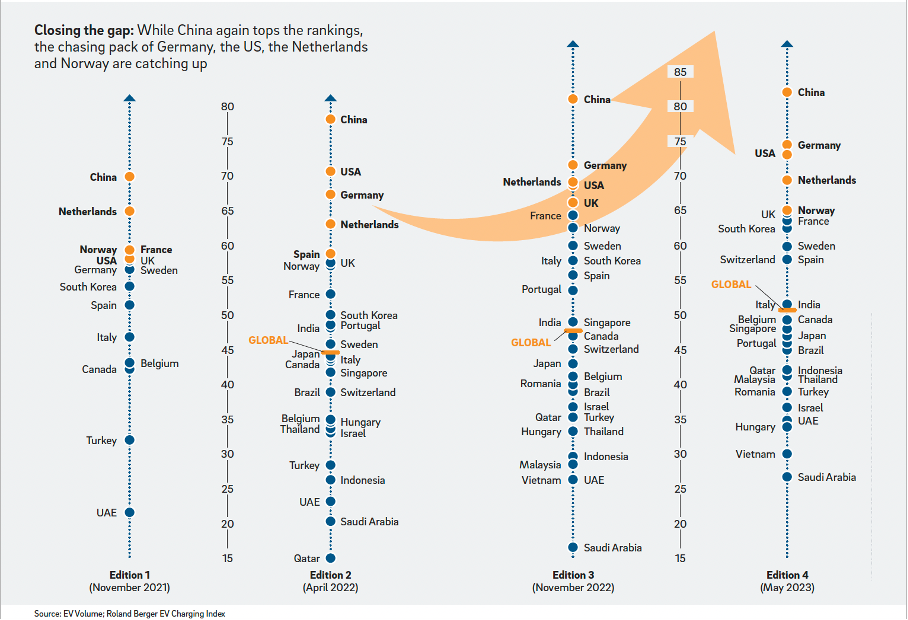

Notably, the gaps between the top five countries have narrowed, particularly with Germany and the United States making significant strides in catching up to China’s leading position. Positive news also emerges from the lower end of the table, with countries like Malaysia and Indonesia experiencing substantial improvements in their scores, and Saudi Arabia making a significant jump from 16 to 27 points.

Various factors spurring EV charging scores

The increase in EV charging scores can be attributed to various factors in the EV market. A price war has resulted in automakers introducing more affordable EV models, thereby expanding the choices in the lower-price segment. For instance, Tesla is reducing prices on existing models and exploring low-cost options, while BYD is set to offer a basic Seagull model at a competitive price in China. Additionally, investments and developments in charging infrastructure, such as Tesla’s opening of its supercharger network to all EVs and California’s substantial investment in public chargers, have further bolstered the EV charging market.

New partnerships between companies like Hertz and BP and GM’s push into holistic charging services are driving the expansion of EV charging networks. The impact of the US federal government’s new laws and investment in electrification is also expected to play a significant role in promoting EV sales and charging infrastructure in the country.

