In week 44 we added the following reports:

- Key technical, policy and market developments influencing the electric vehicle battery landscape | Bax & Company

- Accelerating local electric vehicle uptake where it matters | KPMG

- The future of buses and light commercial vehicles is electric | Boston Consulting Group

- EVs spotting the challenges & charting the course | Alvarez and Marsal

- Electric Vehicle as a Service (EVaaS): Applications, Challenges and Enablers | MPDI

The reports are shared and available free of charge in our database.

The capacity of the European market to produce both battery cells and the components that go into making them continues to grow.

While the EU continues to work on adopting the New Battery Regulation, the U.S. has taken the lead by enacting the Inflation Reduction Act, which encourages domestic battery manufacture. On a state level, California unveiled a vision for the electrification of transportation and made strides in creating new battery laws with an emphasis on EV battery take-back.

This report discovers the most recent changes to the battery market, regulations, and research. The COBRA coordinator will also talk about his views on battery developments and explain how recent project successes are assisting Europe in producing more environmentally friendly batteries.

Key technical, policy and market developments influencing the electric vehicle battery landscape | Bax & Company

Predicting the EV uptake in Australia

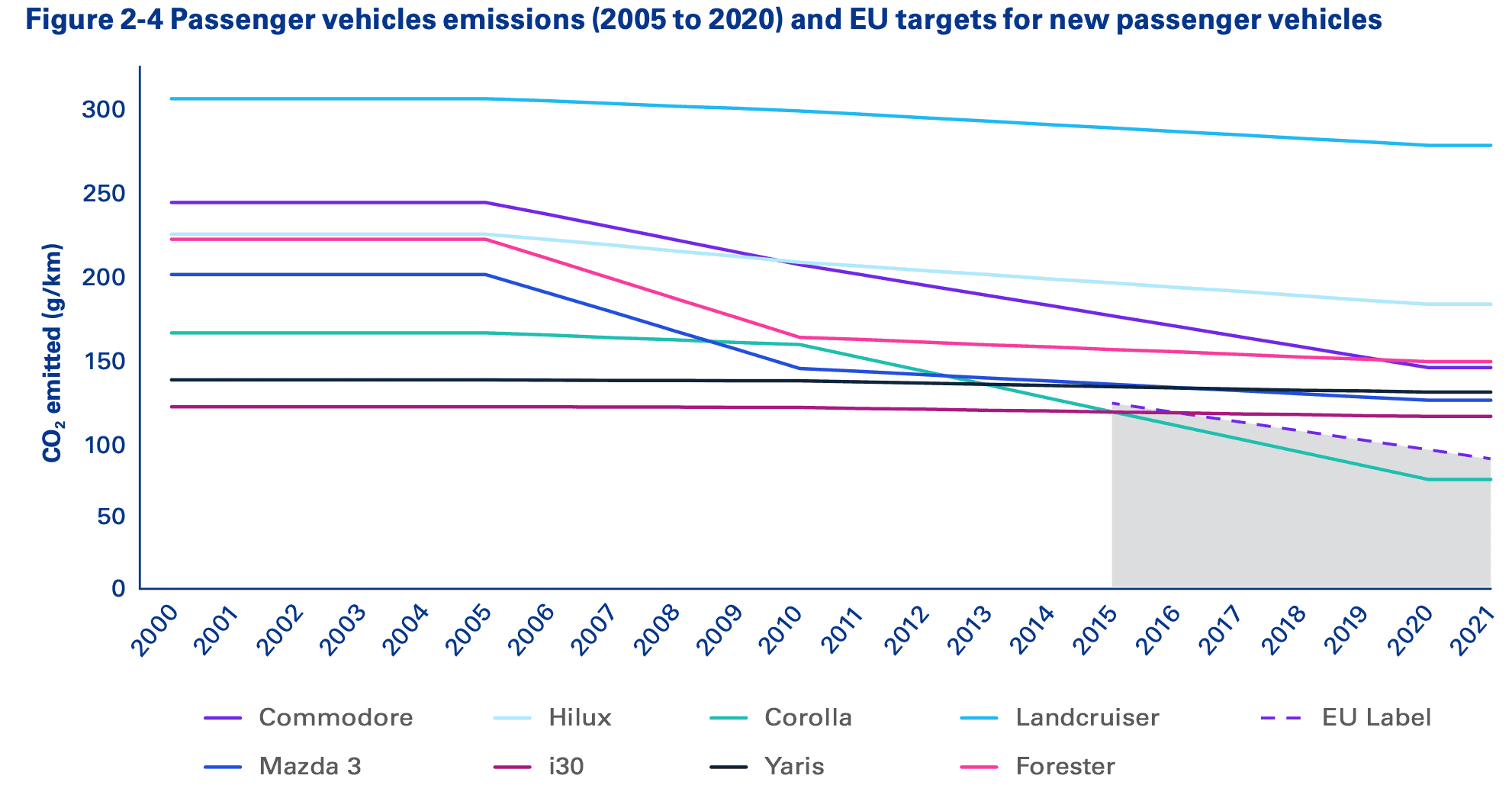

Nearly a quarter of Australia’s carbon emissions as of 2021 were caused by transportation-related activities. As a result, electric cars are a crucial pillar in the effort to reduce carbon emissions, and governments all around Australia are taking action to promote the use of EVs. EVs will be essential in lowering Australia’s carbon footprint when combined with renewable energy.

