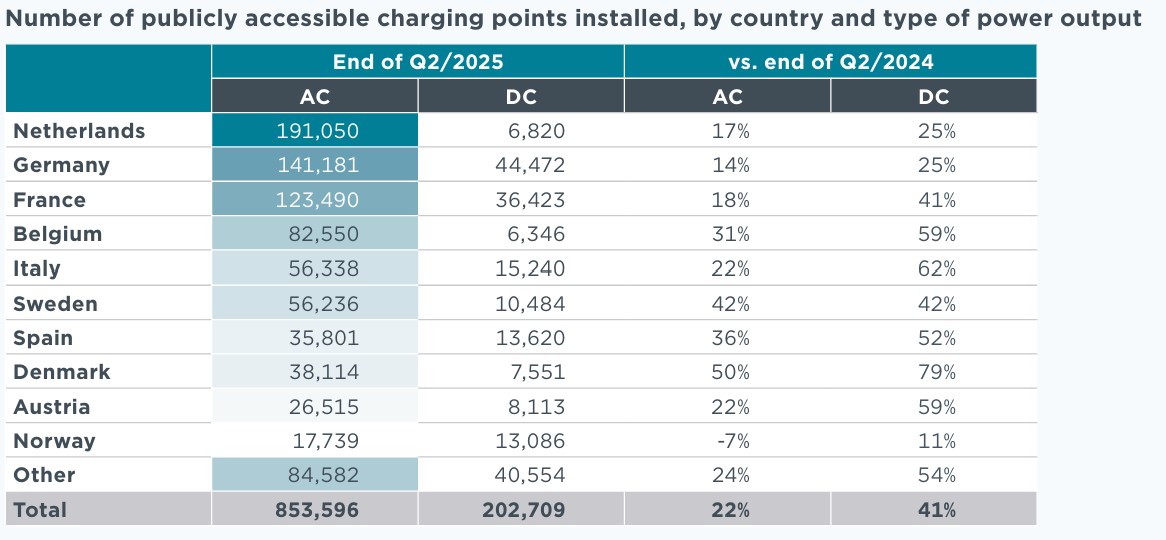

Europe operates more than 200,000 publicly accessible DC Chargers

AC chargers still account for the majority of charging points in Europe, with about 81% of the total network. In absolute numbers, the Netherlands (191,050 AC points) and Germany (141,181 AC points) remain leaders.

But DC chargers are where the real momentum is. By mid-2025, Europe counted 202,709 DC points, crucial for long-distance travel and heavy-duty vehicles. Italy (+62%), Belgium and Austria (both +59%), and Denmark (+79%) saw the biggest year-on-year increases.

The trend is clear: while AC chargers remain vital for daily and overnight charging, DC is becoming the backbone of Europe’s future-proof charging network.

