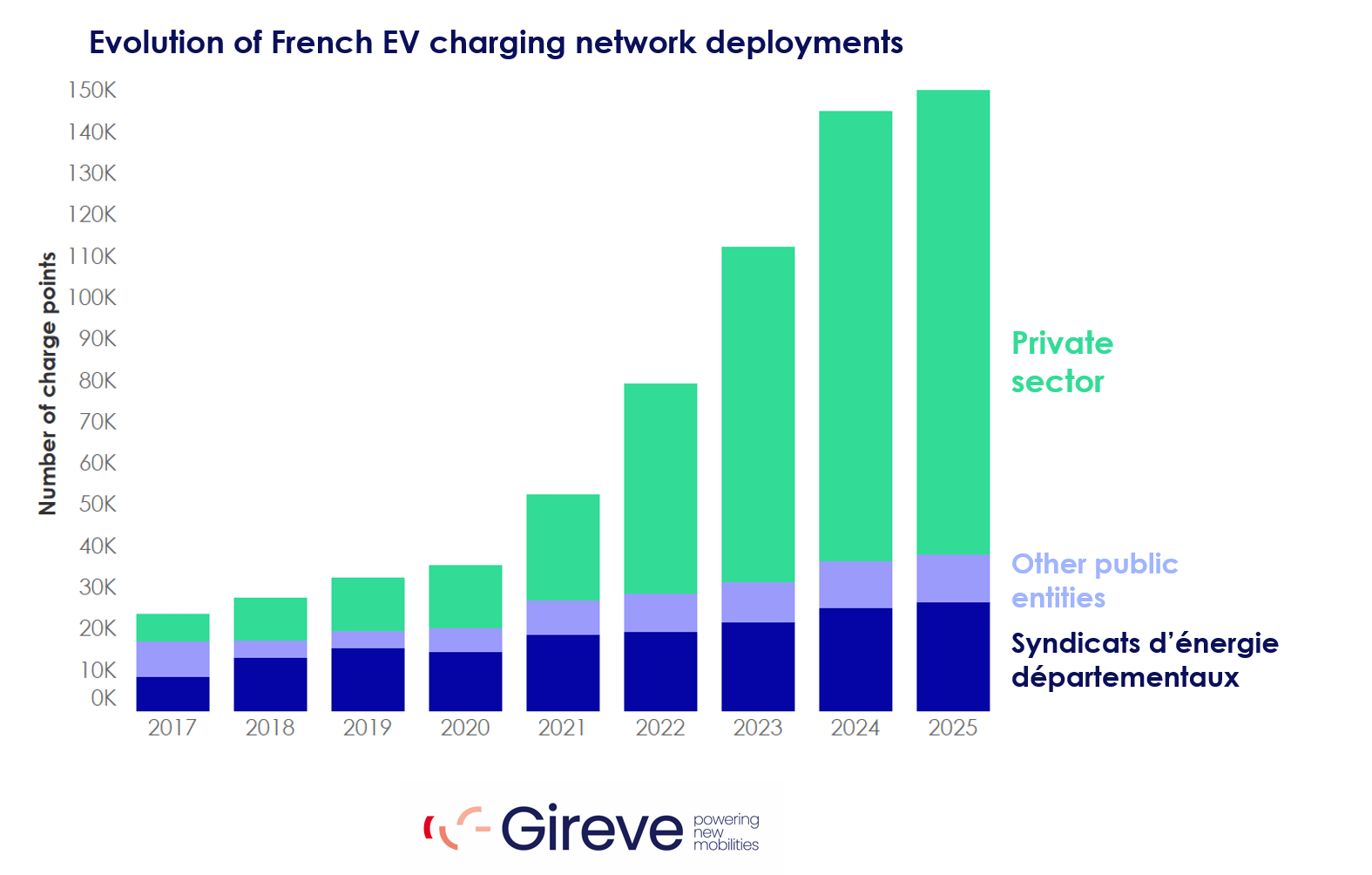

A shift towards private sector dominance

However, from 2021 onwards, the landscape began to shift dramatically. According to Gireve’s data, private sector deployment accelerated sharply. In 2021, private operators overtook public initiatives in terms of the number of charge points installed. By 2025, private operators are projected to dominate the French market with more than 70% of the country’s total charge points.

Meanwhile, the number of public charge points operated by SDEs and other public entities has grown at a much slower pace, leading to a reduced overall market share. Yet in absolute terms, the number of public chargers is still increasing, just not as fast as private installations.

This transition illustrates a classic pattern: public entities build the initial foundation, de-risking the market, after which private capital steps in to scale and innovate.

Different focus, different strategies

Looking deeper into the distribution and types of charge points, interesting differences emerge between public and private operators.

From the third Gireve chart:

Power types: SDEs primarily operate fast AC chargers, with only a small percentage dedicated to DC fast or ultra-fast charging. Private sector networks, on the other hand, show a stronger focus on DC charging technologies, including a much larger share of fast and ultra-fast DC stations.

Site types: Public networks managed by SDEs are predominantly located at car parks and on-street locations. In contrast, private operators are more diversified, installing charge points at retail outlets, highways, enterprises, and increasingly, car parks.

This suggests that SDEs focused on accessibility and convenience in public spaces, whereas the private sector is prioritising profitability, customer turnover, and long-distance travel.

