Strategic Investors: Accelerating the Transition

Strategic investors, particularly vehicle manufacturers, are at the forefront of investment in battery technology. These companies are driven by the need to secure a stable, long-term supply of batteries to meet the growing demand for EVs. Investing in battery technology allows automakers to stay ahead of the curve in innovation, improving the range, efficiency, and charging times of their vehicles. Furthermore, these investments help reduce long-term costs by fostering in-house development and strategic partnerships, making it more cost-effective than relying on external suppliers.

Prominent examples of such investments include BMW’s partnership with Northvolt, Ford’s investment in Solid Power, Volkswagen’s stake in QuantumScape, and Daimler’s collaboration with Farasis. This trend of strategic investments is expected to continue, as manufacturers compete in the electric vehicle market through accelerated innovation and development.

Financial Investors: Seeking Profitability and Impact

Beyond strategic investors, financial entities are also significantly contributing to the battery industry. These investors are primarily driven by the economic potential of the sector, viewing it as a lucrative opportunity in a rapidly growing market.

Private Equity

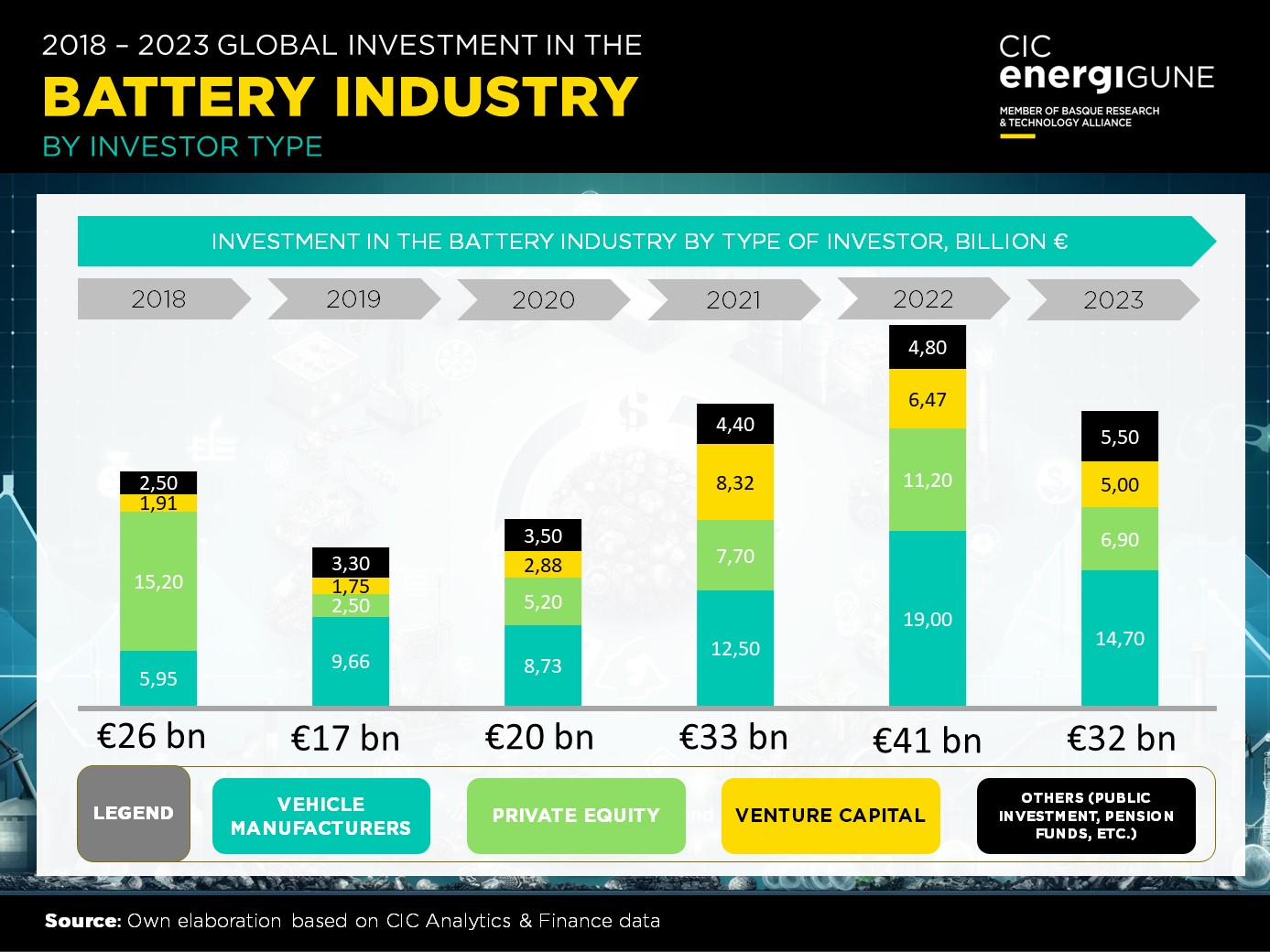

Private equity investors are motivated by the high return expectations in a market propelled by the transition to clean energy and the electrification of transportation. In 2023, nearly $5.2 billion was invested in 44 deals within the battery storage sector. This follows a peak in 2022 with $11.2 billion across 80 transactions. Notable private equity investors include Brookfield Business Partners, Caisse de dépôt, KKR, and BlackRock.

Venture Capital

Venture capital (VC) investment has been particularly dynamic, focusing on early and growth stages of battery companies. In 2023, despite a cautious investment environment, venture capital continued to be a key player in financing innovative battery firms. VC investments support startups from research and development phases to large-scale commercialisation, helping them compete in the highly competitive battery market.

Public Institutions

Public institutions, including governments and state agencies, play a crucial role in financing battery companies to boost local technology, foster innovation, and ensure energy independence. Significant investments have been made by entities like the U.S. Department of Energy and various European government bodies to accelerate industrial development and close the gap with Asian countries.

Pension Funds

Pension funds, managing money earmarked for employee retirements, are increasingly investing in the battery sector. These funds seek stable, long-term returns and align with responsible investment policies focused on sustainability. The expected growth in demand for EVs and energy storage makes battery companies an attractive investment for pension funds.

A Growing Ecosystem

The battery industry is witnessing unprecedented growth driven by the global transition to electric and sustainable mobility. Strategic investors, such as vehicle manufacturers, are ensuring a reliable supply of advanced batteries to improve their products’ range, efficiency, and charging times. Financial investors, including private equity, venture capital, public institutions, and pension funds, are providing the necessary capital for research, development, and expansion of battery infrastructure.

Together, these diverse investors are forming a robust and dynamic ecosystem essential for the commitment to a cleaner and more efficient energy future based on advanced battery technologies.

Source: CIC energiGUNE