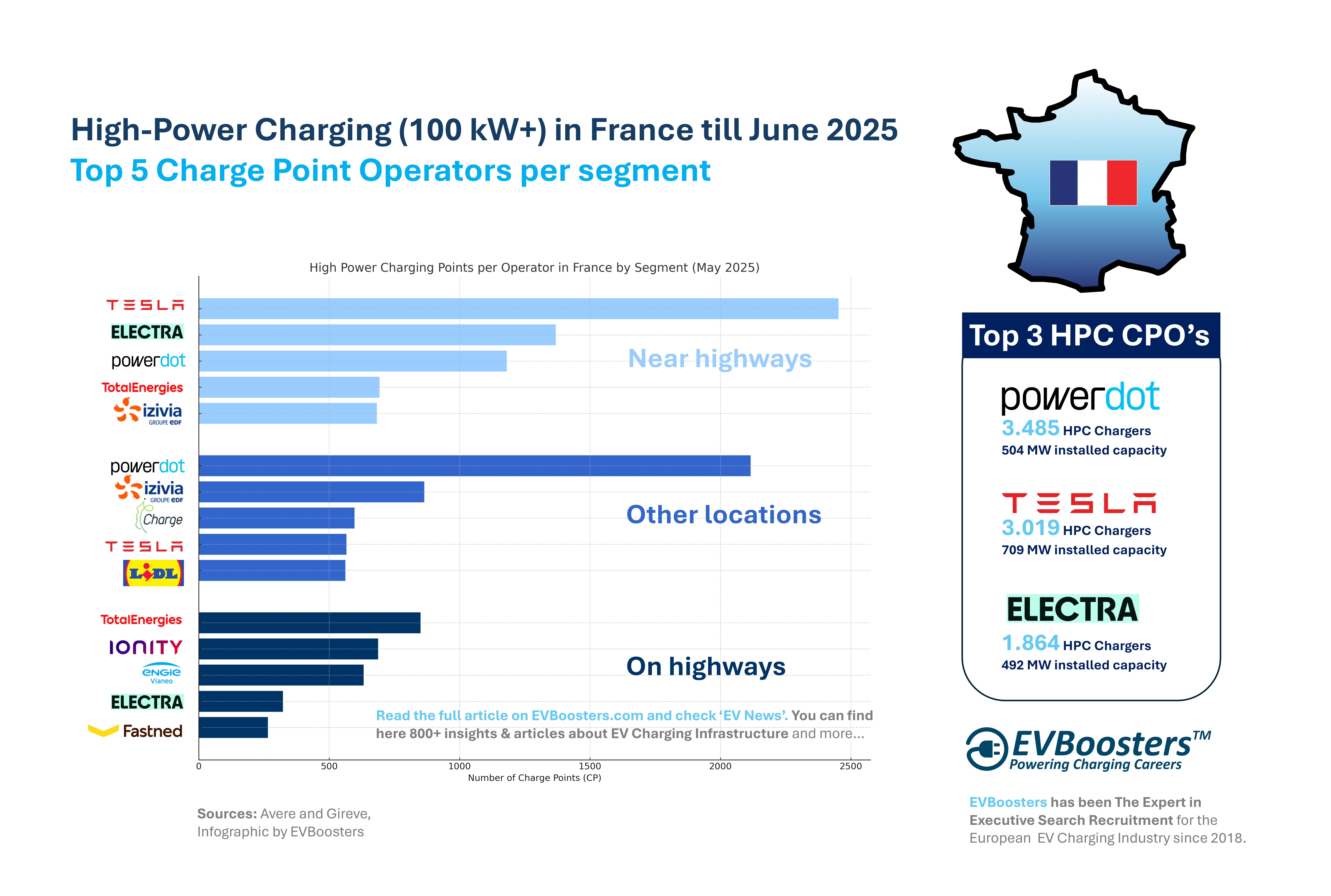

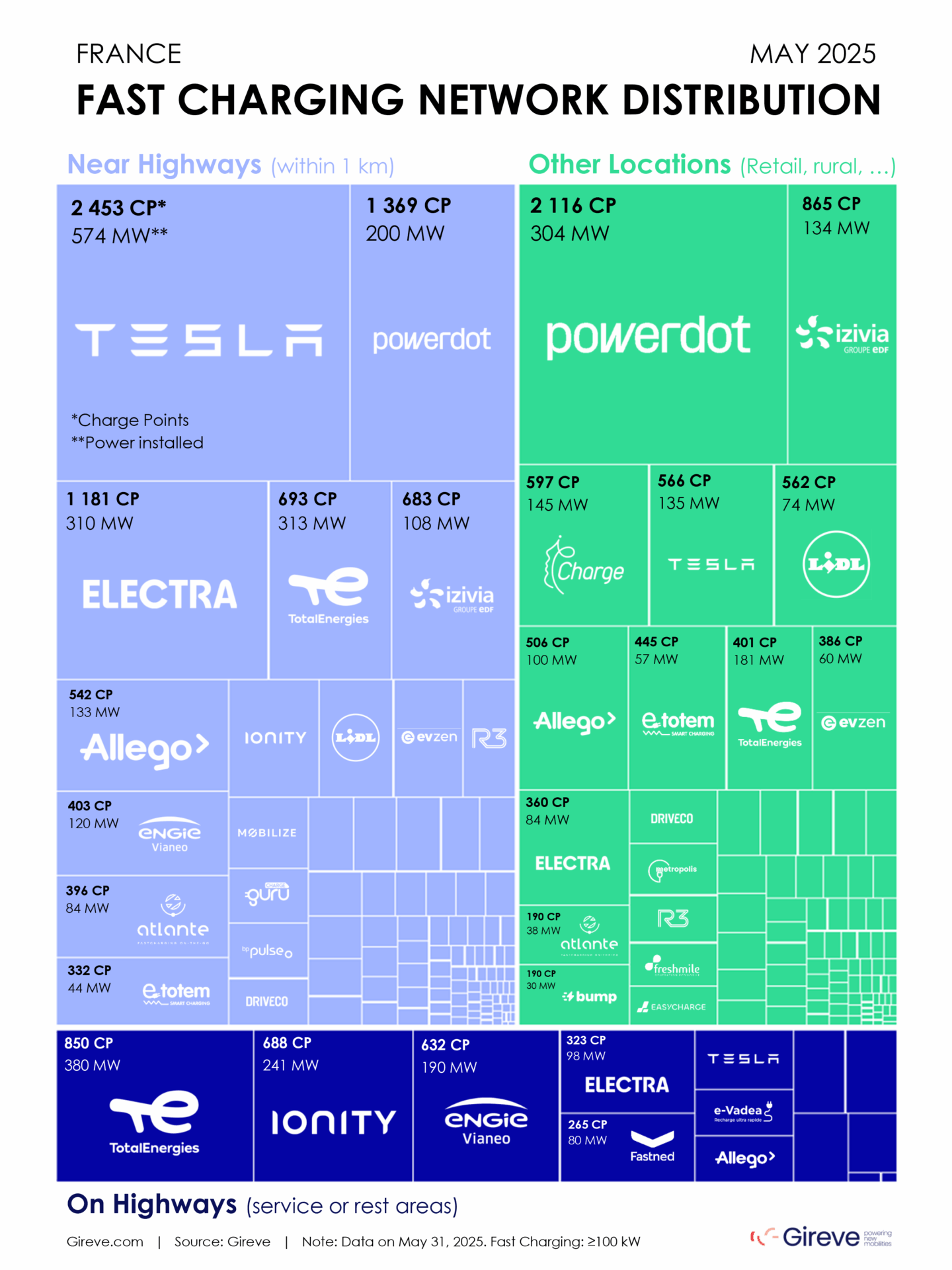

Top 5 HPC Charge Point Operators operators; on highways, near highways and other locations

In this article powered by data and insights of Gireve, we explore the current landscape of France’s high-power charging market. We examine the top five operators per segment, their strategies, and how usage trends reveal both strengths and opportunities for improvement. Whether you’re a policymaker, industry professional or EV driver, this breakdown offers insight into how fast charging is powering the next phase of France’s electric mobility revolution.

1. highways: the backbone of long-distance EV travel

Highways are crucial for long-distance EV drivers, and France has made significant progress in this area. From just 484 high-power charging points in 2021, the number grew to 3.626 by May 2025, covering nearly all motorway service areas.

Top 5 operators on highways

TotalEnergies – 850 CP | 380 MW

As the clear market leader, TotalEnergies is leveraging its extensive fuel station network to transition into electric mobility. It focuses on full-area coverage and high-visibility locations.IONITY – 688 CP | 241 MW

A joint venture of major car manufacturers, IONITY was among the first to invest in high-speed charging along motorways. Its focus is on pan-European connectivity.ENGIE Vianeo – 632 CP | 190 MW

ENGIE’s strategy centres on partnerships with public and private stakeholders. It secured early tenders and is now expanding steadily.Electra – 323 CP | 98 MW

A rising French player, Electra is gaining traction with well-designed, high-efficiency charging hubs.Fastned – 265 CP | 80 MW

Known for its solar-powered yellow stations, Fastned is steadily growing its presence from neighbouring markets into French rest areas.

