China has cemented its position as the dominant force in the global LIB for ESS market, accounting for 45% of the demand with a staggering 84 GWh. North America followed with a 30% share, while Europe and other regions each accounted for 12%. The Chinese battery manufacturers, leveraging their prowess in LFP (Lithium Iron Phosphate) battery technology, have seen more than 100% growth, with EVE, REPT, and HTHIUM leading the pack.

A notable strategy by Chinese battery makers has been their aggressive pricing, offering BESS (Battery Energy Storage System) container solutions in the US at $100/kWh and lower. This move has positioned them favourably against Korean competitors, particularly in light of the US’s IRA (Inflation Reduction Act) regulations, which do not apply to ESS, allowing Chinese-made batteries unfettered access to the US market.

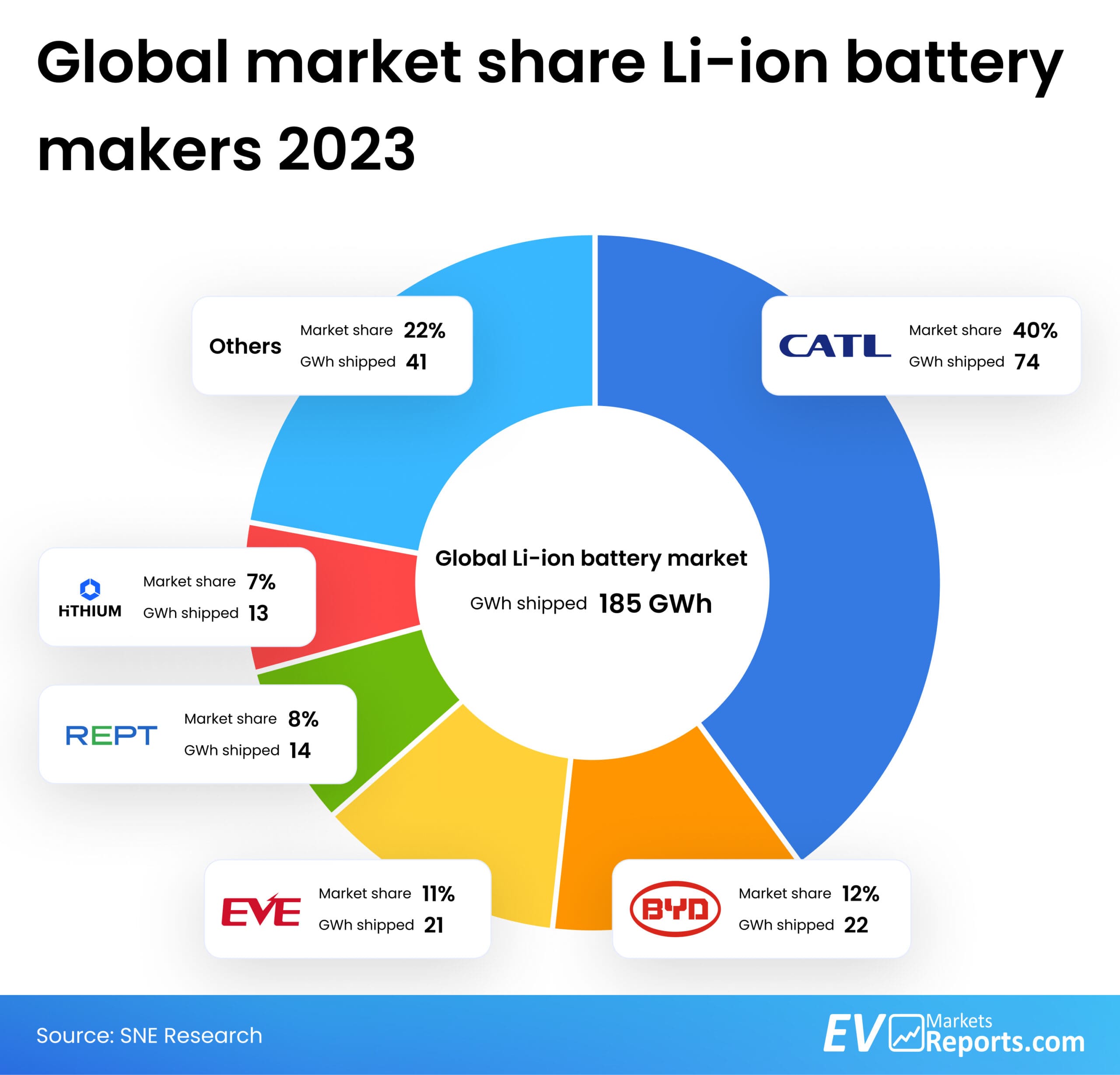

CATL, BYD, and EVE have emerged as top players, outpacing giants like Samsung SDI and LG Energy Solution in shipment volume. The latter, ranking 6th and 7th respectively, faced stagnation in growth from 2022 to 2023, a downturn attributed to their delayed adoption of LFP battery production—a segment that the global market has increasingly favoured.

The Korean battery industry, in response to this competitive disadvantage, has announced plans to commence mass production of LFP batteries in North America by 2026. This strategic pivot aims to revitalise their standing in the ESS market by leveraging the local manufacturing advantage sought by many North American customers. The move is seen as crucial for Korean manufacturers to remain competitive, especially against Chinese counterparts who have demonstrated significant price competitiveness.

However, achieving cost competitiveness comparable to Chinese manufacturers remains a formidable challenge for Korean battery makers. The global LIB for ESS market continues to evolve rapidly, with technological advancements and strategic shifts shaping the competitive landscape. As Korean companies prepare to make their foray into LFP production in North America, the industry watches closely to see if this strategy will enable them to reclaim lost ground and secure a more significant share of the booming ESS market.

EV Policy Europe 2010 – 2025: Why the ‘deer in the headlights’ strategy puts its Automotive future at risk

The European Commission’s 16 December announcement to ease the 2035 CO₂ reduction targets marks a pivotal moment for Europe’s automotive sector. After more than a decade in which the industry