As the market for light vehicles, which currently leads the EV market and thus global battery demand, is expected to grow from around 79 million units in 2022 to 110 million by 2040, the demand for battery cells is set to skyrocket. Tesla and BYD are leading the charge in 2023, with projections suggesting they will each produce around 1.8-2 million cars. However, it’s the ambitious goal of Tesla to manufacture 20 million vehicles annually by 2030 that underscores the scale of future demand for battery cells.

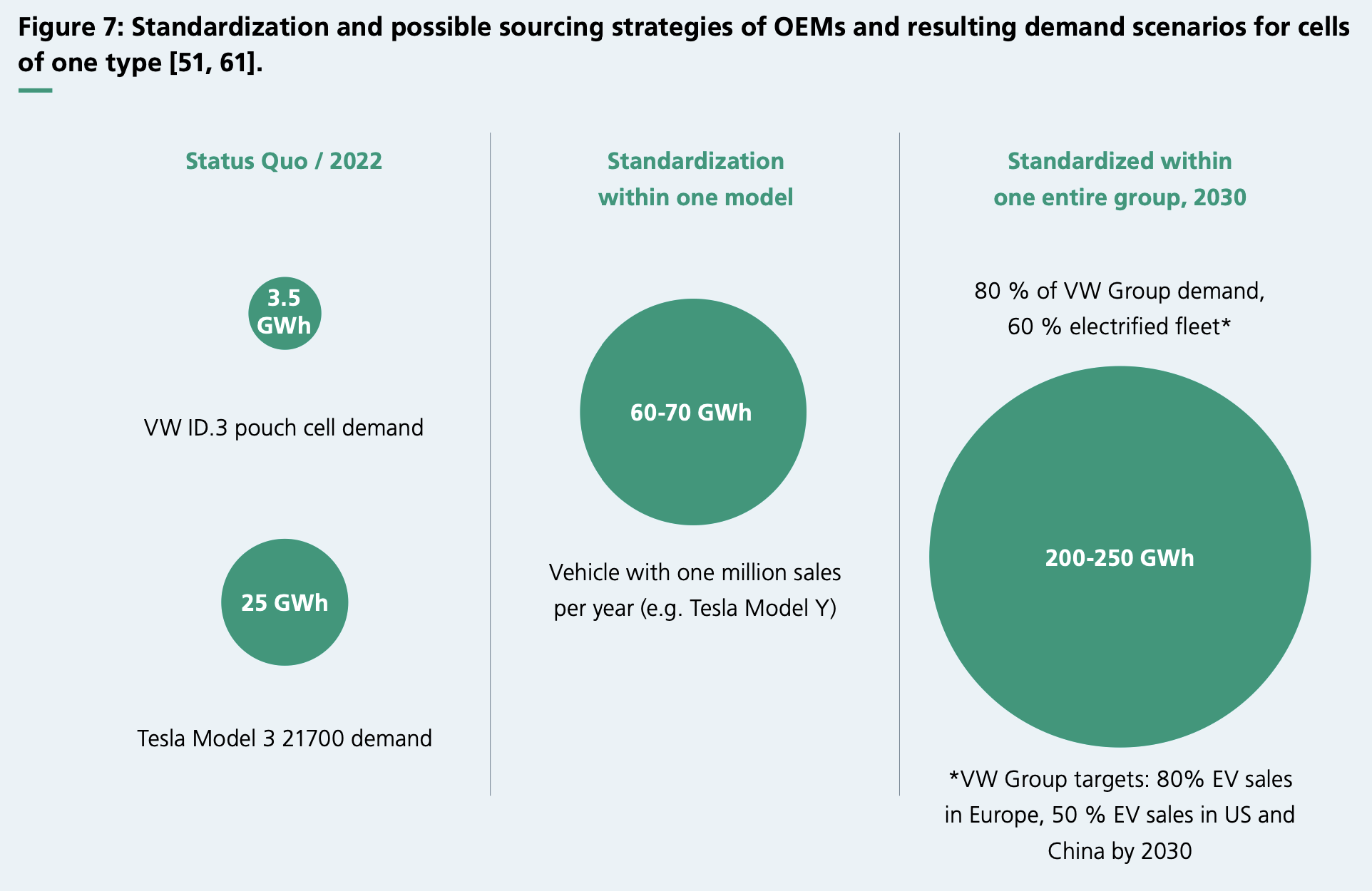

The conversation around battery cells is not just about quantity but also about the move towards standardisation. OEMs and cell manufacturers are increasingly focusing on standardised cell designs to facilitate production scalability and streamline procurement across diverse suppliers. For instance, Volkswagen (VW) has been utilizing prismatic and pouch cells, with a future aim to focus on prismatic cell design. Tesla is also known for employing both cylindrical and prismatic cell formats in standardised configurations, with plans to use 4680 format round cells extensively in the future.

This shift towards standardisation is not without its challenges. The demand for standardised cells for individual models could soar to 50-100 GWh, escalating further if major global OEMs electrify most of their model portfolio. For example, VW’s 2030 target of achieving 80% BEV in Europe and over 50% in North America and China could result in a battery requirement of up to 300 GWh for the group. Meeting this demand will require a significant scaling up of production capacities, with projections suggesting that up to 60 production lines could be needed for VW’s standardised prismatic cells alone by 2030.

The implications of this high demand extend beyond the manufacturing of cells. It touches on security of supply, logistics, and maintaining consistent quality across all production sites. OEMs are exploring multi-sourcing strategies to secure supply and reduce dependency on single manufacturers. Tesla, for instance, sources its round cells from LGES and Panasonic, while BMW has announced intentions to purchase 46 format round cells from CATL, AESC, and EVE Energy.

Furthermore, the high demand for standardised cells impacts upstream production steps, triggering a corresponding demand for cell materials and raw materials. Cell manufacturers are thus purchasing active materials from different suppliers to keep up with the demand.

In contrast to the EV market, the stationary energy storage systems (ESS) industry, while growing, does not yet place the same level of demand on cell manufacturers. However, the standardisation of ESS cells is likely to come from the manufacturers themselves, aiming to supply several customers with the same cell.

The journey towards electrification and standardisation in the automotive industry is a complex but necessary one, requiring careful navigation of supply chain logistics, manufacturing capabilities, and strategic sourcing. As OEMs and cell manufacturers adapt to these evolving demands, the industry moves closer to a future where electric mobility is not just a possibility but a reality.

Source: Lithium-Ion Battery Roadmap – Industrialisation Perspectives Toward 2030 | Fraunhofer isi

EV Policy Europe 2010 – 2025: Why the ‘deer in the headlights’ strategy puts its Automotive future at risk

The European Commission’s 16 December announcement to ease the 2035 CO₂ reduction targets marks a pivotal moment for Europe’s automotive sector. After more than a decade in which the industry