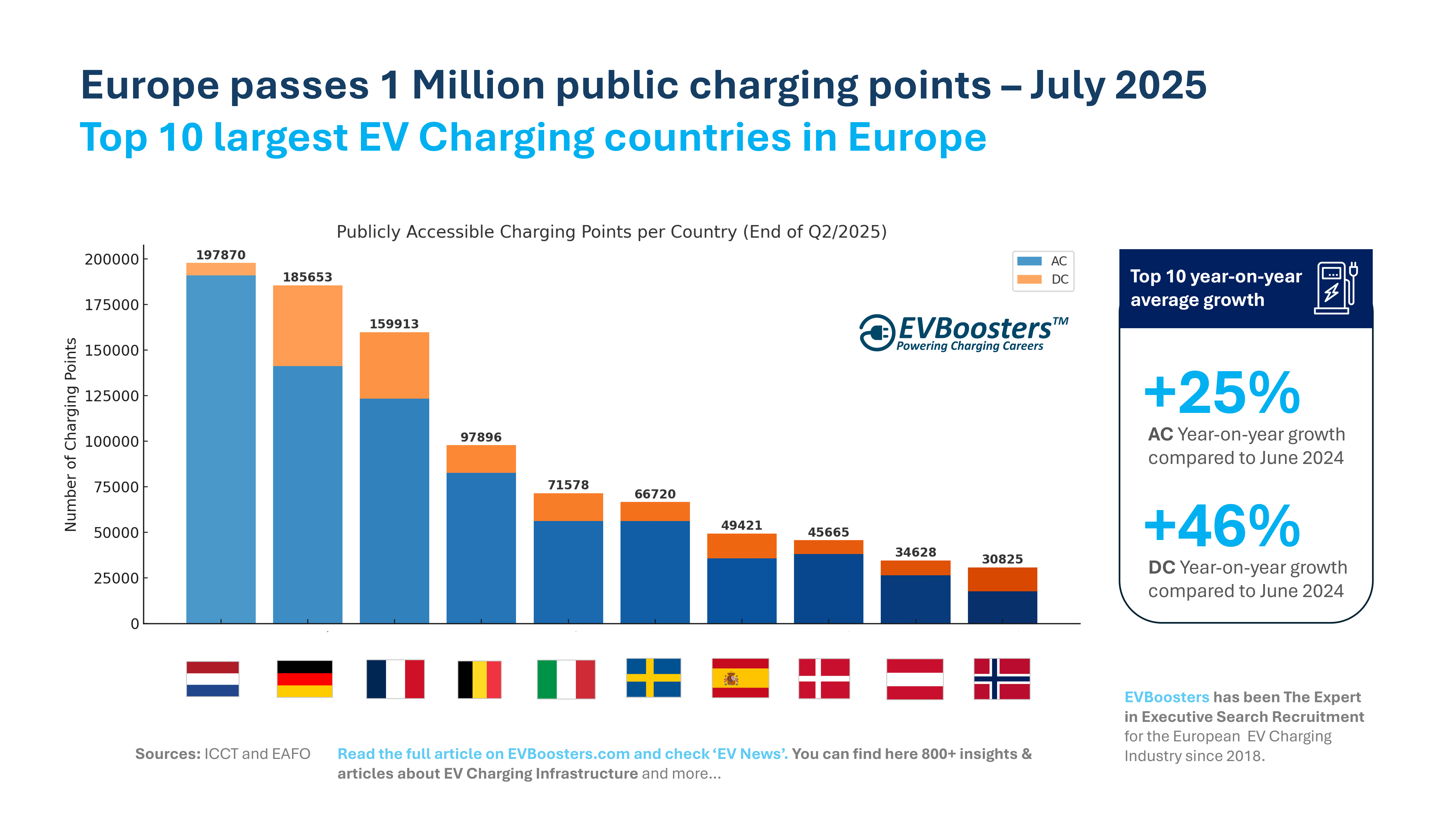

Leaders in absolute and relative growth

In terms of absolute numbers, the Netherlands is still ahead, with nearly 198,000 total charging points. Germany follows with more than 185,000, while France adds over 159,000.

When looking at percentage growth, Denmark stands out. AC chargers grew by 50% and DC chargers by 79% in a single year, far above the European average. Italy and Spain also made strong progress, closing the gap with Northern Europe. By contrast, Norway’s AC chargers dropped by 7%, though it still leads in charging density with 46 public chargers per 1,000 cars on the road.

