- Investment landscape of indian e-Mobility market | USAID

- U.S. Electric Vehicle Manufacturing Investments and Jobs | EDF

- 2023 Global Automotive Consumer Study Key findings: EMEA Focus countries | Deloitte

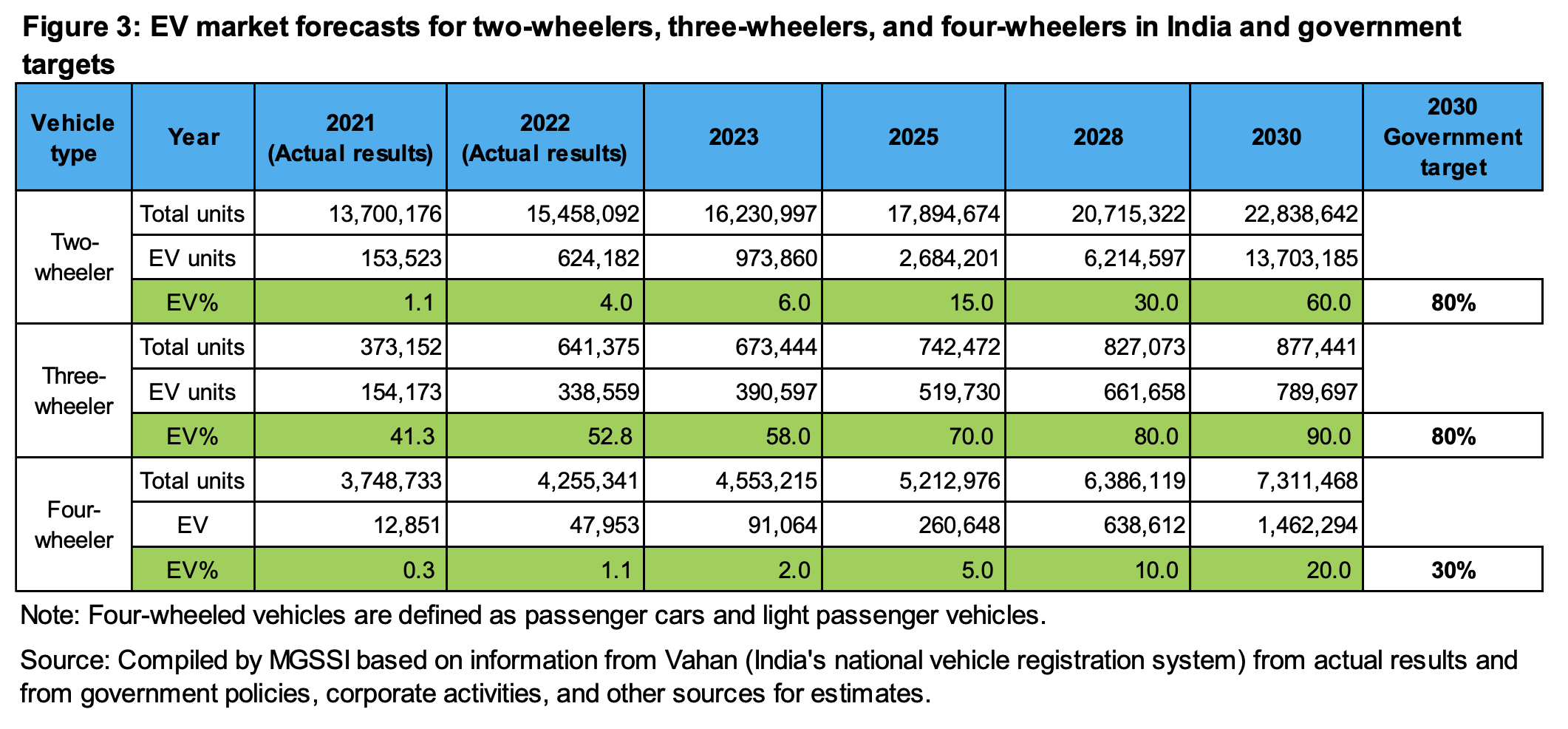

Investment landscape of indian e-Mobility market | USAID

The electric mobility sector has grown significantly in recent years, fueled by policy support and increased concern about climate change. Companies are looking to diversify their EV supply chains due to geopolitical instability, and India is emerging as a strong contender. The country’s government policies and incentives, as well as the availability of low-cost labor, make it an appealing investment destination. However, the sector still faces challenges such as information asymmetry among investors, limited financing options for end users, and insufficient supporting infrastructure such as public charging stations.

