Impact of tariffs on Chinese EV imports

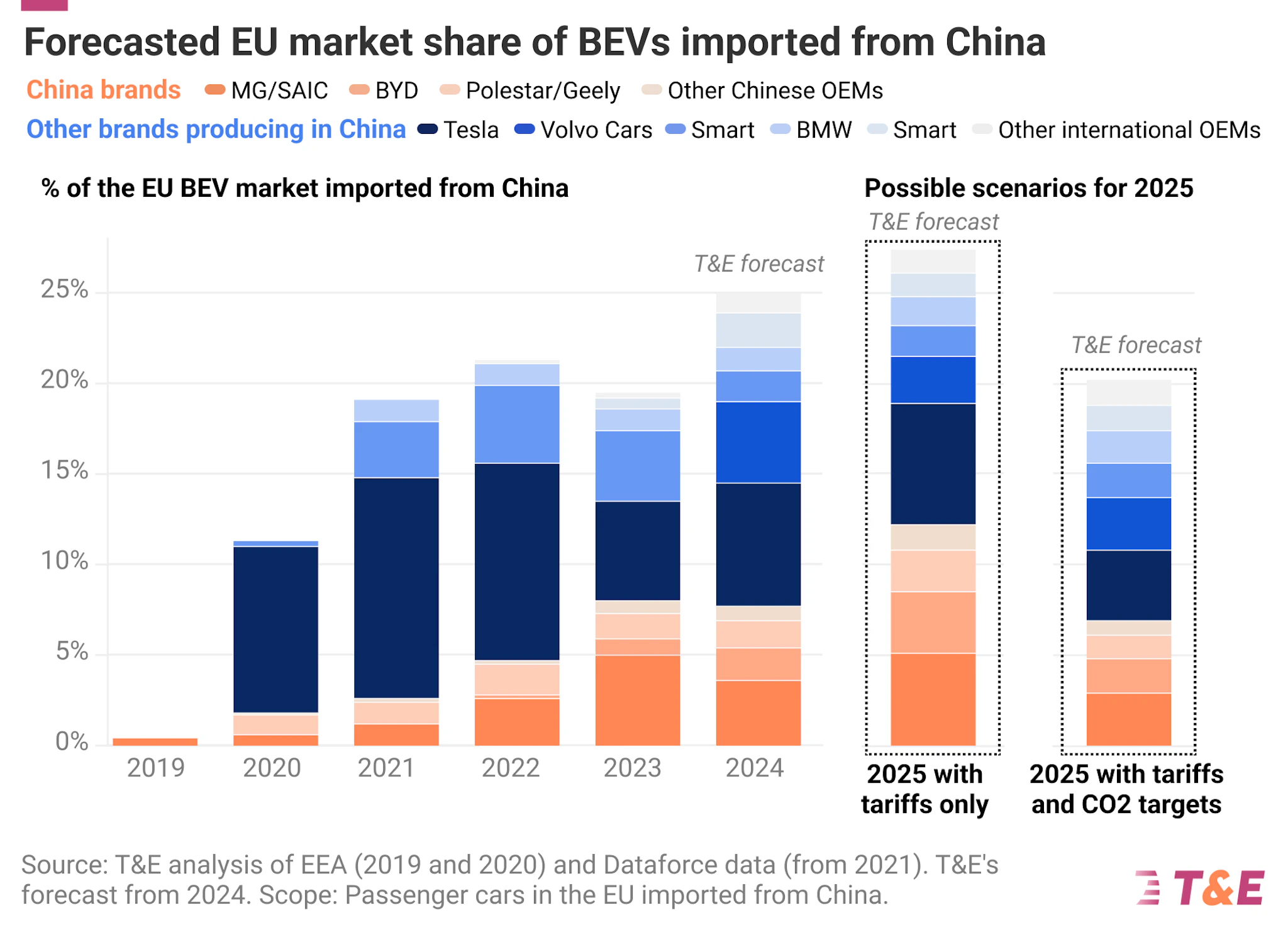

The EU introduced tariffs on battery electric vehicles (BEVs) imported from China as part of an effort to level the playing field for European automakers. These tariffs range from 7,8% for Tesla to a steep 35,3% for SAIC’s MG. The goal is to help European manufacturers regain lost ground in a market where Chinese imports have rapidly expanded, accounting for one in five electric cars sold in Europe last year.

