China remains the leader in EV infrastructure

China continues to dominate the EV landscape, particularly when it comes to charging infrastructure. Although the country’s EV sales growth moderated in 2023, it achieved a strong 36% sales penetration, holding its lead globally. China’s network of public and private charge points expanded by 65%, now totaling 8.6 million. Much of this growth came from private charge points in residential areas, driven by local regulations and incentives to support home and community-based charging options.

A notable shift in China’s EV strategy has been the government’s move from subsidising EV purchases to prioritising robust charging infrastructure. Major cities like Shenzhen and Guangzhou are expanding supercharging facilities, a move in line with the Chinese government’s new emphasis on coverage quality. Survey results show that Chinese EV drivers are generally satisfied with the accessibility and quality of charging options available, with over 86% of respondents noting that public charging has become easier recently.

The U.S.: progress at home, public charging lags

In the United States, EV sales penetration reached 10% in 2023, with nearly 1.5 million EVs sold. However, public charging infrastructure growth hasn’t kept up. The ratio of vehicles to public chargers increased from 17.1 to 24.5 over the year, indicating that public charging development is lagging behind the country’s EV adoption rate.

Most American EV owners, around 96%, rely on home chargers, the highest proportion globally. This preference for home charging highlights the need for more public charging points in suburban and rural areas where options remain sparse. Federal policies like the Inflation Reduction Act (IRA) and the National Electric Vehicle Infrastructure (NEVI) program are designed to address this issue, though implementation challenges have slowed progress. NEVI, for instance, has faced delays in distributing funds, though recent efforts aim to streamline the process and ramp up infrastructure development.

Western Europe’s charging network surges

In Western Europe, public charging infrastructure has expanded rapidly. In 2023, the region saw an 80% increase in direct current (DC) charging points, with France and Germany leading the way. However, while charging infrastructure grew, EV sales in established markets like Germany and the UK slowed. Reduced subsidies and economic pressures, including inflation, have curbed sales growth in these mature markets.

Still, most European EV owners are finding it easier to charge their vehicles. About 75% of survey respondents said public charging has improved, although 50% still want faster options. Southern European countries, such as Spain and Italy, continue to push forward with infrastructure development, bolstered by government incentives, which contrasts with the northern countries’ pullback on subsidies.

Rapid expansion in the Middle East and Southeast Asia

In emerging markets, particularly the Middle East and Southeast Asia, the growth in EV adoption and infrastructure development has been striking. In the Middle East, the UAE and Saudi Arabia have made substantial investments to enhance their EV networks. Saudi Arabia improved its vehicle-to-charger ratio from 10.4 to 1.0 in 2023, driven by strong policy support, while the UAE’s ratio improved from 7.6 to 4.3.

Southeast Asia also saw significant momentum, with Malaysia and Thailand among the most active in ramping up EV infrastructure. These countries are focusing on cost-effective options, such as alternating current (AC) chargers in urban areas, while building high-speed DC chargers along highways and in commercial hubs.

Global trends: demand for fast charging, market consolidation, and new business models

Globally, several trends are reshaping the EV charging sector. Demand for fast DC chargers is on the rise, reflecting consumers’ desire for quicker charging times to support longer trips. China leads the way with 44% of its public chargers now supporting DC charging, and Western Europe is close behind as it aims to improve EV convenience across its highly developed transport networks.

Market consolidation is another growing trend, particularly in the United States, where a few major players dominate public charging. Tesla and ChargePoint lead the pack, especially after Tesla’s move to open its Supercharger network to other EV brands. However, recent layoffs within Tesla’s Supercharger team have raised questions about future expansion. In Europe, new entrants continue to join the market, but competition remains relatively concentrated among established players.

The industry is also seeing experimentation with new business models to address unique challenges in different regions. Chinese charging companies are exploring international expansion, leveraging their technology and cost advantages to establish a foothold in overseas markets. In the U.S., companies are testing niche approaches, such as fleet charging solutions and vehicle-to-grid (V2G) technology, which lets EVs feed energy back into the power grid to help balance supply and demand.

Shifts in investor sentiment

Investment in EV infrastructure remains strong, but regional differences in sentiment are emerging. In Western Europe, investment in the sector is still high, though investors are becoming more cautious due to concerns about market saturation and stiff competition. Conversely, investment activity in China is heating up. Several deals were closed in 2023, including an expected IPO from the charging station provider Star Charge.

In the U.S., however, publicly traded charging companies are experiencing declining market caps, indicating challenges with profitability. Companies like ChargePoint and EVGo have seen their valuations fall as they grapple with the high costs of expanding their networks.