This report delves into the growth and potential of India’s electric mobility sector, highlighting challenges, opportunities, and various sub-segments. It emphasizes the importance of financing and government assistance, as well as identifying unique value propositions and strong traction when considering investment opportunities in the sector.

U.S. Electric Vehicle Manufacturing Investments and Jobs | EDF

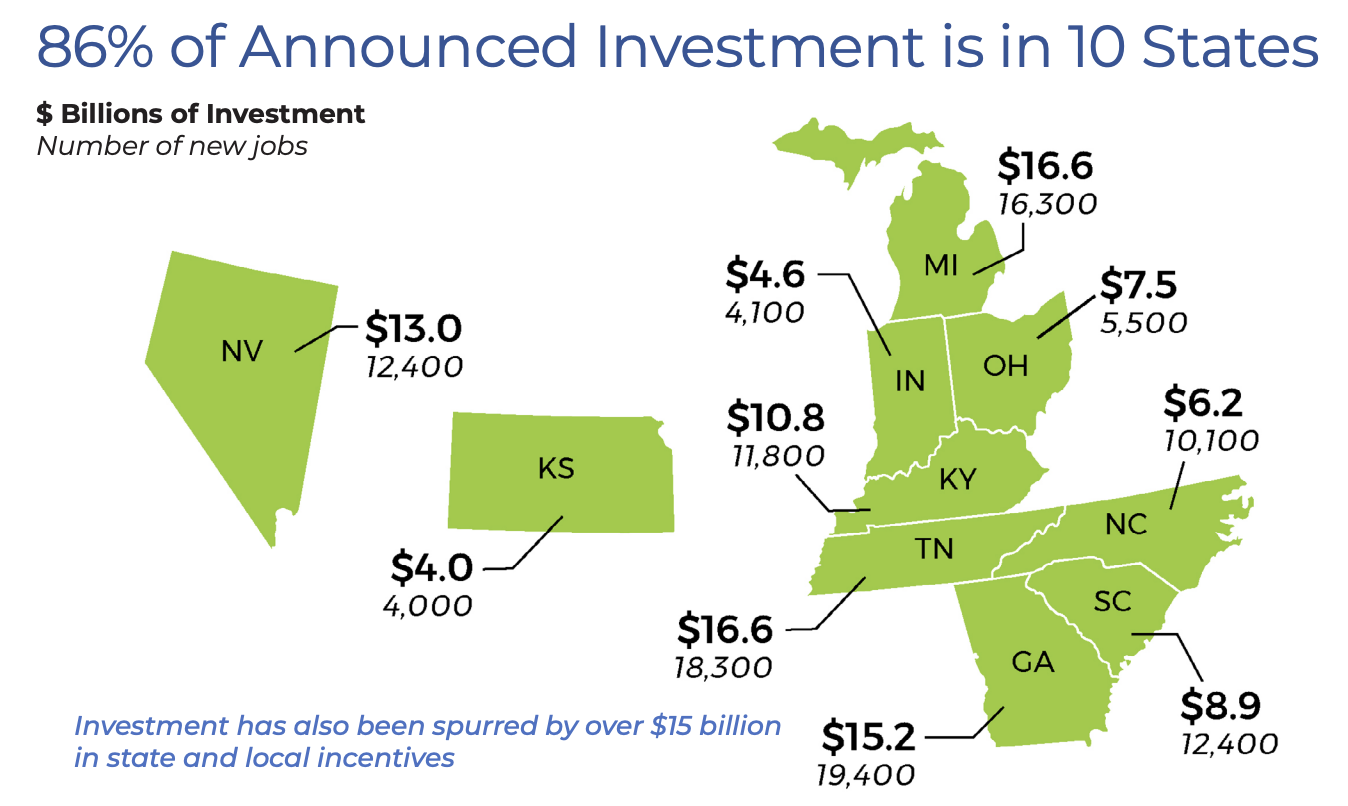

The electric vehicle (EV) ecosystem has seen tremendous investment over the last eight years, with a total of $120.1 billion announced for the production of EVs, EV batteries, and battery component manufacturing. Federal laws such as the Bipartisan Infrastructure Law (BIL) and the Inflation Reduction Act (IRA), which provided over $100 billion and $369 billion in funding to promote EVs and clean energy policies, respectively, have contributed to this investment. These expenditures are expected to generate 143,000 new jobs, with just ten states accounting for more than 86% of the total stated investment.

This report summarizes the significant investments made in the EV ecosystem over the last eight years, including announced funding for EVs, EV batteries, and battery component manufacturing. According to the report, these investments are expected to generate 143,000 new jobs, based on company announcements and some that have already been created for operational facilities.

