The Indian government’s commitment to electrifying the automotive sector is evident through initiatives like the FAME (Faster Adoption and Manufacturing of Electric Vehicles) India scheme, which has already disbursed significant subsidies. The upcoming auto PLI 2.0 scheme is expected to further energise the market by covering all types of EVs, thereby attracting new entrants and ensuring a competitive landscape.

A noticeable trend in the market is the rising popularity of electric SUVs and crossovers. These vehicles, known for their spaciousness and perceived safety, are becoming increasingly attractive to consumers, especially as more affordable and varied electric options become available. The upcoming launches of models such as the Tata Punch EV and Hyundai Exter EV, priced to appeal to a broad segment of consumers, highlight the industry’s shift towards making electric mobility more accessible.

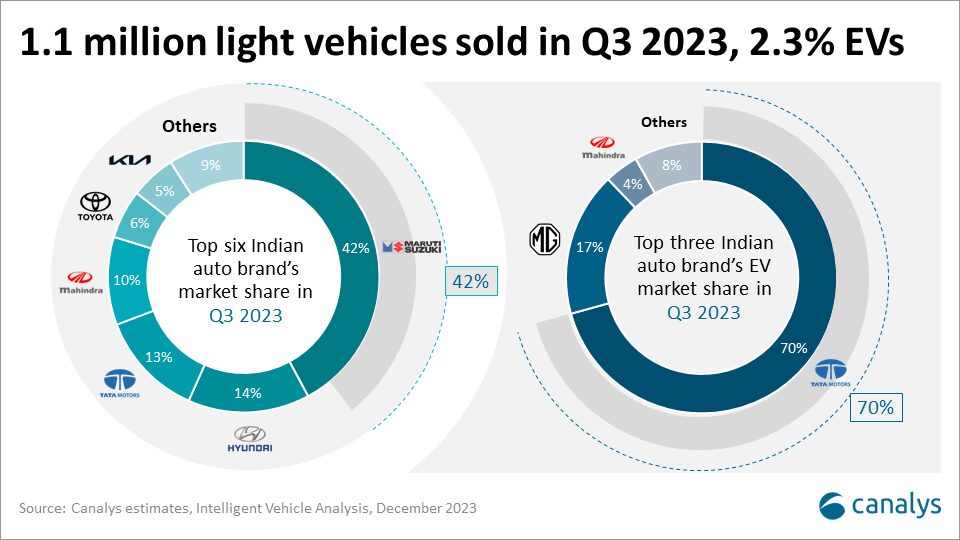

Tata Motors remains at the forefront of India’s EV market, even though it witnessed a sales dip in Q3 2023. This illustrates the company’s significant role in shaping the country’s electric future. On the global front, new entrants like Tesla and VinFast are preparing to make their mark on the Indian market, with Tesla planning a substantial investment for a local factory. This move underscores the global auto industry’s recognition of India’s potential in the electric vehicle space.

Strategic partnerships and joint ventures are also playing a crucial role in enhancing EV manufacturing and sales within the country. For instance, the collaboration between JSW Group and SAIC Motors aims to capitalise on manufacturing EVs, highlighting the concerted efforts being made to bolster the sector.

Despite the promising outlook, the road ahead requires a focused strategy to stimulate EV demand. This includes extending the FAME scheme and introducing policies that not only encourage new market entrants but also support domestic manufacturers in their transition towards electric mobility.

Canalys is optimistic about the future of India’s EV market, forecasting growth to over 300,000 units in 2025, which would represent a compound annual growth rate (CAGR) of 59%. This projection is supported by a mix of government incentives, the debut of new and diverse models, and a growing consumer interest in electric vehicles.

To fully unlock this potential, a multi-faceted approach is necessary. Extending and enhancing the FAME scheme, alongside formulating policies that foster a supportive environment for new entrants and domestic players, will be key. Such measures will not only pave the way for a significant market transformation but also ensure that electric vehicles play a central role in India’s automotive future.

India found itself at a pivotal point in its journey towards widespread EV adoption. With a proactive government, the introduction of new models, and a market ready for change, the stage is set for an electrifying leap forward. Despite the recent dip in EV sales, the future looks bright, with electric vehicles poised to become a cornerstone of India’s drive towards sustainable mobility, shaping a vibrant and sustainable market in the years to come.

Source: Canalys

EV Policy Europe 2010 – 2025: Why the ‘deer in the headlights’ strategy puts its Automotive future at risk

The European Commission’s 16 December announcement to ease the 2035 CO₂ reduction targets marks a pivotal moment for Europe’s automotive sector. After more than a decade in which the industry