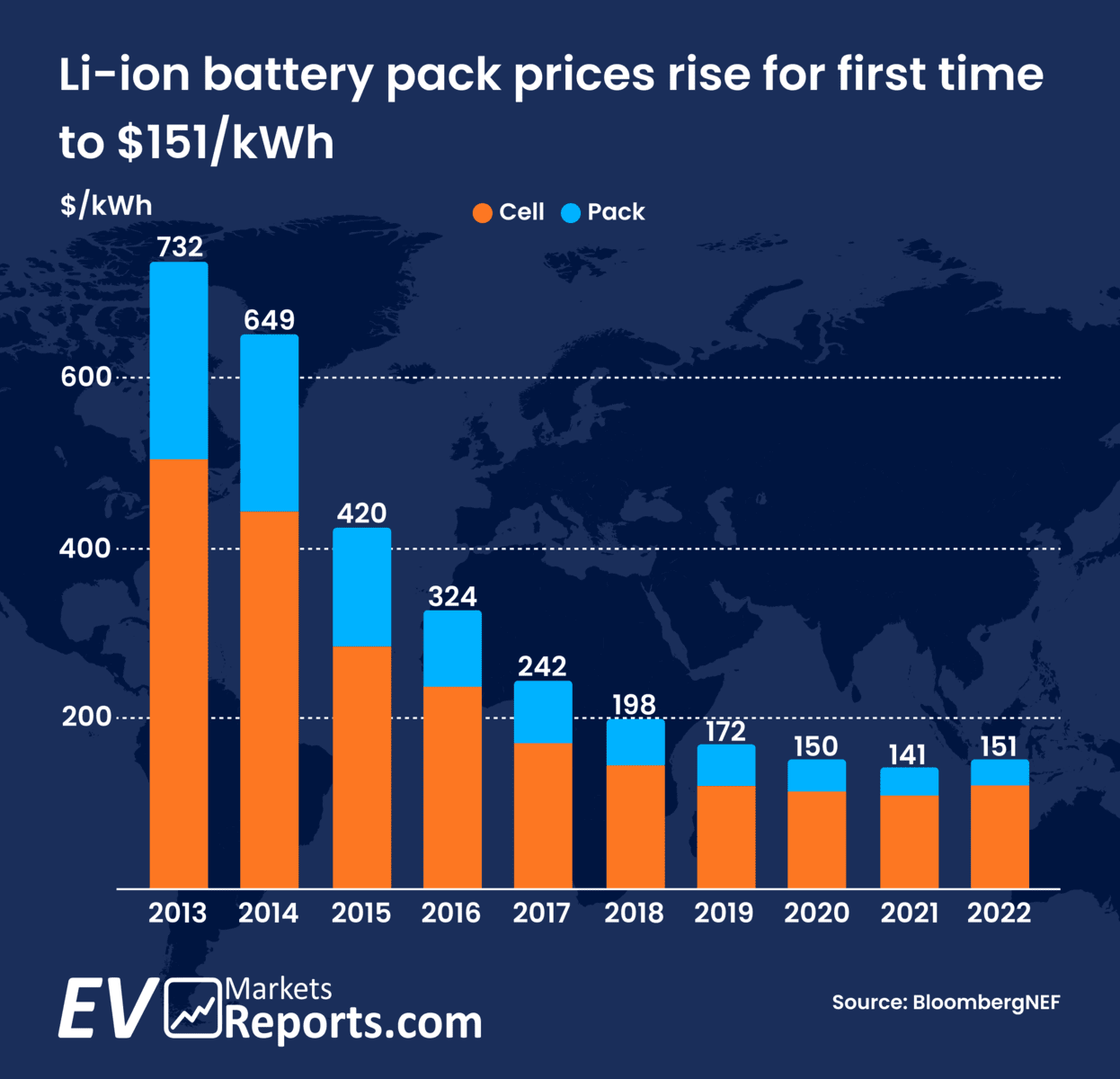

The given numbers are an average across a variety of battery end users, including various types of electric vehicles, buses, and stationary storage projects. Prices were $138/kWh on a volume-weighted average basis in 2022, especially for battery electric vehicle (BEV) packs. Average BEV costs were under $115/kWh at the cell level. According to this, cells represent 83% of the price of a pack on average. The usual 70:30 split has been deviated from the cell-to-pack cost ratio during the past three years. This is partly because pack design has changed, including the introduction of cell-to-pack strategies that have helped save costs.

Regionally, China had the cheapest battery pack costs at $127/kWh. The difference between packs in the US and Europe was 24% and 33%, respectively. The higher costs of manufacture, the wide variety of uses, and battery imports all contribute to these sectors’ relative immaturity. Low volume and customised orders drive costs higher for products at the top end of the spectrum.

If it weren’t for the increased use of LFP, a low-cost cathode chemistry, and the ongoing removal of pricey cobalt from nickel-base cathodes, prices may have increased much more in 2022. In 2022, LFP cells were, on average, 20% less expensive than lithium nickel manganese cobalt oxide (NMC) cells. But even inexpensive chemistries like LFP, which is especially vulnerable to lithium carbonate pricing, have felt the pinch of growing costs across the whole supply chain. In comparison to 2021, LFP battery pack costs increased 27% in 2022.

Although prices for important battery metals like lithium, nickel, and cobalt have recently softened marginally, BNEF anticipates that average battery pack prices will remain high in 2023 at $152/kWh (in real 2022 dollars).