Demand is growing, but costs are a major concern

PwC’s “eReadiness” study surveyed over 17.000 people across 27 countries, including the Netherlands. The report found that although interest in EVs is high, costs remain a key concern. The study highlights a strong desire for electric vehicles in the Netherlands, a country known for its advanced charging infrastructure and eco-conscious consumers.

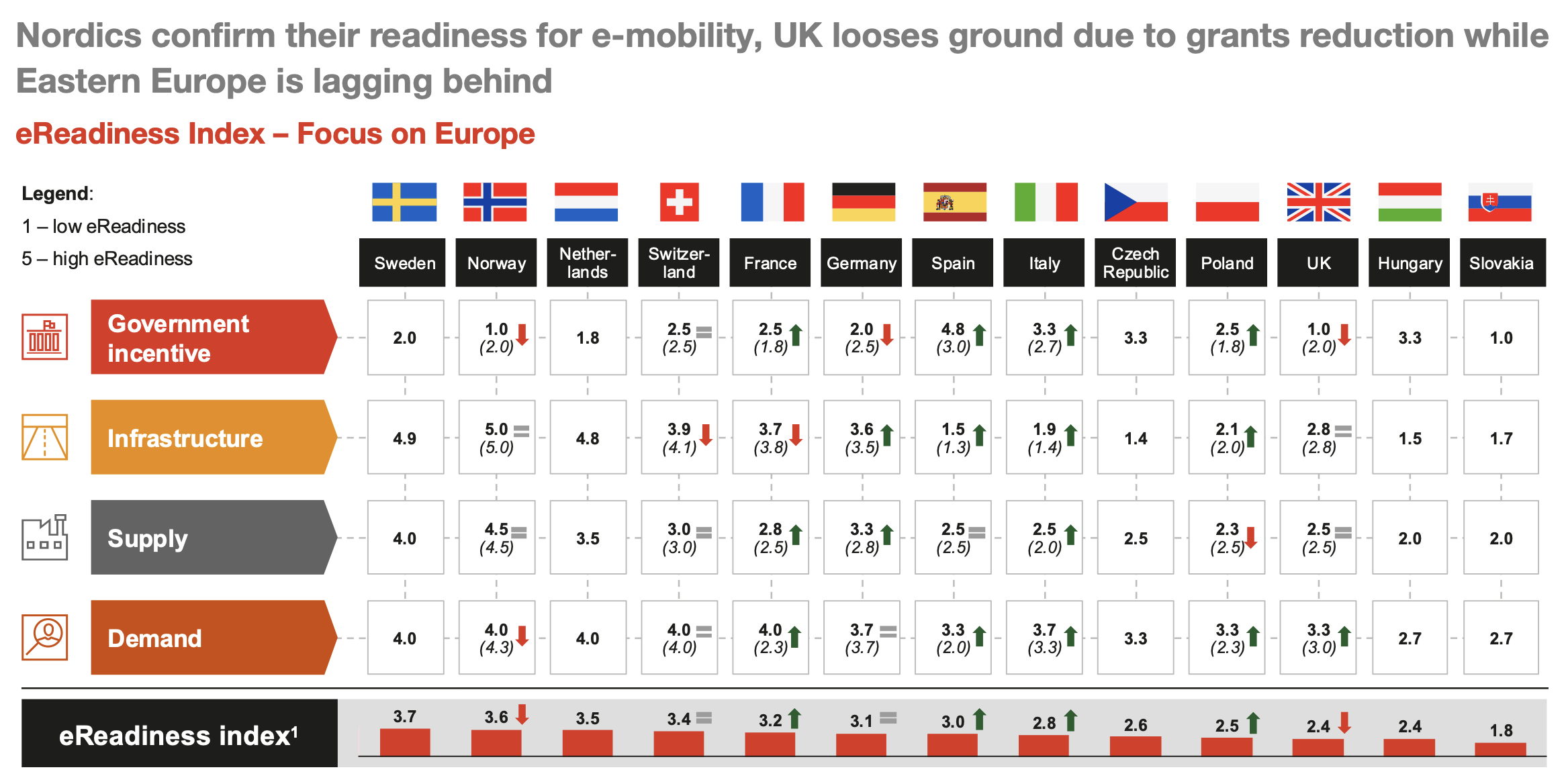

The Netherlands ranks as one of the most “eReady” countries globally, meaning it has the infrastructure, supply, and demand to support an electric vehicle market. However, the cost of EVs could be a roadblock, especially as government incentives begin to fade. Currently, 75% of consumers in Europe, the Middle East, and Africa say price is their top consideration when buying an EV, and over half expect to pay under €40.000 for a new one. These expectations reveal a clear preference for affordability that may clash with market realities.

Satisfaction is high, but many consider returning to gas cars

Interestingly, current EV owners are mostly happy with their vehicles—93% expressed satisfaction in the survey. Despite this, nearly a third of owners say they would consider going back to a traditional gas-powered vehicle. The reasons? Many report being surprised by higher-than-expected costs, including maintenance, and limited range, especially for long-distance travel.

These findings show that while EVs are often appealing for eco-conscious consumers, practical issues around cost and convenience are still holding some people back. It’s a reminder that even with high levels of interest, consumer expectations must be balanced with what the technology can currently offer.

Reduced government incentives could slow EV adoption

Another significant factor impacting EV sales is the reduction of government incentives in countries that have traditionally provided subsidies for EV buyers. In the Netherlands, for instance, these subsidies will end in 2025. By 2026, tax breaks for EV owners will also be phased out, which could make EVs a less attractive choice compared to traditional cars. The tax benefits for company cars—a popular choice for EVs in corporate fleets—are also expected to shrink, making it harder for businesses to justify the higher upfront costs of EVs.

While the Netherlands has done well in preparing for EV adoption in terms of infrastructure and demand, it ranks lower when it comes to government incentives, placing 18th out of 27 surveyed countries. In fact, within Europe, only a few countries like Slovakia and South Africa score lower in government support for e-mobility. This lack of incentives could become a major obstacle, especially in a price-sensitive market.

Future of EVs in a cost-conscious market

In the Netherlands, many consumers have grown accustomed to financial support when making environmentally friendly purchases, and this reduction in incentives may lead some buyers to reconsider. Bart van Osch, Senior Director at PwC Netherlands, suggests that while the country is well-prepared in terms of infrastructure, the shift in policy might slow EV adoption. “The market for EVs might slow down as incentives decrease. If we want to maintain momentum, we’ll need new strategies that make EVs accessible to all consumer segments,” he said.

This is particularly important as price remains a significant factor for Dutch consumers. The PwC study found that over half of buyers chose their EV based on the vehicle’s price, and nearly two-thirds cited cost as a key reason for investing in home charging infrastructure. Without government subsidies, more affordable models and flexible financing options could be crucial in keeping consumers interested in EVs.

Balancing aspirations and affordability

The study paints a picture of a market in transition. While interest in EVs is rising, affordability is a concern that cannot be overlooked. For many potential buyers, the appeal of owning an EV is not just about sustainability—it’s about making a financially sensible decision. As government incentives decline, the focus may need to shift toward industry innovations that make EVs more affordable and convenient for the average consumer.

Ultimately, PwC’s report highlights the need for balanced policies that keep the EV market growing. The Dutch government, for example, may need to consider ways to support the market indirectly—such as by investing in even more charging infrastructure or encouraging automakers to develop more affordable models. For now, the message is clear: consumers are interested in EVs, but without financial support, that interest may not be enough to spark the shift policymakers and industry leaders hope to see.

Source: PwC