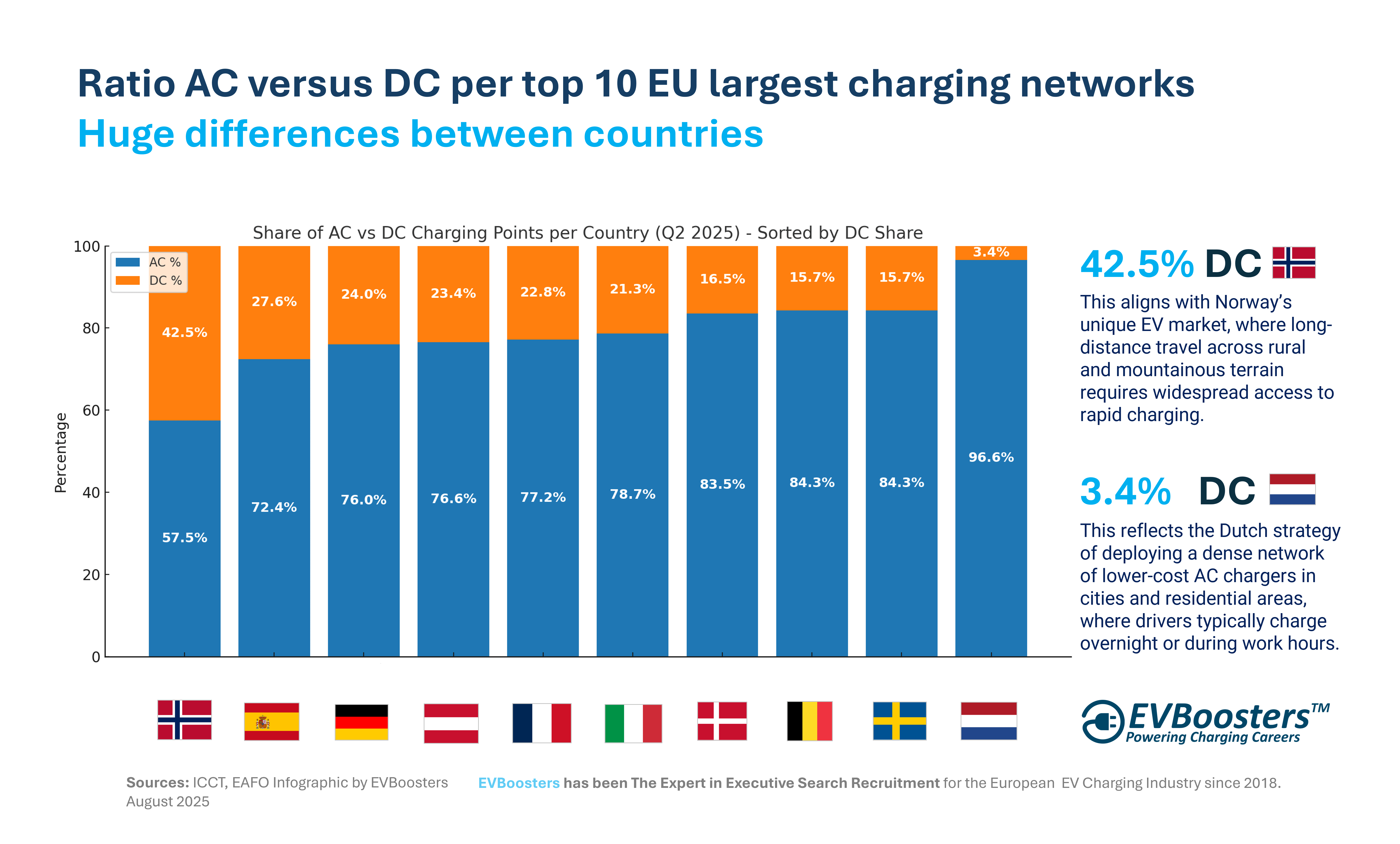

Ratio AC versus DC Charging networks across EU Countries

The balance between AC and DC charging varies strongly between countries. The Netherlands is heavily skewed toward AC, with nearly 97% of its chargers being AC. This reflects the Dutch strategy of deploying a dense network of lower-cost AC chargers in cities and residential areas, where drivers typically charge overnight or during work hours.

In contrast, Norway has the highest DC share in Europe, with 42.5% of its chargers being fast or ultra-fast. This aligns with Norway’s unique EV market, where long-distance travel across rural and mountainous terrain requires widespread access to rapid charging. It also reflects Norway’s early leadership in EV adoption, which has created demand for faster charging infrastructure as the market matures.

Spain (27.6% DC) and Germany (24% DC) also stand out for higher-than-average DC shares. Spain is catching up after years of underinvestment, focusing on motorway corridors to support intercity EV travel. Germany’s strong automotive industry, combined with policy pressure and investments from major charging operators, has led to the rapid expansion of its DC backbone.

Countries like Belgium, Sweden, and Denmark maintain a more balanced mix but are still weighted toward AC (around 83–84%). These markets are transitioning, as governments and utilities increasingly push DC deployments to complement their urban AC networks.

These differences highlight how national strategies, geography, and EV adoption maturity shape charging infrastructure. Dense urban countries such as the Netherlands prioritize AC availability, while large or early-adopting EV markets like Norway and Germany invest more in DC to support fast, long-distance mobility.