Looking ahead

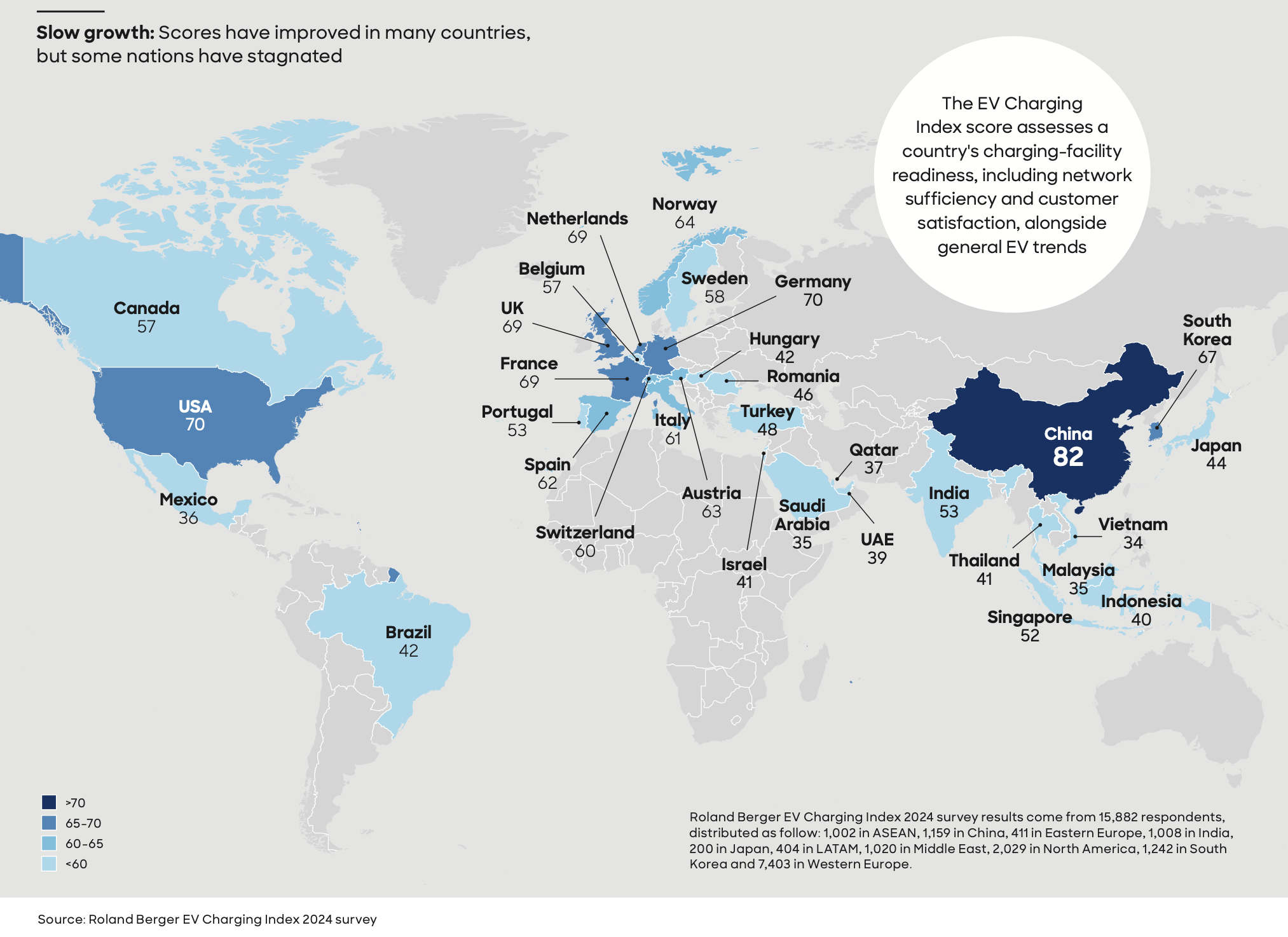

Roland Bergers’s EV Charging Index 2024 shows that while global EV sales have decelerated, charging infrastructure continues to evolve to meet consumer demand. Regions are recalibrating their approaches, with established markets prioritising network quality and reliability, and emerging markets investing aggressively to catch up. Challenges remain, from infrastructure shortfalls in the U.S. to investor caution in Europe. Yet, the growing focus on robust, accessible, and fast charging options indicates that global progress toward widespread EV adoption is well underway.

In the coming years, as EV ownership grows and demand for convenient charging options intensifies, regions that balance infrastructure expansion with user satisfaction will likely lead the transition to a cleaner, electric future.