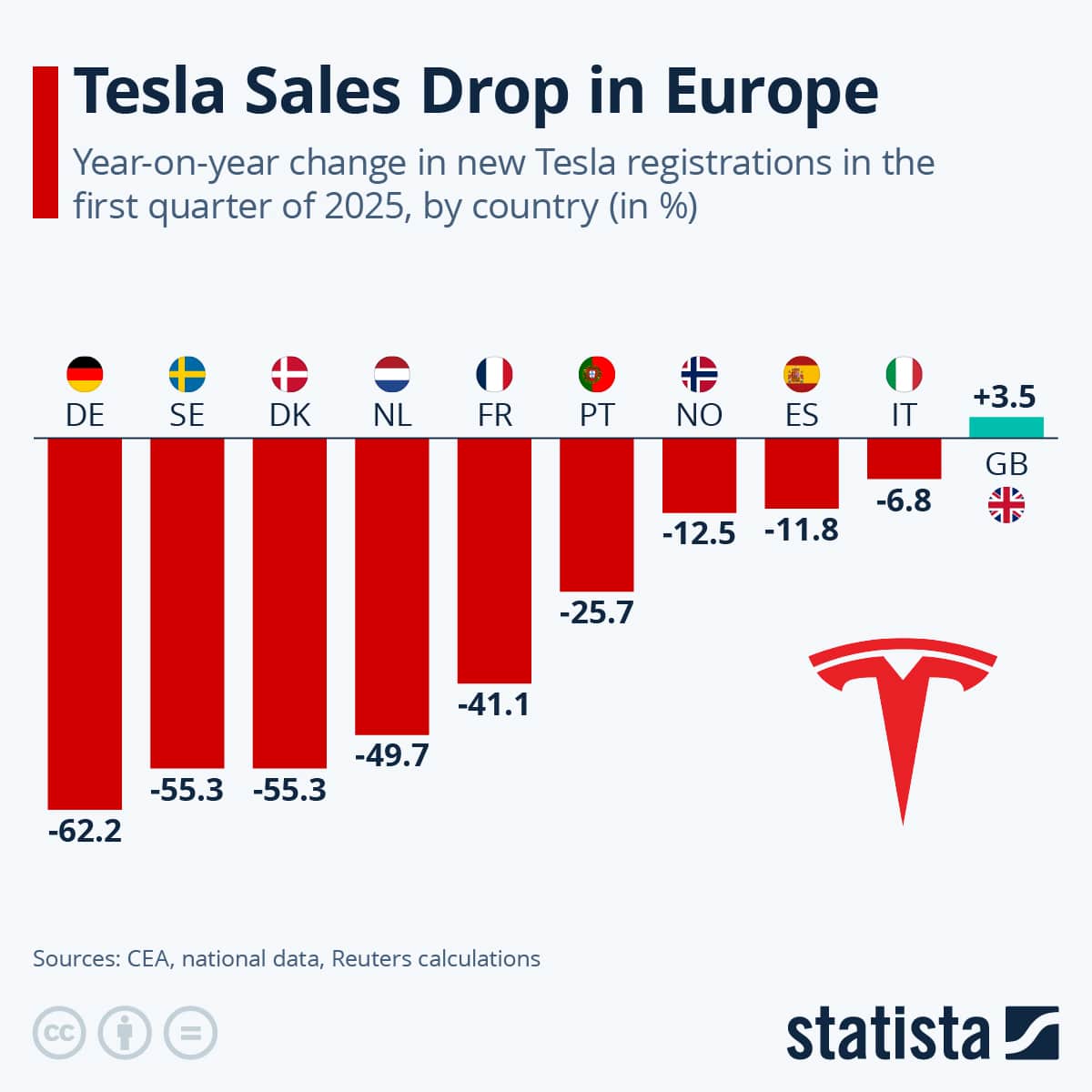

What’s driving Tesla’s decline in Europe?

1. Brand repair must come first

Tesla’s brand is now inseparable from Elon Musk’s public persona, which is increasingly turning off European consumers. His political commentary, controversial actions on X (formerly Twitter), and confrontational style alienate sustainability-minded drivers. To win back market trust, Tesla must refocus on innovation, reliability, and climate leadership, and Musk must step back from the spotlight.

2. Stronger Chinese competition

Brands like BYD, NIO, and XPeng are launching aggressively priced, tech-rich EVs across Europe. These challengers match or exceed Tesla on performance and design, often at lower price points. Tesla’s long-standing price advantage is eroding fast.

3. End of subsidies hits premium brands

Many European countries, including Germany, have phased out or reduced EV subsidies, especially for premium models. This disproportionately affects Tesla, which lacks lower-cost alternatives in its current line-up.

4. Aging model line-up

Tesla’s key models—the Model 3 and Model Y—have seen only minor updates. Meanwhile, European and Asian automakers are launching fresh, more exciting vehicles with advanced features, new styling, and better comfort.

5. Limited European production

Gigafactory Berlin is growing, but production remains limited. Legacy automakers already have deep local supply chains, faster delivery times, and stronger after-sales networks, giving them a serious advantage in serving European buyers.

What Tesla must do to regain momentum

Tesla faces a defining moment in Europe. To reverse its downward trend, it must take bold, strategic action:

Rebuild the brand by distancing itself from controversy and re-emphasising innovation and sustainability.

Refresh the product line-up, bringing new models like the compact Tesla to market quickly.

Adapt pricing strategy to offer more affordable models in a highly competitive environment.

Scale up European production via Gigafactory Berlin to improve responsiveness and local appeal.