Slower growth in Europe and the U.S., but Asia keeps rising

The global battery market is closely tied to the growth of EVs, and while EV sales are slowing in Europe and the U.S., the overall demand for batteries is expected to keep rising. According to the report, fading subsidies and less aggressive emissions standards are contributing to the slowdown in these Western markets. However, the long-term outlook remains positive, as more affordable EV models and continued government commitments to net-zero goals will sustain demand in the years to come.

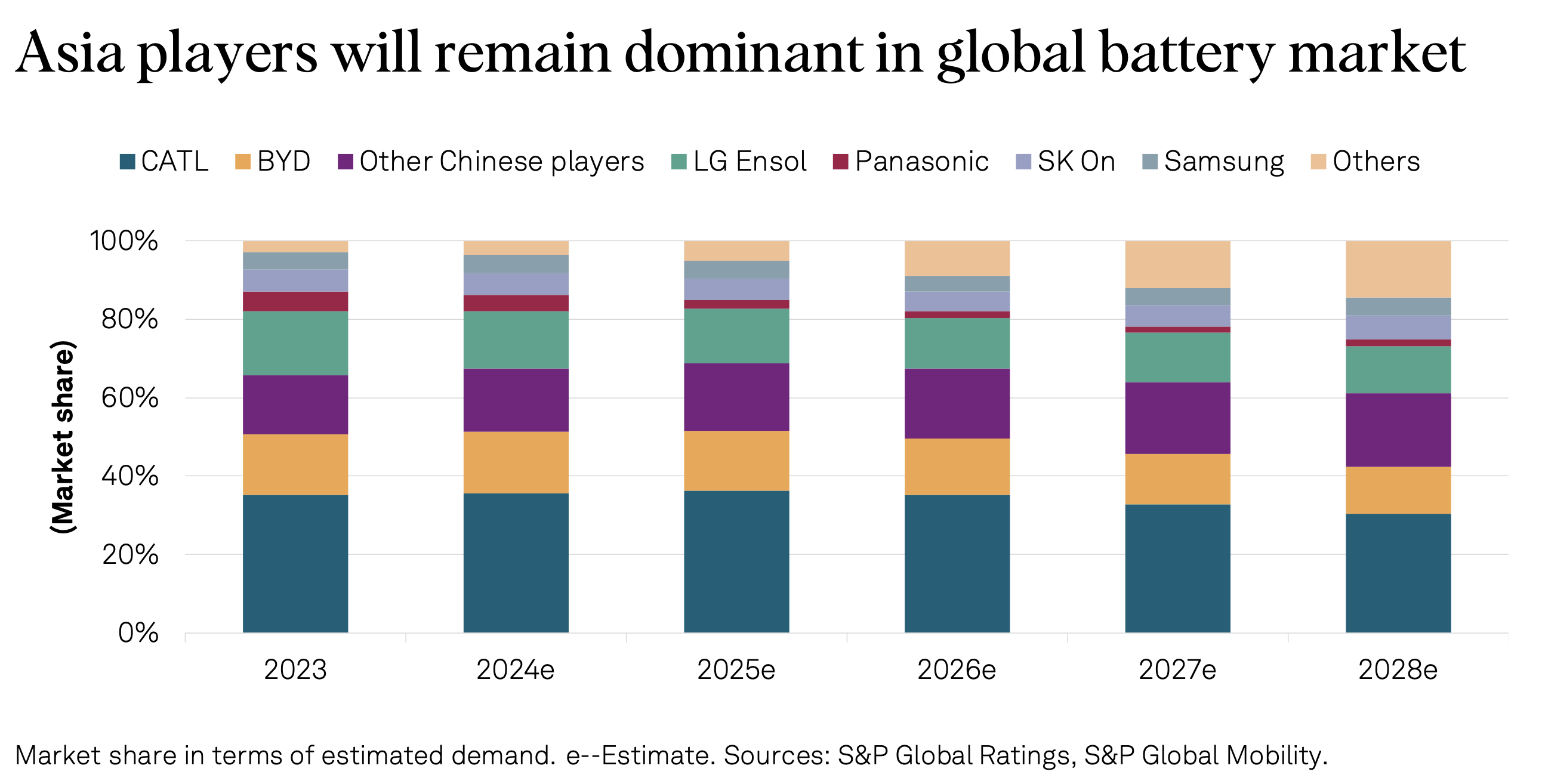

In contrast, China’s battery market is booming. With the country’s EV market continuing to expand, Chinese manufacturers like Contemporary Amperex Technology Co., Ltd. (CATL) and BYD are expected to drive much of the global battery market’s growth. China’s position as the world’s largest EV market gives these companies a significant advantage, allowing them to benefit from both domestic demand and their ability to export competitively priced batteries.

