In week 14 we added the following reports:

- What is the environmental impact of electric cars? | ECOS, EEB, DUH

- Nine trends in the development of China’s electric passenger car market | The ICCT

- The future of automotive distribution in the Middle East | Roland Berger

- Electric Vehicle Charging Infrastructure Trends from the Alternative Fueling Station Locator | NREL

- Navigating the data challenge of electric urban logistics | Bax & Company

What is the environmental impact of electric cars? | ECOS, EEB, DUH

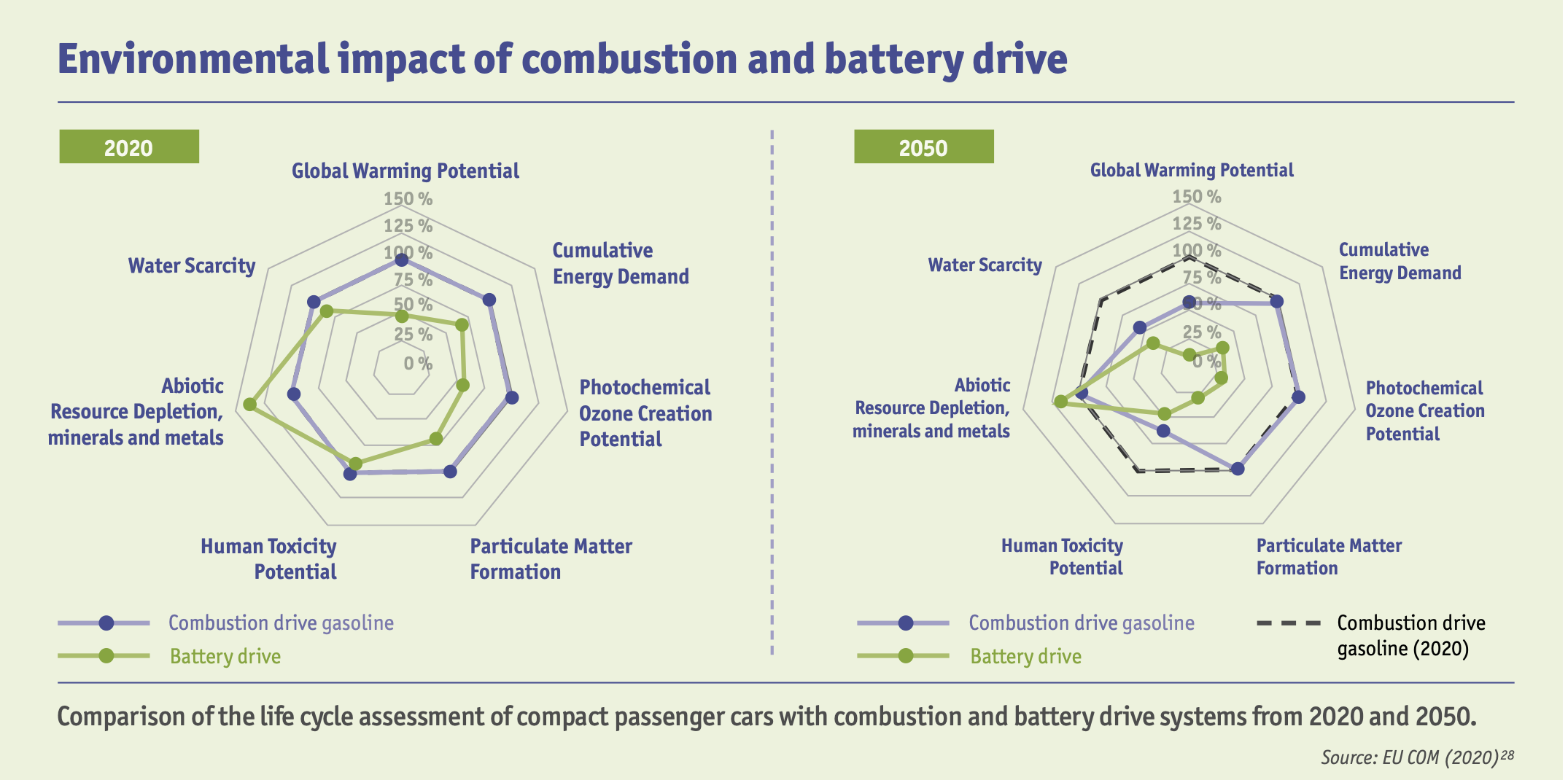

When compared to other passenger car drive types, electric cars are the most environmentally friendly option when considering all environmental effects. When compared directly to other types of auto propulsion, a battery drive is the most effective and environmentally friendly choice. For instance, newly registered electric cars in Europe currently emit 75 grams (g) of CO2 e/km on average over the course of their lifetime, which is roughly 69% less greenhouse gases than comparable petrol-powered cars.

This report discusses the need for a climate-friendly transport sector in Europe to limit global warming to 1.5°C. It emphasizes the challenges facing the transport sector, the importance of reducing emissions, and the detrimental effects of air pollution on public health. The report concludes that all-electric vehicles are the most environmentally compatible option and highlights the need for renewable energy expansion, efficiency standards, and environmentally compatible resource extraction and recycling to fully reduce the environmental footprint of electromobility.

Nine trends in the development of China’s electric passenger car market | The ICCT