2023 Global Automotive Consumer Study Key findings: EMEA Focus countries | Deloitte

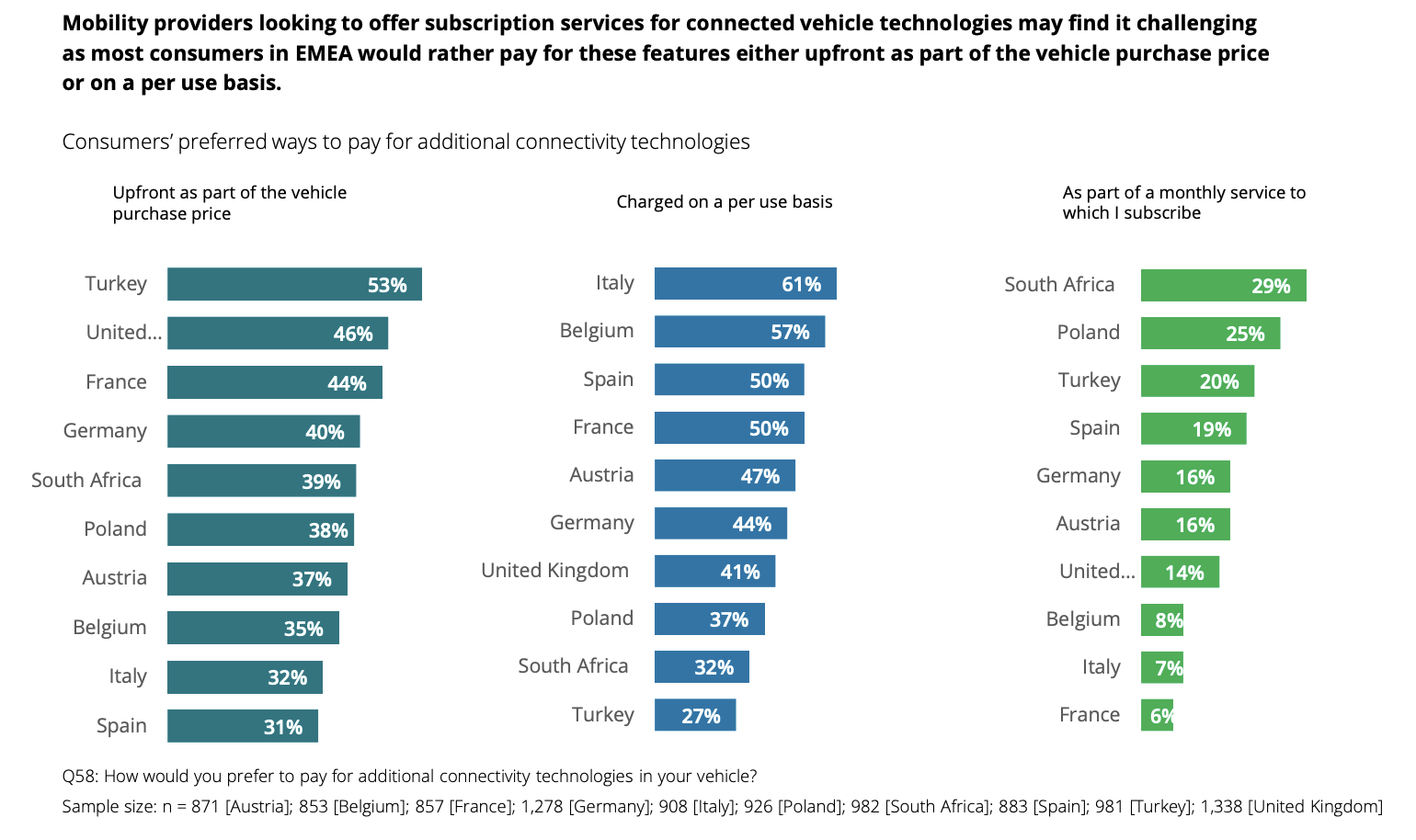

The global shift toward electric vehicles (EVs) is gaining traction, but affordability, range anxiety, and a lack of charging infrastructure continue to be significant barriers to adoption in various markets. Consumers are becoming more accepting of longer delivery times as a result of the ongoing vehicle inventory crisis, but product quality remains at the top of the list of factors influencing consumer decisions. Consumers continue to place the most trust in dealers. While consumers are interested in connected vehicle features, they are less willing to subscribe to them and would rather pay for them upfront or on a per-use basis.

This report summarizes the key findings of a global automotive consumer study focusing on EMEA countries. It investigates consumer attitudes toward EV adoption, brand perception, and advanced automotive technologies. The report aims to assist companies in the region in prioritizing and positioning their business strategies and investments.