Growth EV Sales in Europe 2024 year on year compared to 2023

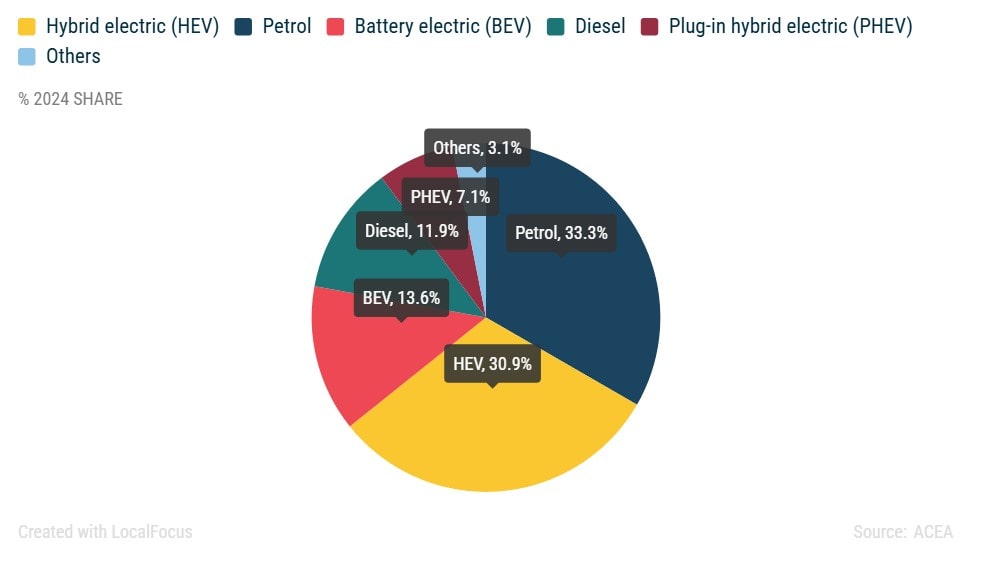

Battery Electric Vehicles (BEVs): BEV registrations fell by 5.9% in 2024 compared to 2023. In December alone, BEV registrations dropped by 10.2%. Despite this, BEVs outperformed diesel cars, whose share fell to 11.9%.

Plug-in Hybrid Electric Vehicles (PHEVs): PHEV registrations rose by 4.9% in December, with notable increases in France (+44.9%) and Germany (+6.8%). However, total registrations for the year were down by 6.8% compared to 2023, reflecting mixed sentiment toward this category.

Development indicators per key EV Market in Europe

United Kingdom: Leading the Charge, overtaking Germany in overall EV Sales

The United Kingdom emerged as the top European market for BEVs in 2024, with over 382,000 new registrations—a growth of more than 20% compared to 2023. This significant increase allowed the UK to overtake Germany as Europe’s largest BEV market, solidifying its position as a leader in EV adoption.

Germany: A Slowing Powerhouse

Germany, traditionally a frontrunner in the EV market, saw BEV registrations decline by 27,4 % to approximately 381,000 units (KBA), placing it just behind the UK.

France: Modest Decline

In France, BEV registrations fell by 20,7% to around 290,000 units. However, the country’s robust growth in PHEV registrations (+44.9% in December) provided some balance to the overall market performance.

Netherlands: Consistent Growth

The Netherlands recorded a 16% increase in BEV registrations, reaching approximately 132,000 units. This steady growth underscores the country’s continued commitment to EV adoption.

Belgium: Exceptional Growth

Belgium stood out with a 37% increase in BEV registrations, totalling nearly 128,000 units. This made it one of Europe’s fastest-growing EV markets in 2024.

Norway: A Steady Leader

Norway maintained its position as a global leader in EV penetration, with nearly 115,000 new BEVs registered in 2024. While growth was slower than in previous years, the country’s strong infrastructure and incentives kept it among the top performers.

Sweden: A Sharp Decline

Sweden experienced a significant decline in BEV registrations, falling 16% to 95,000 units. Once a top performer, Sweden’s drop into the five-digit range highlighted the challenges in sustaining momentum.

Conclusion – EV market stabilised

The EV market in Europe in 2024 marked a period of stabilisation after years of rapid growth. While BEV registrations declined slightly, PHEVs gained traction, reflecting a diversified and evolving market.

As countries like the UK and Belgium lead with significant growth, others, including Germany and Sweden, face challenges that may influence market dynamics in 2025. For industry stakeholders, the key will be to address these disparities and leverage opportunities in a shifting automotive landscape.

Trusted growth partner for EV Charging Companies since 2018

Since 2018, EVBoosters has been the trusted executive search partner for powering EV Charging Networks in Europe —helping them scale by recruiting the leaders and experts who drive real growth. If you’re a CEO, founder, or investor looking to strengthen your leadership team or critical senior position (sales/operations/product), we’re here to help.

Schedule your introductory call HERE with our founder and managing partner Paul Jan Jacobs and let’s explore how we can support your growth journey too.