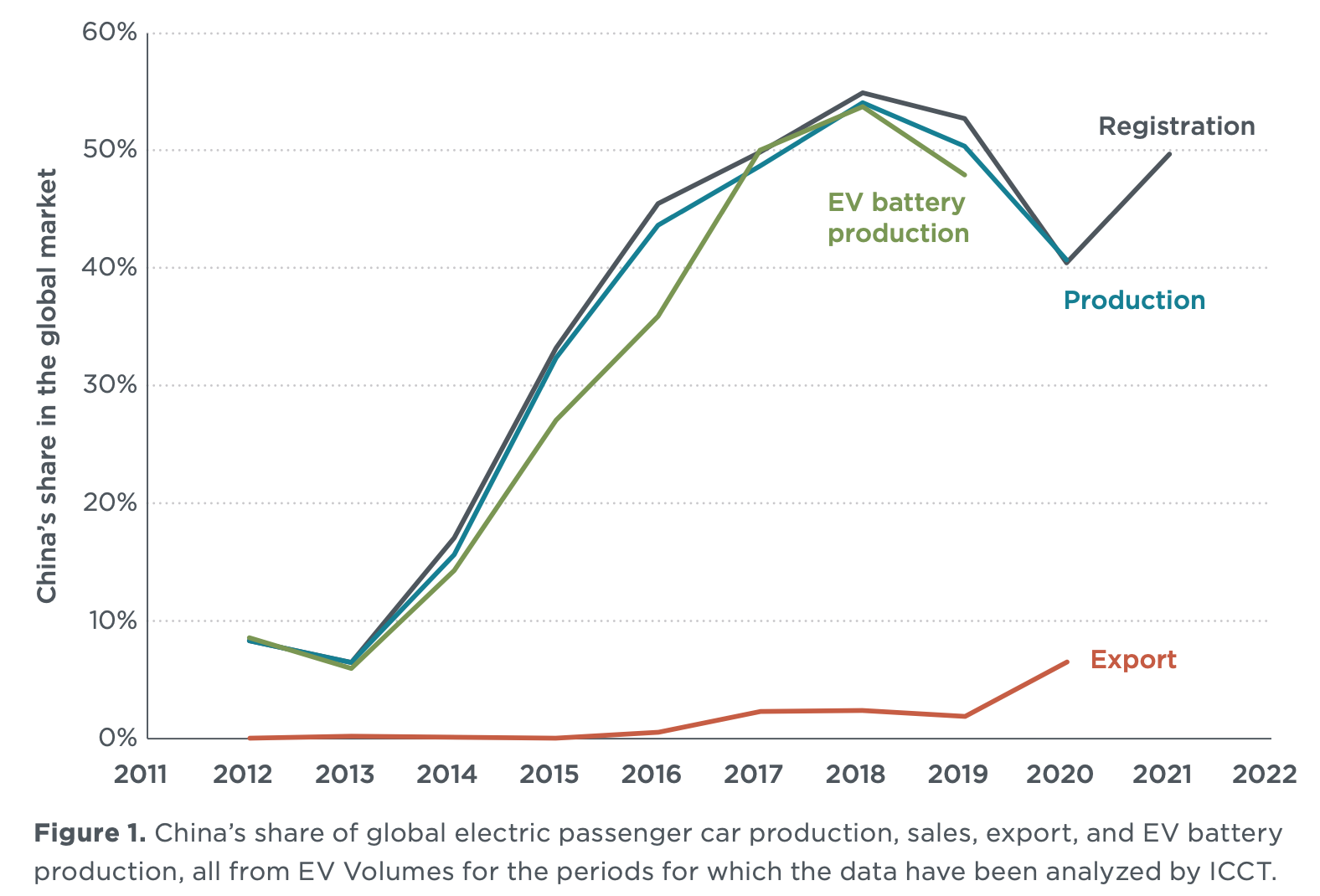

China has been leading the transition to electric vehicles around the world since the publication of its first new energy vehicle (NEV) development plan in 2012. The nation has produced and sold more NEVs than any other nation or region. However, China continues to face challenges such as the need for more competitive domestic brands, supply chain security for raw materials and components used in the manufacture of vehicles, and the creation of adequate charging infrastructure.

This report summarizes nine major trends in China’s electric vehicle market development since 2012, focusing on battery electric and plug-in hybrid electric passenger cars. The report excludes hydrogen fuel cell electric vehicles and highlights the major achievements and current challenges of China’s EV market, including the need for competitive native brands, supply chain security, and adequate charging infrastructure.

The future of automotive distribution in the Middle East | Roland Berger

Megatrends related to new mobility concepts, autonomous driving, digitalization, and electrification are having a profound impact on the automotive industry. This has led to the exploration of a number of new business models, with OEMs, distributors, and emerging players—such as digital platforms and tech providers—seeking to introduce highly digital and agile sales models. As the number of electric vehicles rises, the distribution industry will become more relevant to value-added services and diversify its source of revenue. As the importance of car ownership declines for younger generations, distributors should be able to maintain their relevance by putting more emphasis on the certified pre-owned (CPO) market and growing subscription sales.

This report discusses the changing landscape of automotive distribution in the Middle East, highlighting the role of dealers and distributors. It focuses on the four key trends shaping the industry: Mobility, Autonomous, Digitalization, and Electrification. The report suggests that more efforts are expected in the coming years to integrate these trends into regional strategies.

![Bar chart titled "EV penetration scenarios in Saudi Arabia, 2020–2035 [% of new light vehicle sales]". It shows two scenarios: base case and high case. Base case: 3% (2025), 10% (2030), 14% (2035). High case: 8% (2025), 30% (2030), 57% (2035).](https://evboosters.com/wp-content/uploads/2024/11/database-week-14-the-data-challenge-of-electric-urban-logistics-2.png)

Electric Vehicle Charging Infrastructure Trends from the Alternative Fueling Station Locator | NREL

