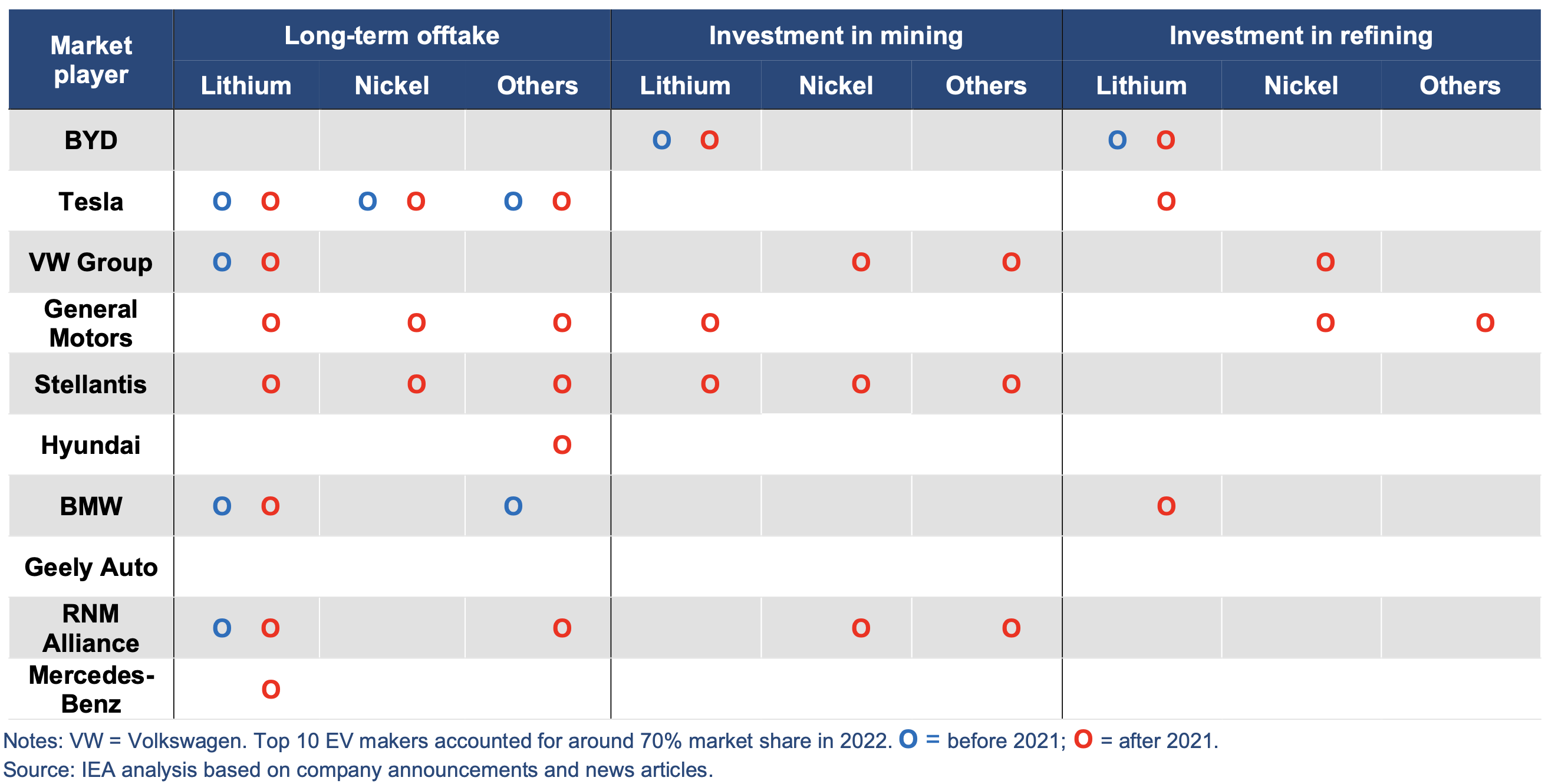

To address this challenge, the industry is increasingly relying on long-term offtake agreements. These contracts guarantee a consistent supply of critical minerals over an extended period, providing stability to manufacturers. Major players like Tesla, General Motors, BMW, and Renault have signed such agreements, securing vital minerals like lithium, nickel, cobalt, and more.

However, a recent trend is seeing EV OEMs and battery cell manufacturers taking a more proactive approach by investing directly in the critical minerals value chain. This strategic shift aims to gain better control over mineral supplies, protect production pipelines, and reduce exposure to market risks.

For instance, China’s CATL, the world’s largest battery cell maker, invested significantly in critical mineral assets. Its subsidiary, Sichuan CATL, acquired a substantial stake in CMOC, a major cobalt producer in the Democratic Republic of the Congo. CATL-led consortiums also secured lithium reserves in Bolivia.

Other manufacturers, like LG Chemical, BYD, and SK On, have invested in mining projects, securing access to valuable resources. General Motors announced a substantial investment in Lithium Americas to develop a lithium mining project.

Investment is not limited to mining; it extends to refining and even the entire EV value chain. Tesla plans to build a lithium hydroxide refinery in Texas, and Volkswagen Group aims to establish a nickel ore production and processing plant in Indonesia.

In Indonesia, CATL and LG Energy Solution are collaborating on a mining-to-batteries complex worth $6 billion. LG Energy Solution is also part of a consortium investing $9 billion in the entire EV battery value chain in the same country. In Canada, General Motors, BASF, POSCO, and Vale are working together to create a comprehensive battery hub.

These investments strengthen supply chains, reduce environmental footprints, and ensure a stable source of critical minerals, ultimately propelling the EV industry closer to a sustainable and greener future.

Source: Critical Minerals Market Review 2023 | IEA