The shift in growth rates

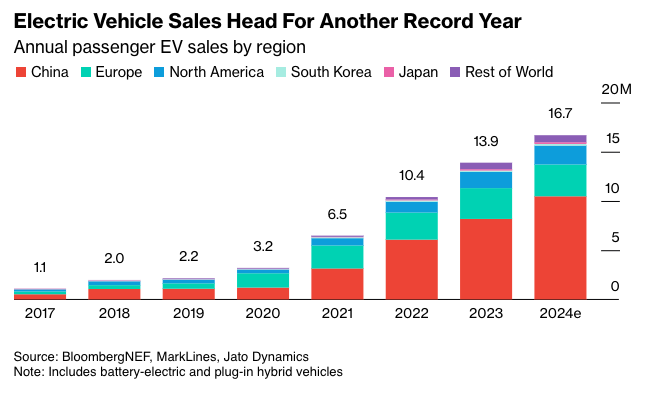

EV sales have seen explosive growth in recent years, with a 60% surge in 2022 and a 33% increase in 2023. This year, however, the global market has cooled slightly, growing by 26% in the first half of 2024 and showing a 30% uptick in September. The momentum is still strong, but it’s not the rapid acceleration seen in earlier stages of EV adoption.

Certain markets, like Germany and Japan, have shown worrying signs of decline. In Germany, sales dropped 61% in August compared to last year. But the drop comes with context—2023 saw an unusual spike as buyers rushed to purchase EVs before government subsidies expired. This distortion makes the year-over-year comparison less alarming than it seems at first glance.

A temporary slowdown in Europe

Europe’s EV market is in a holding pattern for now, as automakers gear up for stricter CO2 regulations that take effect in 2025. Many manufacturers are waiting to launch more affordable EV models until the new rules provide greater incentives. This isn’t the first time Europe has seen this kind of pattern. Back in 2019, EV sales slowed ahead of stricter 2020 emissions standards, only to rebound sharply once those rules went into effect.

Affordability is still a sticking point for many European consumers. Take the Fiat 500e, for example. It costs nearly €12.000 more than its gas-powered counterpart, even though the additional cost of the battery is only about €3.000. This steep price gap makes it hard for many buyers to justify the switch, and it’s something automakers will need to address to reach mass-market customers.

China leads the way

China continues to dominate the global EV market, accounting for 60% of all plug-in vehicle sales this year. In September alone, EV sales in the country jumped by 50%, with electric models now making up more than half of all cars sold. This momentum underscores China’s unmatched role in shaping the global EV landscape.

However, the growth in China isn’t solely driven by battery-electric vehicles (BEVs). Plug-in hybrids and range-extended EVs have gained significant traction, growing faster than BEVs this year. BEV sales in China are up 18%, while total plug-in vehicle sales have risen by 37%. This trend suggests that Chinese consumers are increasingly drawn to vehicles that offer a mix of electric and traditional fuel capabilities, likely for their flexibility and affordability.

For international automakers, the Chinese market presents both opportunities and challenges. Local brands continue to dominate, leaving foreign companies with tough decisions about how to stay competitive in a highly dynamic environment.

The US steadily grows

While the United States is still behind Europe and China in terms of EV adoption, the market is picking up steam. Preliminary data shows that around 390.000 EVs were sold in the third quarter of 2024, marking a new record. Tesla remains a significant player, but its share of the U.S. EV market has dropped below 50% as competitors like GM, Hyundai, and Honda gain ground. Honda’s new Prologue model has been particularly well-received, helping diversify the landscape.

EVs are expected to account for over 10% of total U.S. vehicle sales this year. While that’s a smaller share compared to global leaders, it represents steady progress in a country where infrastructure and pricing challenges have traditionally slowed adoption.

Challenges and the road ahead

The global EV market faces several hurdles as it matures. High prices remain a barrier, especially in Europe, where the premium for going electric can be substantial. Charging infrastructure also needs to expand, particularly in regions where EV adoption has been slower. Additionally, regulatory uncertainty continues to shape the market, with inconsistent policies across regions creating challenges for manufacturers. Geopolitical tensions, particularly between the U.S. and China, could further complicate supply chains and market dynamics.

Despite these challenges, there are reasons to be optimistic. In 2025, Europe’s market is expected to surge as new, affordable models like the Renault 5 and VW ID.2 hit the streets. Stricter CO2 standards will also give automakers a renewed push to increase EV sales. Meanwhile, the U.S. is set to benefit from ongoing investments in charging networks and more diverse EV offerings.

China, already the global leader, will likely maintain its dominant position. However, competition is expected to intensify as domestic and international automakers vie for market share in an increasingly crowded field.

Conclusion

EV sales may not be growing at the breakneck pace of previous years, but the market remains on solid ground. With a record 16,7 million units expected to sell in 2024, EVs are poised to account for 20% of global vehicle sales—a significant milestone in the shift toward cleaner transportation. As automakers address affordability, infrastructure, and competition, the next wave of adoption will likely focus on making EVs accessible to a wider audience.

While the challenges are real, the future of the EV market is bright. As governments and industries adapt to new realities, 2025 is shaping up to be a pivotal year for electrification worldwide.

Source: BloombergNEF