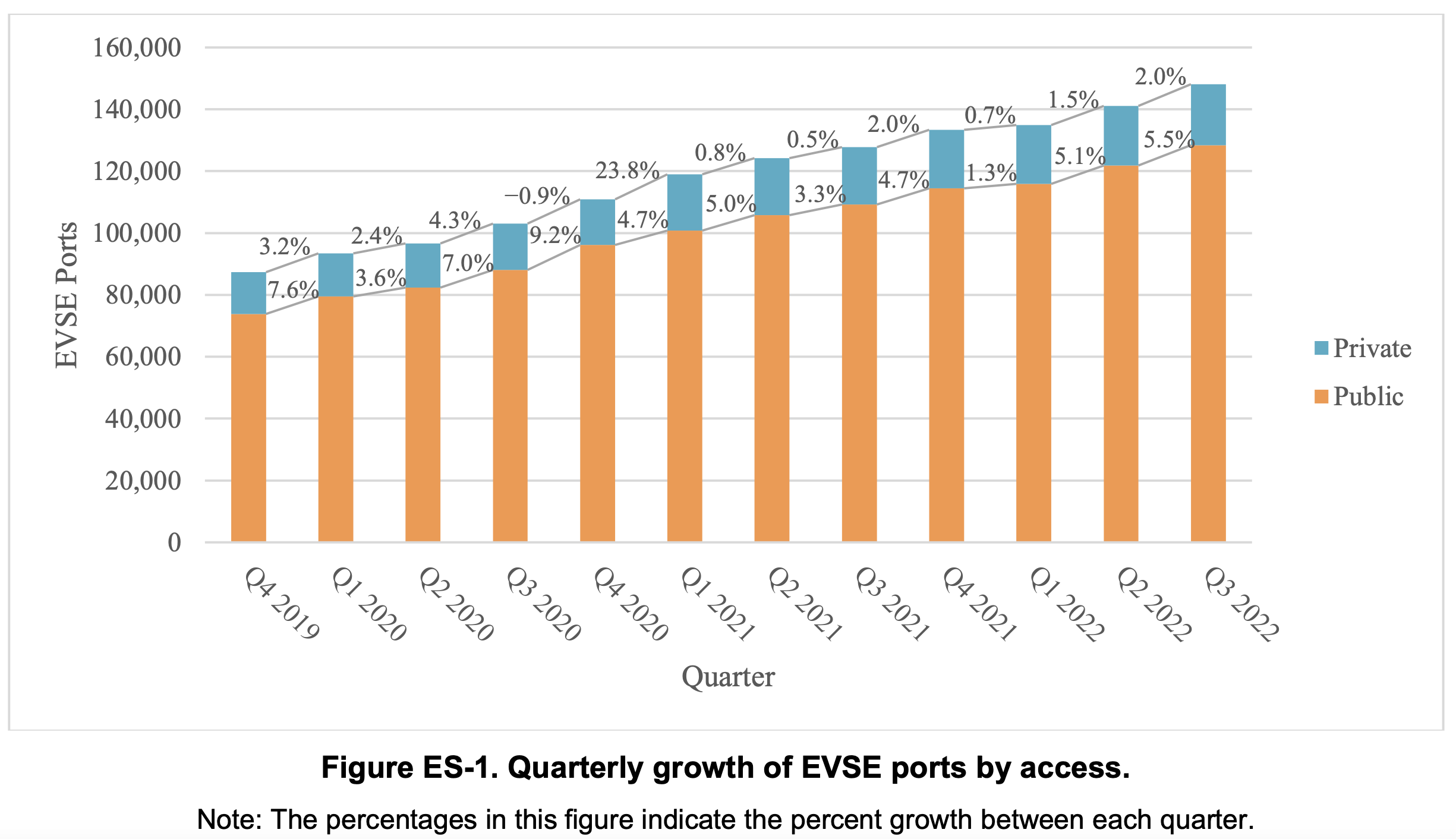

The Station Locator reported an increase of 7,034 electric vehicle supply equipment (EVSE) ports in Q3 2022, or 5.0%. The total number of public ports in the Station Locator increased by 5.5%, or 6,653 EVSE ports, to 128,431 in total, making up the majority of ports in the Station Locator. 381 more private EVSE ports, or 2.0%, were added.

This report provides an overview of electric vehicle (EV) charging infrastructure in the United States during Q3 2022. It covers charging levels, networks, and locations and compares the current state with two 2030 infrastructure requirement scenarios. The aim is to provide helpful information for policymakers, planners, developers, and researchers to understand the evolving landscape of EV charging infrastructure. This report is part of a series that provides regular updates on the state of EV charging infrastructure in the United States.