The early results from these measures paint a complex picture. MG, which faced the highest tariffs, saw its market share in Europe drop significantly—from 4,1% in August 2023 to 2,4% in August this year. Meanwhile, BYD managed to expand its share from 1,6% to 2,9%, although at a slower pace than before. Geely also experienced modest growth, from 1,3% to 2%.

These figures suggest that while tariffs may be curbing the rise of some Chinese brands, they aren’t stopping it entirely. Chinese-made vehicles are still gaining ground, particularly in markets where affordability is key. Julia Poliscanova, Senior Director for Vehicles & E-mobility at T&E, noted that “higher EV tariffs are right, but only in tandem with the car CO2 targets.” She warned that without these CO2 targets, the tariffs could end up hurting consumers by limiting options without boosting European production.

The critical role of 2025 CO2 targets

The EU’s CO2 targets for 2025 are a key driver for European automakers to ramp up production of affordable electric models. As things stand, many European manufacturers are set to roll out new, lower-cost electric vehicles in the coming year, largely to comply with these stricter emissions standards.

If the EU sticks to its 2025 targets, Chinese imports could drop to 18% of the market by 2026 as more European-made EVs come online. However, if these targets are delayed or watered down, the opposite could happen. T&E estimates that Chinese-made EVs could capture as much as 27% of the European market by next year, as local manufacturers would likely continue focusing on more profitable internal combustion engines (ICEs) rather than affordable electric models.

A struggling battery supply chain

Beyond electric cars, the EU’s approach to its homegrown battery industry is also under scrutiny. Despite ambitious plans for dozens of gigafactories, many of these projects are now at risk. T&E’s analysis estimates that 59% of the planned battery production capacity in Europe could be scrapped, leading to a loss of billions in investments and close to 100.000 potential jobs.

One of the major issues is that the EU’s current tariff on imported batteries is just over 1%, the lowest globally. This makes it far cheaper to import batteries from China than to produce them locally, undermining European gigafactory projects. As Poliscanova pointed out, “It makes no sense to jeopardise the billions of investment in EU gigafactories while keeping the lowest battery tariff in the world.”

Recommendations for Moving Forward

T&E’s analysis outlines several key recommendations for the EU to ensure a sustainable future for electric vehicle production and battery manufacturing in Europe:

- Confirming the additional import duties: The EU should lock in the extra tariffs on China-made EVs while keeping the 2025 CO2 targets intact. This dual approach would push European automakers to accelerate their electric vehicle production, including more affordable options.

- Launching an investigation into battery imports: To help protect European battery producers, the EU should launch an anti-subsidy investigation into imported battery cells. Higher tariffs on these imports could help local manufacturers compete on a more level playing field.

- Rolling out the EU battery fund: The EU should quickly implement the long-discussed Battery Fund to support scaling up local battery production. T&E also recommends introducing carbon footprint thresholds for batteries to reward cleaner manufacturing.

The bigger picture: A race against time

The EU is at a critical juncture. The tariffs on Chinese-made EVs are a promising start, but they are not enough on their own. Without the 2025 CO2 targets, there is little incentive for European carmakers to invest in affordable electric models. The delay or weakening of these targets would not only stall progress in local EV production but also make Europe even more reliant on Chinese imports.

Moreover, the EU’s battery production plans are also in jeopardy unless more is done to protect and encourage local investment. Many European gigafactory projects have been delayed or canceled altogether, largely due to the availability of cheaper, high-quality batteries from China. Without higher tariffs on these imports and better support for local production, Europe risks losing the race to establish a secure and sustainable battery supply chain.

The next few weeks will be crucial. EU policymakers must decide whether to confirm the tariffs on Chinese-made EVs by the end of October and whether they will maintain the 2025 CO2 targets. These decisions will shape the future of electric vehicle production in Europe—determining whether the continent can stand on its own or continues to depend on cheaper, imported alternatives.

Conclusion

The provisional tariffs on China-made EVs have had some effect, but their true power lies in tandem with strong emissions regulations and support for local manufacturing. The EU needs to act decisively to maintain its CO2 targets, secure investments in battery production, and build a resilient electric vehicle industry.

Failure to do so could mean missing out on billions in investment, thousands of jobs, and, ultimately, leadership in a sector that is critical for Europe’s green future. The time for half measures is over—only a coherent and committed strategy will allow Europe to compete on the global EV stage.

Source: Transport & Environment