In this report, KPMG investigates the predicted EV uptake at the local neighbourhood level in Sydney, Melbourne, and Brisbane. The impact of EVs will be heavily influenced by people’s own tastes and decisions when it comes to buying and driving a car. Major Australian cities have a broad metropolitan footprint, and people’s automobile usage varies between the inner city and the outskirts.

Accelerating local electric vehicle uptake where it matters | KPMG

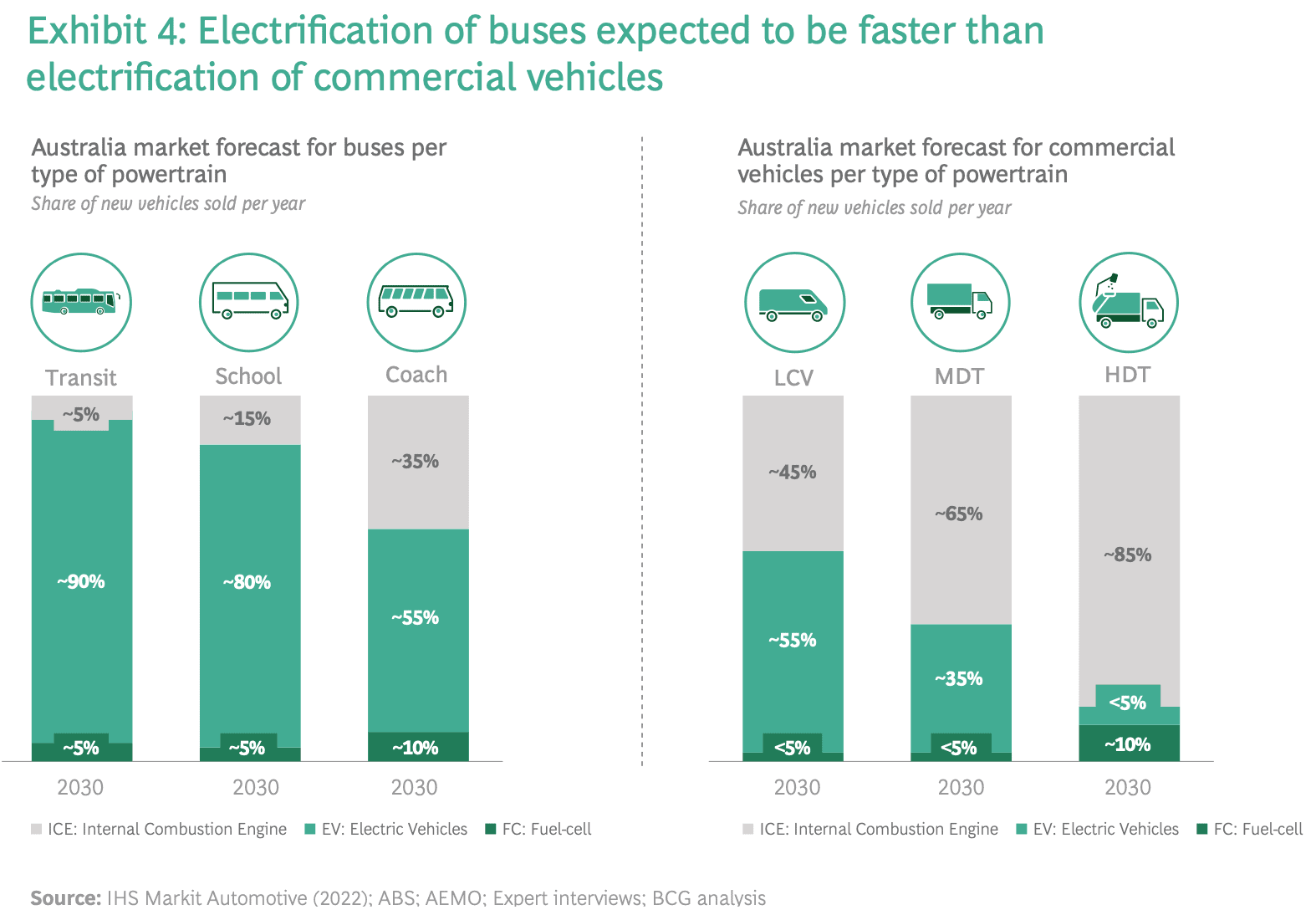

The switch to electric busses in Australia

Commercial road transportation is a significant contributor to greenhouse gas emissions and a critical tool to attain net zero, as outlined by the Federal Government in its recent National Electric Vehicle Strategy, with more than 1.5 million trucks and buses on the road in Australia alone. Expect to see tremendous growth over the next ten years even if the use of electric vehicle (EV) transportation is still in its infancy outside of passenger cars.

