Fastned and Tesla: Market Leaders

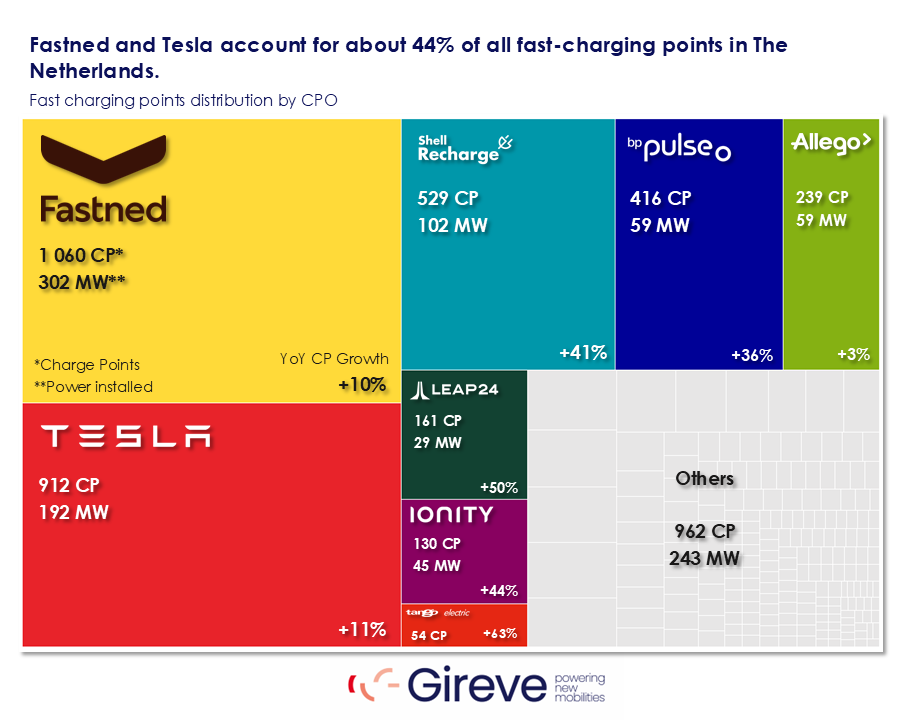

Two CPOs currently dominate the fast-charging market in the Netherlands: Fastned and Tesla. Together, they account for nearly 44% of all fast-charging points in the country — a significant share considering the growing number of players entering the field.

Fastned has installed 1.060 fast charge points (CPs), with a total installed capacity of 302 MW. Their year-on-year growth is measured at +10%, demonstrating steady expansion and reliability in scaling up.

Tesla follows closely with 912 fast charge points and 192 MW of capacity, and a slightly higher year-on-year growth rate of +11%. With its proprietary network, Tesla continues to attract both Tesla and non-Tesla drivers thanks to the increasing openness of its Supercharger locations.

Tango Electric, Leap24, AVIA Volt and IONITY show largest YoY growth rates

While Fastned and Tesla remain dominant, several other CPOs have recorded impressive growth rates and are beginning to carve out a meaningful presence in the Dutch market.

Shell Recharge operates 529 CPs, providing 102 MW of power. Its +41% year-on-year growth is one of the highest among top players.

BP pulse, with 416 CPs and 59 MW, has grown by +36%, although its retail and charging activities on Dutch soil are for sale.

LEAP24, a newer but rapidly growing operator, now has 161 CPs and 29 MW, with an astonishing +50% year-on-year growth. This places them in the group of fastest-growing challengers, especially among urban and logistics-focused locations.

IONITY, known for its pan-European ultra-fast charging network, operates 130 CPs in the Netherlands with 45 MW of power. Their growth rate of +44% reflects strong confidence in the Dutch market.

AVIA Volt, while not included in the original top list of Gireve, this specialist in operating fast charging infrastructure clearly deserves a place among the fast-growing CPO’s in the Netherlands. With 66 charge points as of May 1st 2025 and a year-on-year growth of 52%, the company is rapidly expanding its presence.

Tango Electric, a relatively small player with 54 CPs, has shown the highest growth rate in the market at +63%, albeit from a smaller base.

Allego, a well-established CPO in the Netherlands and across Europe, holds 239 CPs and 59 MW, but its growth rate of +3% suggests a more mature and stabilised operation compared to others.

While these 8 major CPOs dominate the headlines in Gireve’s overview, the category of “Others” — representing a wide array of smaller or regional operators — still accounts for 962 CPs and a total of 243 MW of installed capacity. This segment is critical for ensuring network redundancy, availability in less-populated regions, and flexibility in service models.

Why fast charging matters more than ever

Fast-charging stations, typically offering power outputs between 50 and 350 kW, are a vital piece of the electric mobility puzzle. For many Dutch drivers, especially those without private home charging, these stations provide the speed and convenience necessary to rely fully on electric transport.

In urban areas, fast charging supports ride-hailing services, delivery vehicles and private users who need to “top up” in minutes rather than hours. Along the motorway network, fast charging enables long-distance travel, connecting cities such as Amsterdam, Rotterdam, Eindhoven and Groningen with minimal charging disruption.

Challenges ahead

Despite the positive developments, the Netherlands faces several challenges:

Grid capacity constraints: The Dutch electricity grid is operating near full capacity in many areas, which slows down the expansion of new fast-charging locations.

Permit procedures and spatial planning: Local permitting processes can vary widely and add delays to infrastructure rollouts.

Operator coordination: As more CPOs enter the market, there is increasing need for interoperability, transparent pricing and standardised customer experiences.

Still, the continued growth of the challenger CPOs like Shell Recharge, LEAP24 and IONITY suggests that the Dutch market remains attractive for investment — particularly for high-power, publicly accessible charging infrastructure.

Trusted growth partner for Charging Companies since 2018

Since 2018, EVBoosters has been the trusted executive search partner for the EV Charging Industry—helping them scale by recruiting the leaders and experts who drive real growth. If you’re a CEO, founder, or investor looking to strengthen your leadership team or critical senior position (sales/operations/product), we’re here to help.

Schedule your introductory call HERE with our founder and managing partner Paul Jan Jacobs and let’s explore how we can support your growth journey too.

Sources

Gireve (2025) – Fast Charging in the Netherlands, Beyond EV Charging #17

RVO (2024) – EV Monitor Nederland

ElaadNL & EVBox (2018–2024) – Charging Infrastructure Reports

Ministry of Infrastructure and Water Management (NL) – Public Charging Policy Data