Navigating the data challenge of electric urban logistics | Bax & Company

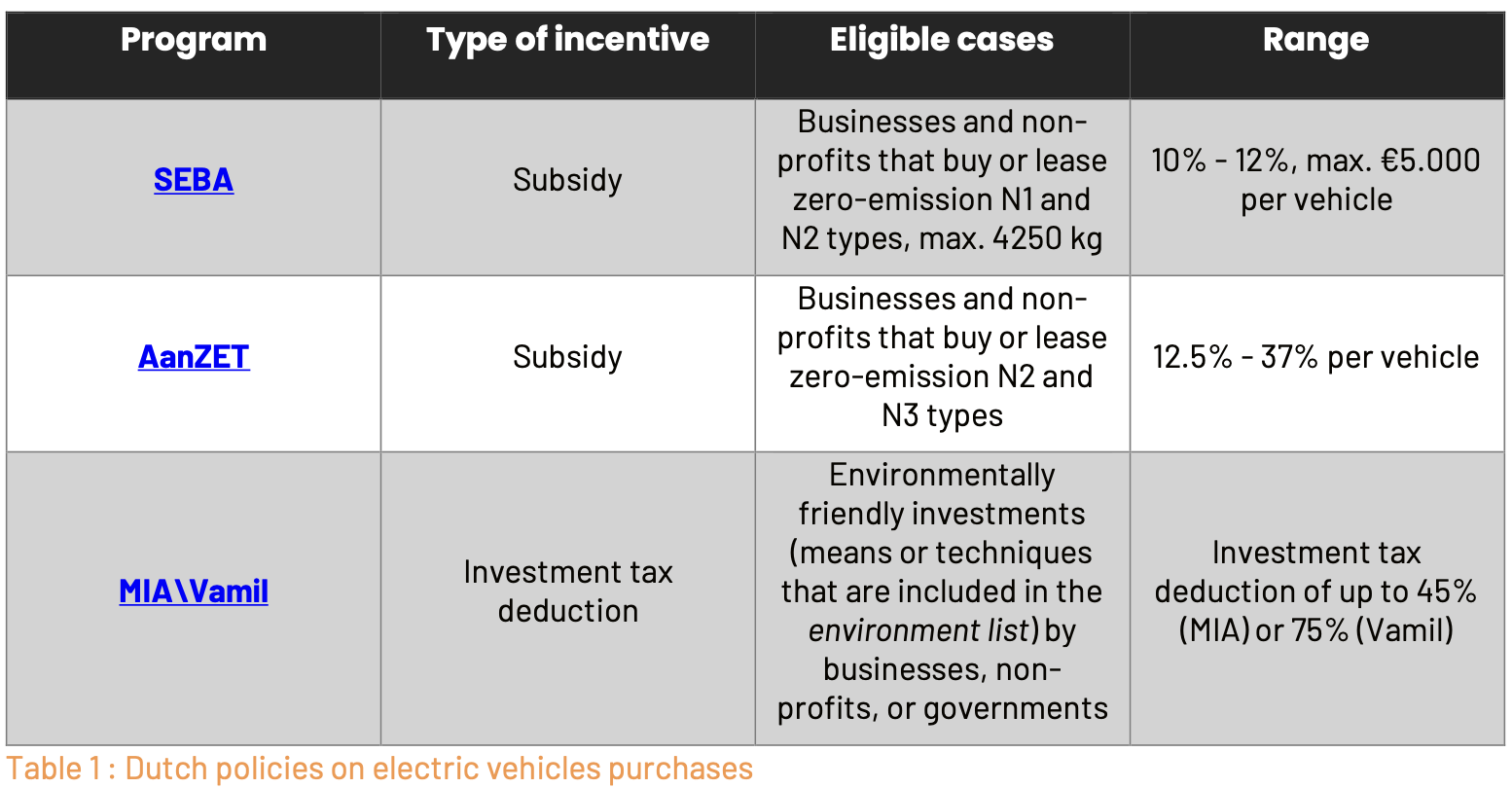

Electric vehicles (EVs) are being hailed as the solution to the challenges of urban logistics, such as air pollution, traffic congestion, and the need for sustainable transportation. However, there are some obstacles to EV adoption in the logistics industry, including the price, availability, location, and power of charging infrastructure.

This report focuses on the challenges and opportunities of adopting electric vehicles (EVs) in urban logistics, particularly the role of charging infrastructure. It examines academic and grey literature and includes insights from interviews with stakeholders. It also looks at the charging infrastructures of the Netherlands and France and the role of data in decision-making. The report aims to provide a comprehensive understanding of the issues to contribute to the decision-making framework.

If you have any suggestions please consider providing feedback or uploading your report.