The sector remains resilient

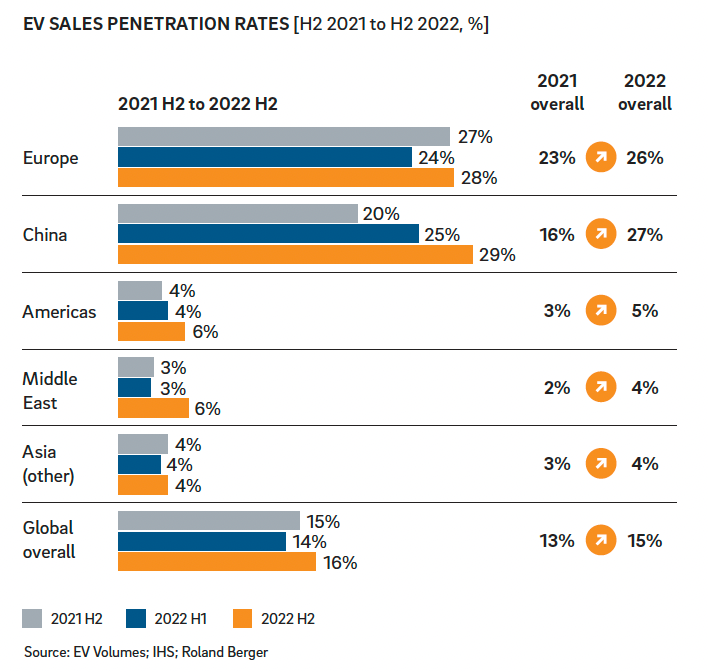

The global EV sales penetration rate reached a record 15% in the second half of 2022, indicating a resilient market in the face of external factors. European EV sales rebounded in late 2022 after a downturn in the first half, primarily caused by rising electricity prices affecting EV driving costs. However, as energy costs normalized, European EV sales and penetration rates increased, with H2 2022 seeing higher figures than H2 2021.

The rising share of fast chargers is boosting satisfaction levels

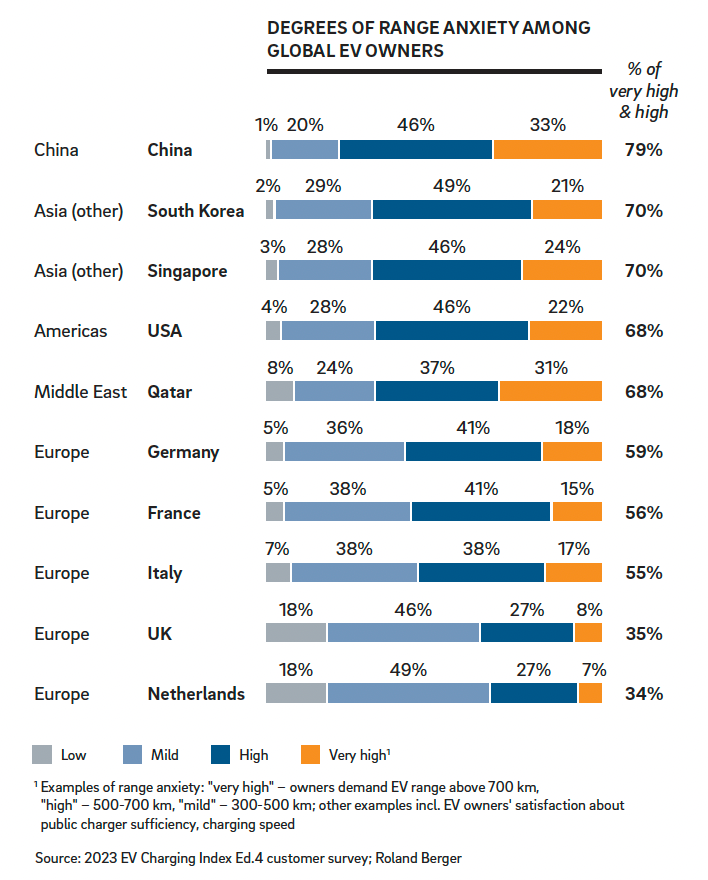

The report also delves into customer perceptions of public charging networks and fast charging. The rapid expansion of public DC chargers has positively impacted EV owners’ satisfaction and convenience. However, range anxiety remains an issue for many EV owners, especially in Asia, where respondents showed the highest levels of anxiety about their EV’s range.

Increased regionalization of OEMs’ EV charging infrastructure strategy

The charging strategies of different regions and automakers also vary. In the United States, standardization of charging technology is considered crucial to accelerating the EV transition, leading to agreements between various OEMs and Tesla’s supercharger network. In contrast, Chinese OEMs focus on branded charging as a key differentiator in their EV strategy, offering diverse charging options and premium services to enhance customer experience.

Overall, the global EV charging market is witnessing remarkable growth and improvements, driven by innovations in EV models, charging infrastructure, and government support. Moreover, the global EV charging market has shown resilience amid geopolitical tensions and energy price fluctuations. As EV sales continue to rise, the industry is poised for a transformative future, with EVs projected to reach a penetration rate of over 50% by 2030.

Get ‘free of charge’ access to more than 650 valuable EV Market Insights via www.EVMarketsReports.com, the world’s largest e-Mobility Reports and Outlooks database. Enjoy reading!