According to recent report published by CALSTART, the average price of lithium-ion battery packs for commercial vehicles, excluding China, is around $186 per kilowatt-hour (kWh), which is 45 percent higher than the average battery pack price for electric passenger cars at $128 per kWh in 2023. This price difference underscores the challenges faced by the commercial vehicle sector, including lower production volumes and higher battery price volatility.

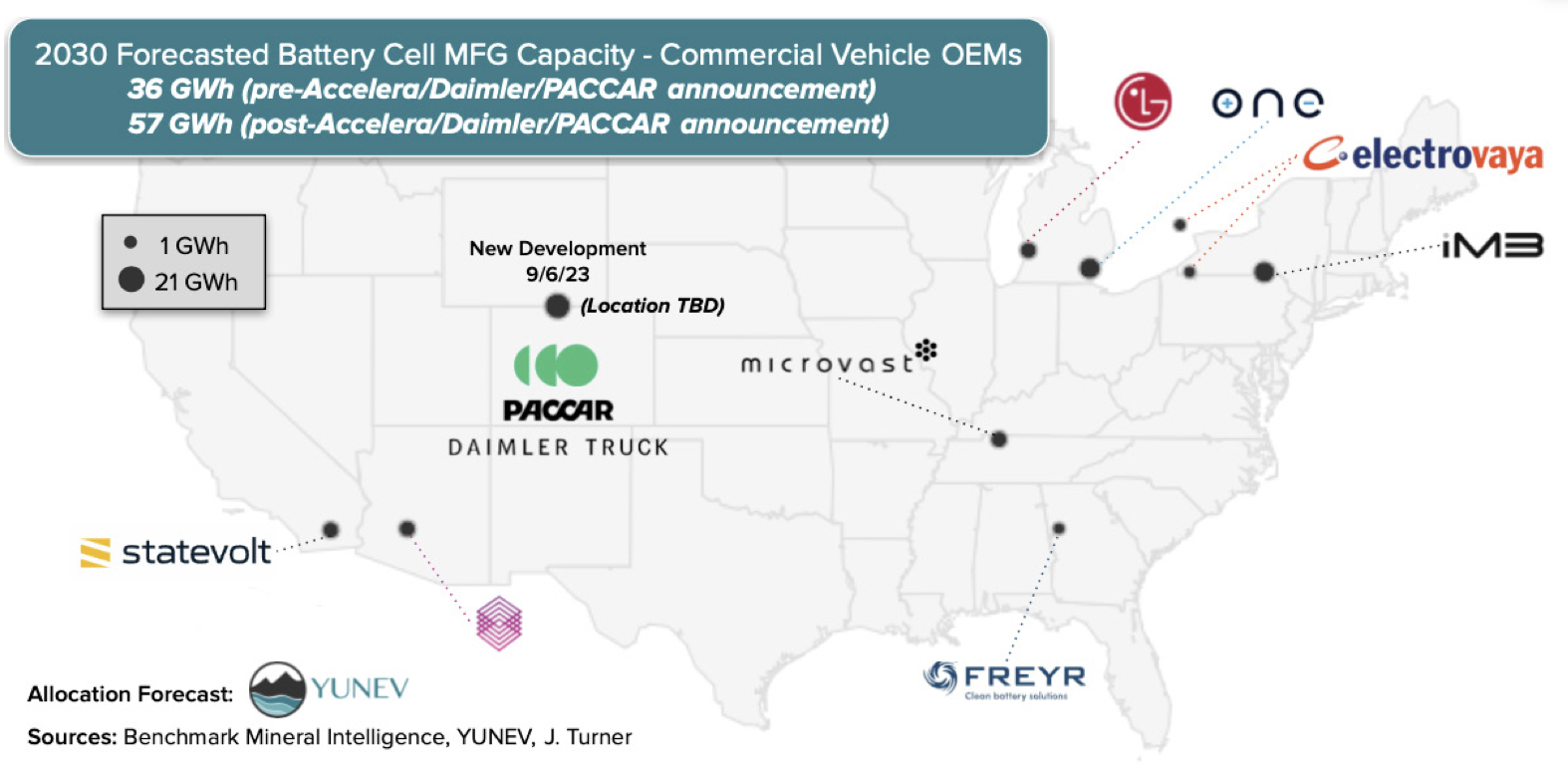

Despite representing about 10 percent of the U.S. vehicle market, the medium and heavy-duty (MHD) commercial vehicle market currently has access to only about 3 percent of the forecasted 1.2 terawatt-hour battery cell manufacturing capacity. This limited capacity has significant implications, not just on vehicle cost, but also on the production capabilities of original equipment manufacturers (OEMs). Incidents such as GM’s temporary halt in the production of its all-electric BrightDrop delivery vans due to battery supply issues underscore the urgency of addressing these challenges.

In response, several ZET OEMs are taking proactive steps to bolster the commercial vehicle-focused battery manufacturing landscape. Notable initiatives include the joint venture announced in September 2023 by Accelera by Cummins, Daimler Truck, and PACCAR, committing between $2–3 billion for a 21 gigawatt-hour factory. Additionally, the Volvo Group’s acquisition of Proterra Powered’s battery business unit signifies further investment in the sector.

Further support comes from the U.S. government through the Advanced Manufacturing Production Credit (45X), offering significant subsidies for domestic battery manufacturing. These incentives, along with a $3.5 billion investment from the U.S. Department of Energy aimed at boosting domestic battery production, especially for the commercial vehicle market, are poised to make a substantial impact.

These investments and initiatives are expected to not only reduce the cost and volatility of battery prices for commercial vehicles but also significantly increase the U.S. battery manufacturing capacity dedicated to this sector. With projections indicating a continued decline in battery pack prices and an increase in domestic production capacity, the future looks promising for the U.S. commercial vehicle industry.

Moreover, the industry is expected to create more than 102,000 U.S. jobs in battery manufacturing, with an additional 38,000 jobs in electric vehicle manufacturing, further bolstering the economic impact of this sector’s growth. These developments signal a pivotal shift towards a more sustainable and economically robust commercial vehicle sector in the United States, with far-reaching benefits for the environment, the economy, and the transportation industry as a whole.

Source: Zeroing in on Zero-Emission Trucks: The state of the U.S. Market | CALSTART

EV Policy Europe 2010 – 2025: Why the ‘deer in the headlights’ strategy puts its Automotive future at risk

The European Commission’s 16 December announcement to ease the 2035 CO₂ reduction targets marks a pivotal moment for Europe’s automotive sector. After more than a decade in which the industry