Usage and performance

Highway chargers have the highest usage and availability rates in the country. In 2025, availability improved by 1.5% compared to the previous year, reflecting strong maintenance practices and reliable access. These stations are used 25% more frequently than those in urban or rural areas.

2. near highways: freedom to scale without tenders

A growing number of operators are opting to build within 1 km of highway exits to avoid the strict regulations of motorway tenders. These “near highway” locations offer convenience for travellers without the bureaucratic barriers.

Top 5 operators near highways

Tesla – 2.453 CP | 574 MW

Tesla leads by far. Its strategy of acquiring land directly near exits allows for faster rollouts, superior user experience, and independence from local concessions.Powerdot – 1.369 CP | 200 MW

Powerdot combines flexible site selection with rapid deployment, targeting high-traffic zones near major roads.Electra – 1.181 CP | 310 MW

Electra is becoming a serious contender near highways, using data to optimise station locations and charging speed combinations.TotalEnergies – 693 CP | 313 MW

Besides its strong motorway presence, TotalEnergies is diversifying with strategically placed near-highway stations.Izivia (EDF Group) – 683 CP | 108 MW

Backed by energy giant EDF, Izivia targets high-accessibility locations to complement its city and rural footprint.

3. retail, rural, and urban: the new frontier for EV access

While highways are now well-covered, the real growth is happening in retail zones, supermarkets, and rural towns. These locations are essential for everyday users and for ensuring equal access across regions.

Top 5 operators in other locations

Powerdot – 2.116 CP | 304 MW

Powerdot tops this segment by placing chargers at shopping centres, large car parks and local hubs. Its wide footprint supports both local residents and travellers.Izivia – 865 CP | 134 MW

With support from EDF, Izivia focuses on municipalities and secondary cities, providing reliable infrastructure where private investment is limited.IECharge – 597 CP | 145 MW

IECharge partners with local retailers and municipalities to offer affordable, high-power charging in underserved areas. Their model focuses on accessibility and cost-efficiency.Tesla – 566 CP | 135 MW

Expanding beyond Superchargers, Tesla is growing in off-motorway areas, especially where premium access is in demand.Lidl – 562 CP | 74 MW

The supermarket chain is turning its car parks into charging hubs, promoting accessibility in suburbs and smaller towns.

How is the network being used?

The current usage pattern shows clear differences between segments:

Motorway sites are the most heavily used, thanks to long journeys and necessity-based charging.

Urban and rural stations see 25% lower usage, indicating either under-utilisation or lack of awareness.

Availability remains strong on highways but needs improvement off-motorway. Many retail and rural chargers haven’t yet reached 98% uptime, which may affect public trust and convenience.

What can be improved for better utilization of the French High Power Charging network?

1. more consistent availability

Operators must invest in predictive maintenance and better uptime tracking, particularly in rural areas.

2. public awareness campaigns

Retail and rural stations are often underused simply because drivers don’t know they exist. Better signage and mobile integration can fix that.

3. Unified payment systems

Making all stations easy to use, with roaming platforms, will encourage broader adoption.

4. Smart expansion

Not all areas need hundreds of chargers. Using data to predict traffic patterns and EV adoption helps avoid over- or under-investment.

Attention is now shifting where people live, shop and work

France’s high-power EV charging market is evolving rapidly. With full highway coverage nearly complete, attention is now shifting to where people live, shop and work.

The next step? Balance and reliability. France has built a robust skeleton—now it must fill in the body. By focusing on availability, awareness and smart deployment, France could set the European standard for a truly usable fast-charging network.

EVBoosters Executive Search: Trusted growth partner for EV Charging & e-Mobility leadership since 2018

Since 2018, EVBoosters has been the trusted executive search partner for Europe’s leading EV Charging and e-Mobility companies — supporting their growth by placing board members, senior executives and functional leaders who truly shape the industry. If you’re a founder, investor, senior manager or board member looking to strengthen your leadership team or fill a critical senior role in sales, operations or product, we know the market, the talent and the challenges you face.

📅 Schedule an introductory call HERE with our founder and managing partner, Paul Jan Jacobs — and let’s explore together how we can accelerate your growth journey.