Decarbonisation and Regulatory Landscape

Heavy-duty vehicles, like HGVs and buses, make up 21% of the UK’s transportation greenhouse gas emissions. HGVs alone contribute 19%. To address this, the UK Government has set regulations to phase out non-zero emission HGV sales by 2035 for vehicles under 26 tonnes and by 2040 for all new HGVs. The transition timeline for buses and coaches is also under review.

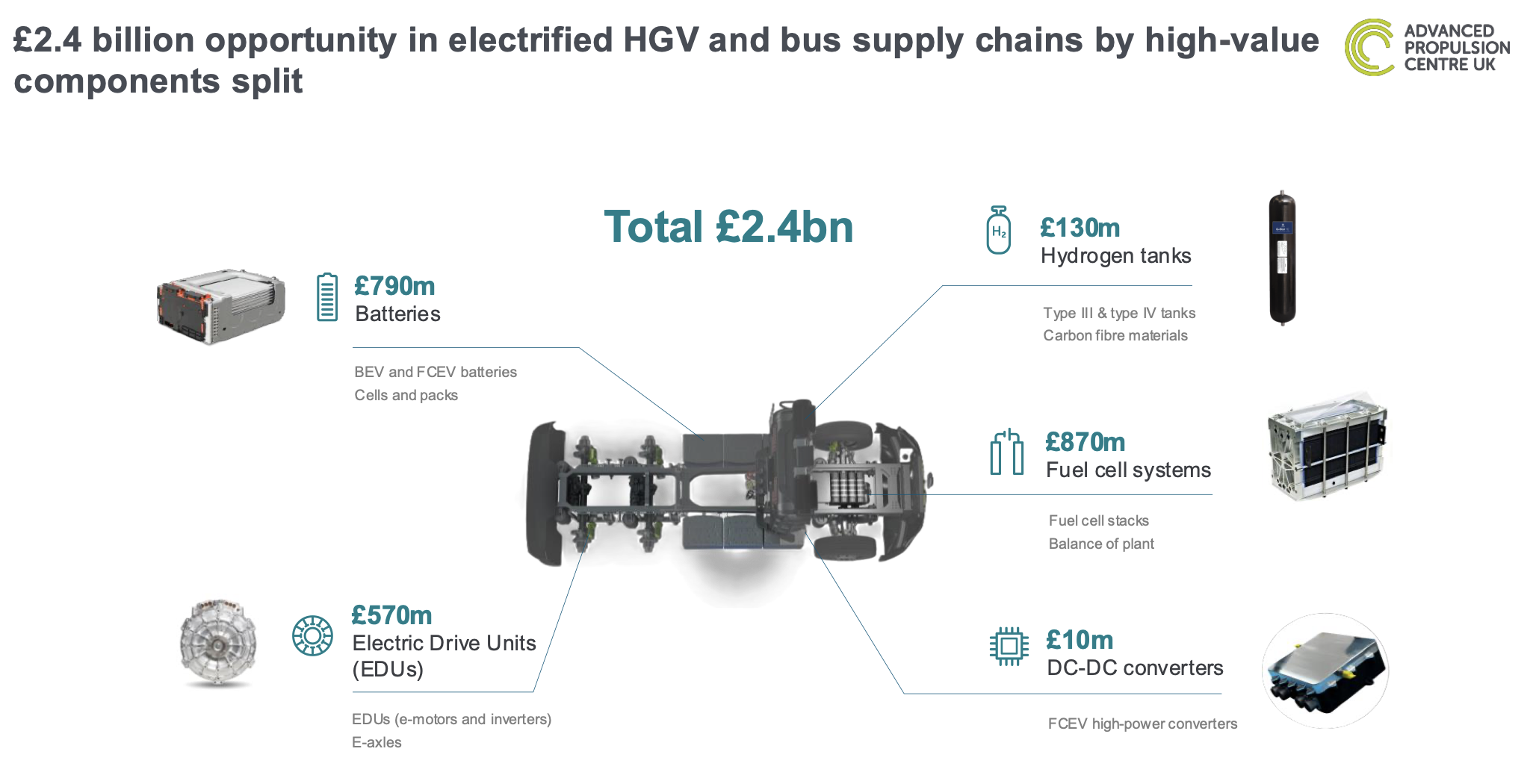

Market Opportunities and Key Components

A report from the Advanced Propulsion Centre (APC) reveals a £2,4 billion revenue potential in the HDV sector. This includes nearly £1 billion in export opportunities, especially in battery electric and fuel cell technology systems. Key components include:

- t

- Battery Packs: Crucial for zero-emission HDVs, with a market opportunity of £790 million. Advances in solid-state and sodium-ion batteries promise better reliability and lower costs.

- Electric Drive Units (EDUs): Essential for converting electrical energy into mechanical power, with a market potential of £570 million. Innovations in transmission design and system integration are key.

- Fuel Cell Systems: Valued at £880 million, with Proton Exchange Membrane (PEM) technology expected to mature. Improving durability and integrating DC-DC converters are vital.

- Hydrogen Storage Tanks: High-pressure carbon fiber tanks have a £130 million market opportunity. Reducing costs and improving material circularity are important goals.

t

t

t

Export Potential and Technological Innovation

The report highlights strong export potential, especially in electric drive units, e-axles, fuel cell systems, and catalyst coated membranes (CCMs). By 2035, export opportunities could reach £970 million. The UK’s established hydrogen supply chain, with over 250 active participants, supports scaling up fuel cell systems for HDVs.

In battery technology, solid-state and sodium-ion chemistries present significant opportunities. Solid-state batteries, offering higher energy density and safety, are poised to become key alternatives. Sodium-ion batteries could provide cost-effective solutions for off-highway heavy-duty applications.

The electric drive unit market expects innovations to meet the unique requirements of HDVs. AI-driven optimisation and integrated system architectures are critical areas for development.

For fuel cells, the focus is on increasing the durability of components like gas diffusion layers and bipolar plates, enhancing power density and lifespan. Integrating compact DC-DC converters will help adapt to existing electric architectures.

Strategic Investments and Industry Implications

The UK’s strategy to decarbonise its HDV sector by leveraging battery and fuel cell technologies is both a regulatory necessity and a significant economic opportunity. Investments in high-value components and technological advancements will transform the UK’s HDV supply chain, fostering innovation, creating jobs, and boosting the economy.

As the market for zero-emission HDVs grows, the UK stands at a critical moment to establish itself as a leader in the electrified vehicle supply chain. With these market opportunities, the country is set to make significant strides towards a sustainable and economically vibrant future.

Source: Advanced Propulsion Centre UK