This report provides some understanding of the anticipated trajectory of the switch to electric buses, potential acceleration and braking effects, and methods for businesses and organisations to prepare for an electric future.

The future of buses and light commercial vehicles is electric | Boston Consulting Group

How can India become a leading country in EV adoption

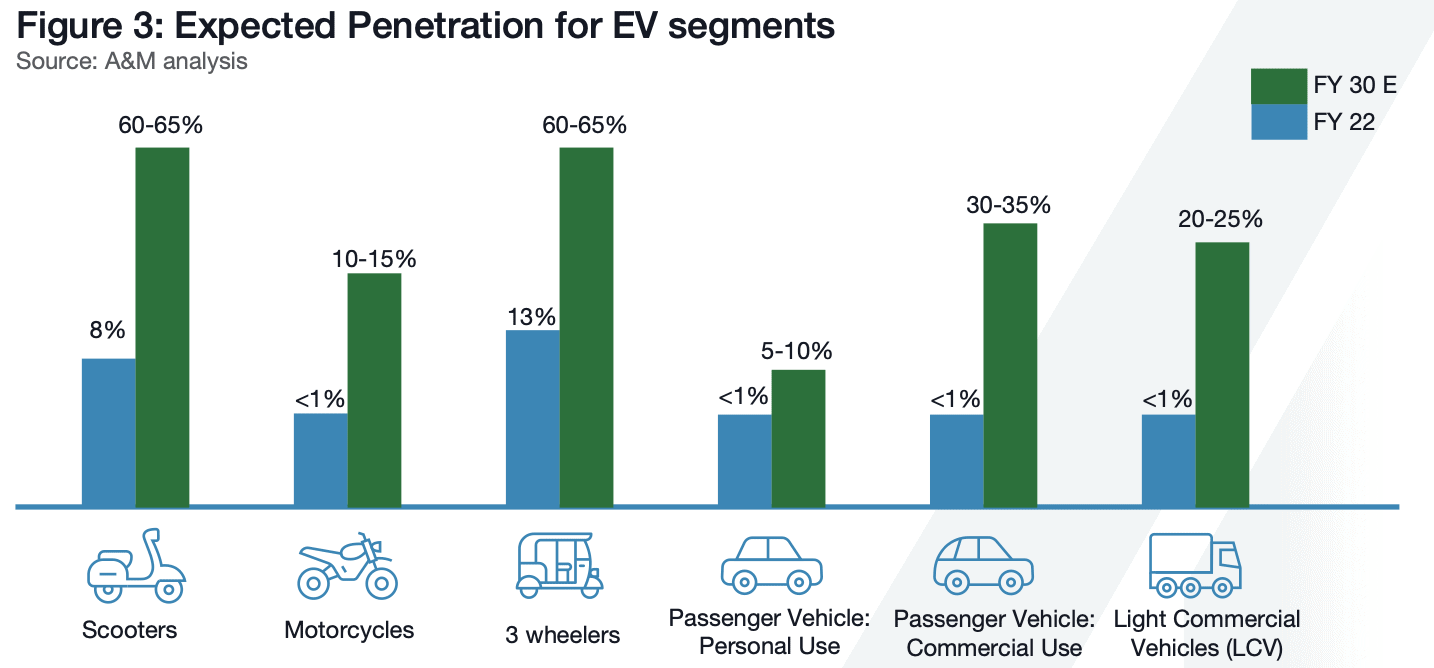

In the upcoming years, India wants to be at the forefront of EV adoption. By 2030, the government wants to electrify 80% of two- and three-wheeler sales, 30% of private automobiles, 40% of buses, and 70% of commercial cars.

This paper discusses the challenges and solutions that each stakeholder must accept in order to make India one of the nations leading the transition to electric vehicles.

EVs spotting the challenges & charting the course | Alvarez and Marsal

The electric vehicle as a service (EVaaS) industry

The vehicle-to-grid (V2G) idea allows for the deployment of electric cars (EVs) as distributed energy resources or loads to absorb surplus output and return some of the stored energy to the grid.

This paper provides an overview of the technologies, technical elements, and system prerequisites required for the adoption of EVs. Utilizing V2G technology, the electric vehicle as a service (EVaaS) industry has created a system where acceptable EVs inside the distribution network are selected individually or collectively to exchange energy with the grid, specific clients, or both.

Electric Vehicle as a Service (EVaaS): Applications, Challenges and Enablers | MPDI

That was it for this week. Expect new reports and a highlighted report next week. If you have any suggestions please consider providing feedback or uploading your report.