A key factor behind this sharp decrease is the collapse of lithium prices. Since peaking in late 2022, lithium prices have plummeted by nearly 90%. The surge in new production, particularly from China, has led to an oversupply of lithium, leaving mines struggling to stay profitable and, in some cases, forcing them to shut down. As a result, the cost to manufacture lithium-ion batteries has dropped significantly, creating a ripple effect across the industry.

Why lithium matters to battery prices

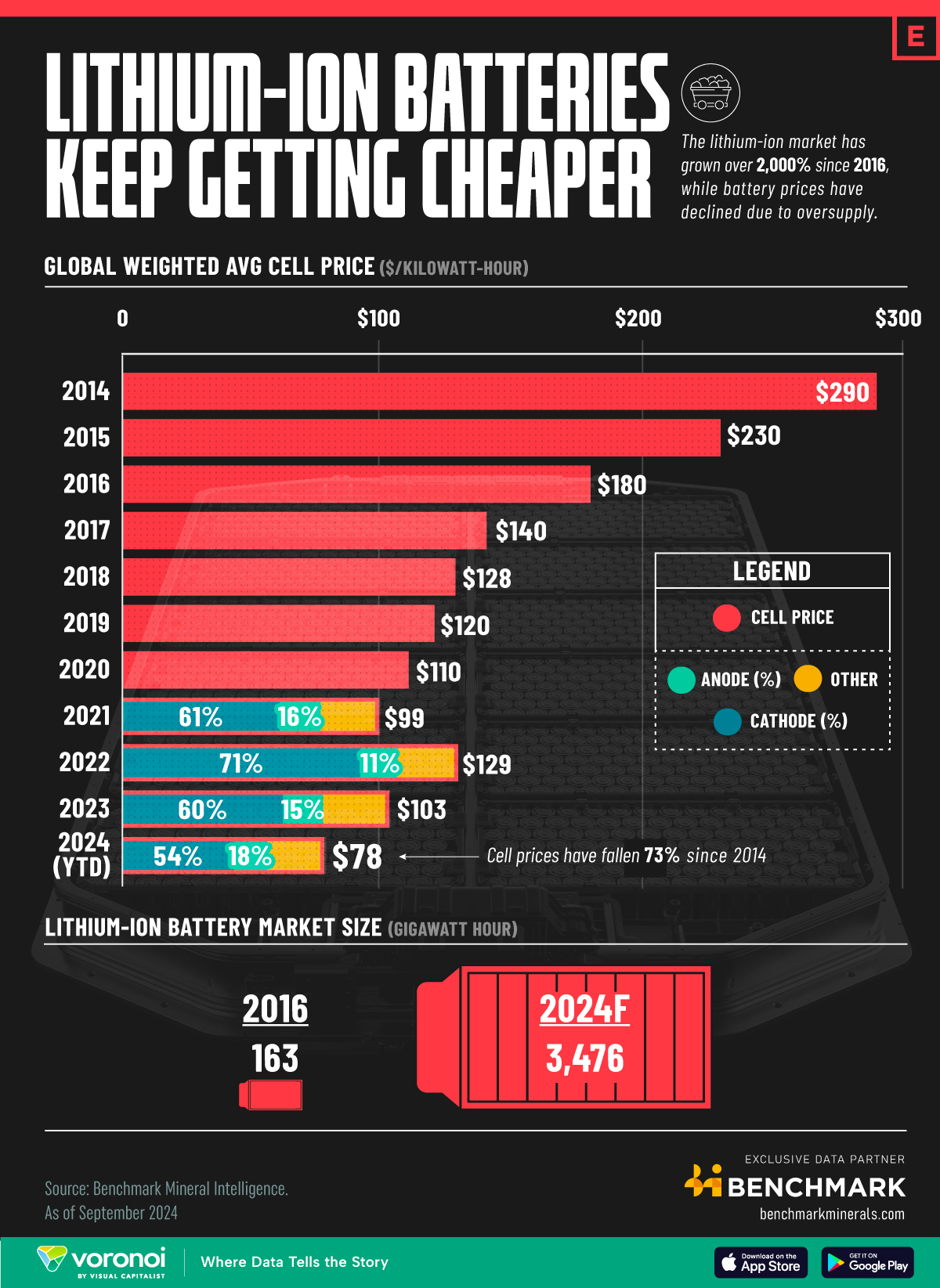

Lithium-ion batteries operate by shuttling lithium ions between the anode and cathode during charging and discharging cycles. The most expensive part of this process is the cathode, which accounts for more than half of the total cost of the battery. In 2023, the breakdown looked like this: 54% of the battery cost came from the cathode, 18% from the anode, and 28% from other components. This makes the price of raw materials, particularly lithium, a critical factor in determining the overall cost of the batteries.

As lithium prices spiked in 2022, battery prices also saw a brief uptick. However, with the recent crash in lithium prices, battery costs have started to decline again. In 2023, the average price of a lithium-ion battery pack was $139 per kWh, and it’s expected to fall even further, potentially reaching $78 per kWh by the end of 2024, as the market continues to be oversupplied.

The role of china and global oversupply

China is by far the world’s largest player when it comes to battery production. By 2030, Chinese manufacturers like CATL and BYD are expected to dominate nearly 70% of global battery capacity. China’s influence spans the entire supply chain—from mining raw materials to assembling batteries and manufacturing electric vehicles.

This rapid expansion, however, has created a significant oversupply in the market. At the same time, demand has softened, particularly in the electric vehicle sector, where adoption has been slower than expected in some regions. This imbalance between supply and demand is pushing prices down even further, benefiting consumers but challenging manufacturers to remain profitable.

Despite this short-term interval in EV adoption, BloombergNEF forecasts that the demand for lithium-ion batteries will surge ninefold by 2040. The market will likely stabilise as EV adoption picks up pace again, and as the world transitions further toward clean energy technologies. The battery industry is expected to see major investments in the coming years, with capital expenditure predicted to jump from $567 billion in 2030 to $1,6 trillion by 2040.

Long-term outlook: Falling prices, rising demand

While the lithium-ion battery market is currently facing an oversupply and price decline, the long-term outlook remains strong. As battery prices continue to fall, electric vehicles will become more affordable, narrowing the price gap between EVs and traditional internal combustion engine vehicles. This could trigger a new wave of consumer demand, driving further growth in the battery sector.

Countries around the world are ramping up efforts to increase their battery production capacity. In the U.S., companies like Tesla and LG Energy Solution are leading the charge, positioning the country as the second-largest producer of batteries by 2030, behind China. Europe, too, is expanding its capacity, with Germany playing a pivotal role through Tesla’s Giga Berlin plant, which is helping to scale up lithium-ion battery production across the continent.

Advances in battery technology are also contributing to the price drop. Improvements in production processes and the development of new battery chemistries are expected to drive costs even lower. By 2024, battery pack prices could drop below $80 per kWh—a critical milestone that could further accelerate EV adoption and help the world transition to cleaner energy sources.

Conclusion

The price of lithium-ion batteries continues to decline, driven by an oversupply of raw materials and a temporary slowdown in electric vehicle adoption. While the market is currently adjusting to these changes, the long-term outlook remains optimistic. As demand for clean energy solutions grows and EV adoption picks up, the battery market is expected to play a central role in the global energy transition. With falling prices and rising demand, lithium-ion batteries are set to remain a critical part of the shift toward a more sustainable future.

Sources: Visualcapitalist, BloombergNEF