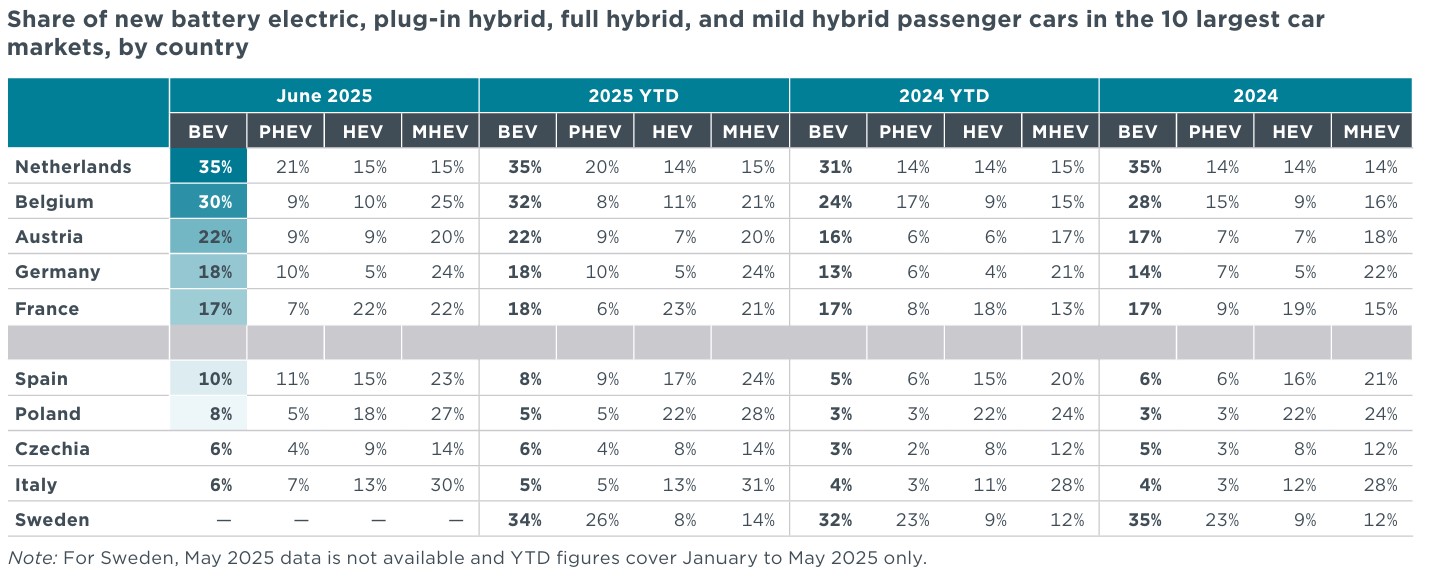

How EV sales drive infrastructure demand

The charging boom is closely linked to electric car sales. In the first half of 2025, Battery Electric Vehicles (BEVs) reached a 17% market share across Europe, up from 13% in H1 2024.

Growth was strongest in Spain (+83%), Czechia (+66%), and Poland (+61%). Germany, Europe’s largest car market, also grew by 35% year-on-year, with more than 47,000 new BEVs sold in June alone. France was the outlier, with a 6% decline in BEV registrations.

Where charging density is high, like in the Netherlands, Denmark, and Norway, EV sales are already above 50% of new registrations. In contrast, Italy and Spain still have just 3 chargers per 1,000 cars, highlighting the need for faster rollout.

Fleets accelerate the transition

Corporate fleets are another factor behind the demand for infrastructure. In H1 2025, 63% of new car registrations came from fleets, rental companies, and dealers. These groups often electrify faster than private consumers, thanks to tax incentives and sustainability goals.

Fleet adoption places extra pressure on the DC network, since high-utilization vehicles require fast, reliable charging.

The direction is clear

With EU rules mandating dense networks of high-power chargers along major transport routes, infrastructure growth is set to continue. The challenge now is not only scaling installations but ensuring interoperability, grid readiness, and smart charging. Countries that combine strong EV sales with aggressive charging rollout will shape the market’s future. The direction is clear: Europe’s charging market is not only growing, it is becoming the foundation of a fully electrified transport system.

EVBoosters Executive Search: Trusted growth partner for EV Charging & e-Mobility leadership since 2018

Since 2018, EVBoosters has been the trusted executive search partner for Europe’s leading EV Charging and e-Mobility companies — supporting their growth by placing board members, senior executives and functional leaders who truly shape the industry. If you’re a founder, investor, senior manager or board member looking to strengthen your leadership team or fill a critical senior role in sales, operations or product, we know the market, the talent and the challenges you face.

📅 Schedule an introductory call HERE with our founder and managing partner, Paul Jan Jacobs — and let’s explore together how we can accelerate your growth journey.