Consolidation ahead for China’s battery market

Despite the growth, China’s battery market faces its own challenges. Overcapacity has become a concern, leading the Chinese government to introduce new regulations aimed at addressing the issue. These measures include raising technical standards and enforcing higher utilisation rates among battery producers. S&P Global predicts that this will lead to market consolidation, with the strongest companies—like CATL and BYD—benefiting the most, while weaker competitors are likely to be pushed out.

CATL, which holds a stable credit rating of A- from S&P Global, is expected to improve its profitability over the next two years. The company is set to increase its free operating cash flow, thanks to the rollout of new products and economies of scale. On the other hand, South Korea’s LG Energy Solution (LG EnSol) is facing a more challenging outlook. As it invests heavily in expanding capacity, its debt-to-EBITDA ratio is expected to rise, reflecting the financial strain of these efforts amid slowing growth in key markets like the U.S. and Europe.

Regional market focus: China, Europe, and the U.S.

China’s dominance in the battery market will likely remain within its own borders, though Chinese companies are gradually expanding into Europe. By offering competitively priced products, they are expected to gain market share from established Korean players like LG EnSol and Samsung. Europe’s market has traditionally been led by Korean manufacturers, but that dynamic is starting to shift.

Meanwhile, in the U.S., Korean battery manufacturers are focusing on expanding their production, spurred by incentives like the Advanced Manufacturing Production Credit (AMPC) introduced under the Inflation Reduction Act. However, plans for several new battery plants in the U.S. have faced delays due to weakening EV demand. For instance, SK On’s joint venture with Ford has postponed the start of its BlueOval SK Battery Park until after 2026, while LG EnSol has held off on expansion plans for its Arizona energy storage plant.

In Europe, the outlook is similarly mixed. Although Chinese and European battery manufacturers are ramping up production capacity, several companies have recently announced delays or cancellations of their planned expansions. The report attributes this to slower-than-expected EV sales growth and difficulties securing long-term orders.

Long-term demand for batteries remains strong

Despite these short-term challenges, the S&P Global report emphasizes that the long-term demand for batteries remains strong. The global market is expected to grow by 30-40% annually in 2024 and 2025, driven primarily by China’s rapid adoption of electric vehicles. By 2030, China is projected to account for 70-75% of global battery demand, cementing its role as a critical player in the industry.

Batteries, which account for 30-50% of the cost of producing an EV, will continue to be a crucial component of the global automotive supply chain. As more countries and carmakers push for electrification, the demand for reliable and affordable batteries is only expected to increase.

Solid-state batteries: the next big thing?

While traditional lithium iron phosphate (LFP) and nickel-cobalt-manganese (NCM) batteries dominate today’s market, the report suggests that solid-state batteries (SSBs) could be a game-changer in the future. Several companies, including CATL and LG EnSol, are investing heavily in developing this technology, which promises higher energy density and improved safety features. However, SSBs are unlikely to gain significant market share until after 2027, given the challenges of scaling up production and the initially higher costs.

For now, LFP and NCM battery chemistries will continue to dominate, with automakers favoring these options due to their reliability and affordability.

The road ahead

As the global battery market continues to evolve, Asian companies are well-positioned to maintain their leadership. Chinese manufacturers, in particular, have established themselves as critical players in the industry, driven by their ability to produce high-quality batteries at competitive prices. Korean firms will remain important, especially in the U.S., but face growing competition and financial pressures.

Although the road ahead includes uncertainties—such as slowing demand in key markets and potential delays in new technologies like solid-state batteries—the outlook for the global battery market remains optimistic. With demand expected to surge over the next decade, Asian battery manufacturers are likely to stay at the forefront of this dynamic and essential industry.

In conclusion, while challenges persist, Asia’s battery giants are well-placed to capitalise on the growing global demand for EVs and the batteries that power them.

Source: S&P Global