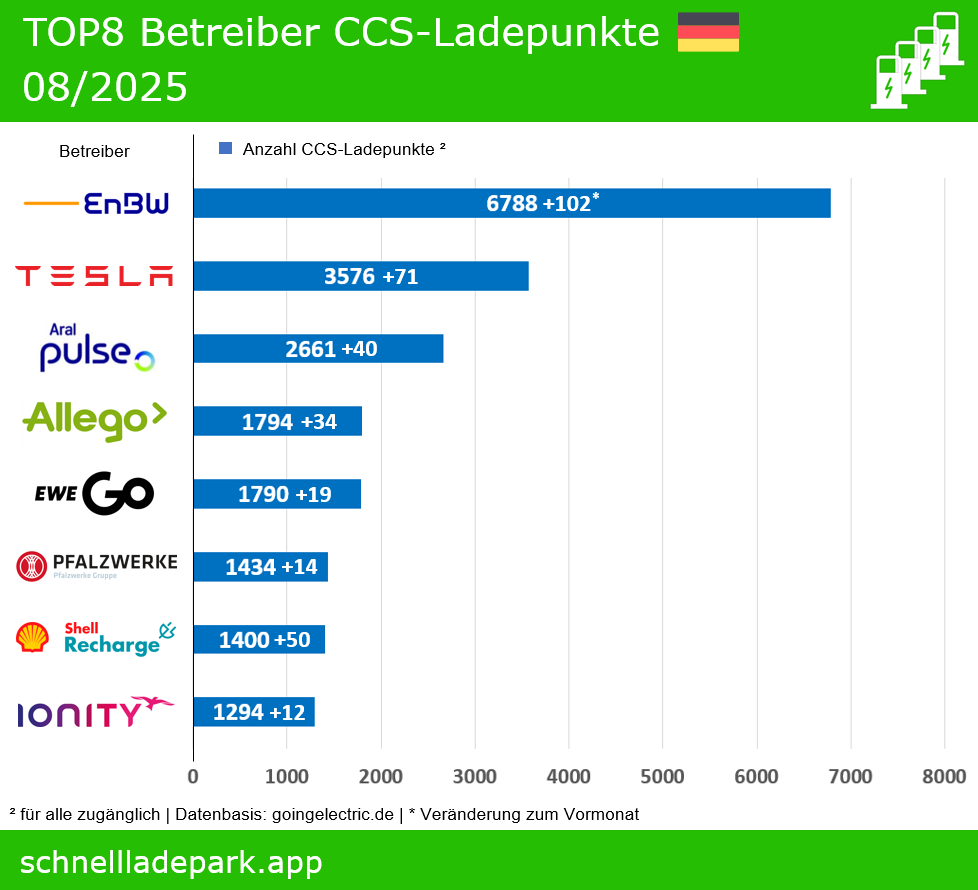

Latest Monthly Growth (August 2025)

Looking specifically at the most recent month, August 2025, we can observe some interesting shifts in momentum across the top charging operators:

EnBW added +102 chargers, maintaining a stable rollout pace and consolidating its lead.

Tesla grew by +71 chargers, continuing its steady expansion with reliable output.

Aral Pulse installed +40 new chargers, slowing down slightly compared to earlier in the year.

Allego and EWE Go grew by +34 and +19 chargers respectively, keeping close in the mid-tier segment.

Shell Recharge saw a notable increase of +50 chargers in August alone, reflecting renewed investment.

Pfalzwerke expanded by +14, indicating a temporary deceleration after previous rapid growth.

IONITY added +12 chargers, showing minimal expansion this month.

While the pace has varied, the overall direction remains upward. Operators appear to be entering a more strategic growth phase, focusing on quality locations, user experience, and compliance with EU-wide standards.

AFIR, grid pressures and the next phase of growth

As Germany’s fast-charging network rapidly scales, operators are entering a more complex phase—shaped by regulation and infrastructure capacity. Two major challenges dominate this next phase: complying with European regulations and dealing with electricity grid limitations.

The first is the EU’s Alternative Fuels Infrastructure Regulation (AFIR). This regulation requires that all public charging stations support both open-loop (e.g., contactless debit/credit cards) and closed-loop (e.g., app-based or RFID) payment methods. While this greatly improves driver convenience and accessibility, it also introduces operational and financial demands for charging point operators, such as:

Retrofitting existing stations with compliant payment hardware

Enabling full interoperability across networks and platforms

Providing real-time transaction and data interfaces

In parallel, grid capacity has become a structural constraint. High-powered fast chargers require substantial local energy availability. Without reinforcement or intelligent load management, many planned installations face delays or reduced service levels.

To respond, operators are turning to technologies like vehicle-to-grid (V2G) and dynamic load balancing, which allow for more flexible, efficient use of limited grid capacity.

Looking ahead, analysts agree: the next competitive advantage won’t come from raw speed or charger count, but from building innovative, scalable, and resilient networks. This includes:

Predictive energy demand planning and load forecasting

Flexibility to respond to evolving regulatory frameworks

Advanced monitoring and data-driven maintenance strategies

Top 8 is heading towards 33,000 fast chargers by Dec 2025

If the current trend holds, 2025 could close with nearly 33,000 fast chargers from the top 8 operators alone. But market leadership may shift. Players like Pfalzwerke and Shell Recharge are proving that agility and focus can rival scale.

Germany is no longer just building a charging network — it’s optimising one. The question heading into 2026 is no longer “who can install the most?” but rather, “who can deliver the smartest, most reliable experience?”

The EV race continues. And Germany is clearly in pole position.

EVBoosters Executive Search: Trusted growth partner for EV Charging & e-Mobility leadership since 2018

Since 2018, EVBoosters has been the trusted executive search partner for Europe’s leading EV Charging and e-Mobility companies — supporting their growth by placing board members, senior executives and functional leaders who truly shape the industry. If you’re a founder, investor, senior manager or board member looking to strengthen your leadership team or fill a critical senior role in sales, operations or product, we know the market, the talent and the challenges you face.

📅 Schedule an introductory call HERE with our founder and managing partner, Paul Jan Jacobs — and let’s explore together how we can accelerate your growth journey.