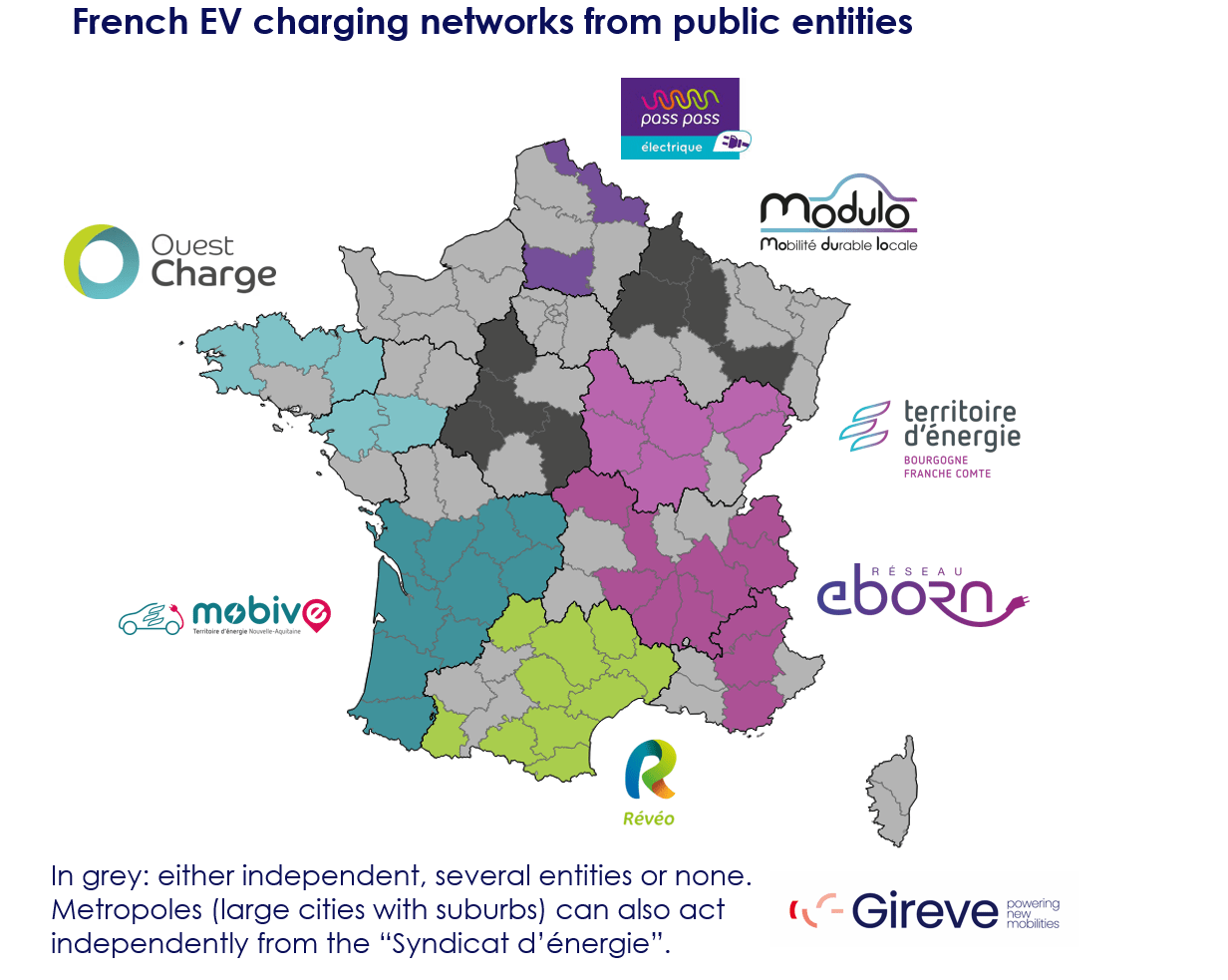

Regional variations and independent actors

The second map from Gireve shows the regional distribution of public EV networks. While large consortiums such as Mobive and Réseau eborn cover wide areas, many regions in grey operate independently or have a fragmented approach.

This patchwork landscape can lead to variations in service quality, pricing, and user experience. It also highlights the need for interoperability and roaming agreements between networks — a critical area for future improvement.

What can we learn?

The French experience offers important lessons for other European markets:

Public entities are essential early on. Without initial investment from public bodies like the SDEs, the EV market might have struggled to gain traction.

The private sector follows success. Once EV adoption grows and business models become proven, private capital can rapidly expand infrastructure.

Infrastructure must evolve. Transitioning from widespread, slow AC chargers to fast and ultra-fast DC chargers is vital as EV usage matures.

Regional coordination matters. Fragmented regional approaches can hinder national EV adoption unless interoperability is prioritised.

Markets such as Spain, Italy, and parts of Eastern Europe — where EV infrastructure is still developing — could greatly benefit from a similar staged approach, combining early public support with gradual private sector scaling.

SDE still play a vital role for the adoption of e-Mobility

In France, the role of syndicats d’énergie is far from over. While they may no longer dominate in raw numbers, their strategic importance remains. They can:

Focus on underserved areas where private operators see little return

Ensure equitable access to EV charging for all socioeconomic groups

Innovate in areas such as vehicle-to-grid technology, local energy management, and green energy integration

Meanwhile, private operators will continue to expand the highway networks, commercial hubs, and ultra-fast corridors needed for a fully electrified mobility future.

France’s EV charging story is a blueprint for how a well-balanced public-private evolution can create a resilient, inclusive, and scalable EV infrastructure.